What the Feds Jumbo Rate Cut Means for European and Global Markets

What the feds jumbo rate cut means for european and global markets – What the Fed’s jumbo rate cut means for European and global markets is a question on everyone’s mind. The Federal Reserve’s recent decision to slash interest rates has sent shockwaves through financial markets, leaving investors wondering about the implications for their portfolios.

This move, unprecedented in its scale, is a bold attempt to stimulate economic growth, but it also carries significant risks.

The impact of this rate cut will be felt across the globe, with potential consequences for European economies, emerging markets, and the overall stability of global financial systems. From the euro’s exchange rate to the volatility of stock markets, the ripple effects of this decision are far-reaching.

Understanding the potential consequences of this jumbo rate cut is crucial for navigating the turbulent waters ahead.

Understanding the Federal Reserve’s Jumbo Rate Cut

The recent announcement of a substantial rate cut by the Federal Reserve has sent ripples through global financial markets. This “jumbo rate cut” is a significant event that warrants careful analysis to understand its implications for the global economy.

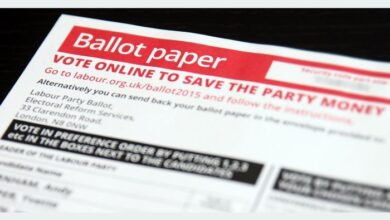

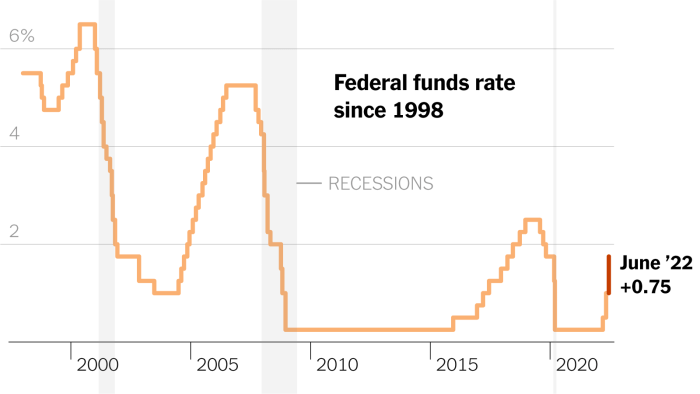

Historical Context of Rate Cuts

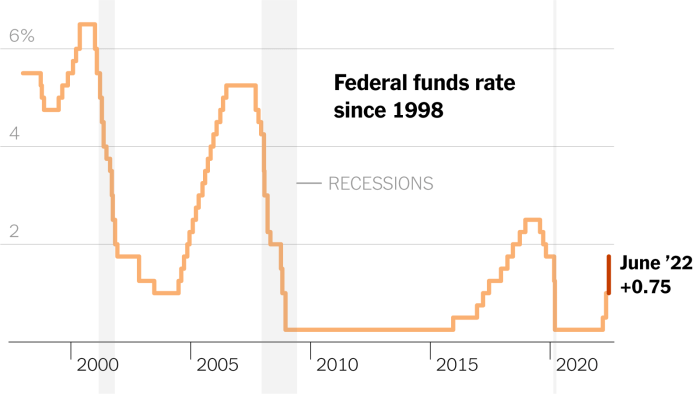

Understanding the current rate cut requires looking at the historical context of similar actions taken by the Federal Reserve. Throughout history, the Fed has implemented rate cuts in response to various economic challenges, such as recessions, financial crises, and periods of low inflation.

For example, during the 2008 financial crisis, the Fed implemented a series of aggressive rate cuts to stimulate the economy and prevent a deeper recession. These historical instances provide a valuable framework for analyzing the current rate cut and its potential impact.

Reasons Behind the Jumbo Rate Cut

The Federal Reserve’s decision to implement a jumbo rate cut is driven by a complex interplay of economic factors.

- One key reason is the current state of the economy. The Fed’s primary mandate is to maintain price stability and maximum employment. Recent economic data has shown signs of slowing growth, which could potentially lead to a recession.

To counter this risk, the Fed aims to stimulate economic activity by lowering borrowing costs for businesses and consumers.

- Another significant factor is the global economic landscape. The ongoing trade war between the United States and China has created uncertainty and volatility in global markets. The Fed’s rate cut is intended to mitigate these external risks and support the US economy.

- The Fed’s rate cut also reflects its assessment of inflation. Inflation has remained below the Fed’s target of 2% for an extended period. By lowering interest rates, the Fed hopes to encourage spending and boost inflation back to its target level.

The Fed’s jumbo rate cut ripples across the globe, impacting everything from European bond yields to Asian stock markets. But while the world watches the economic dance, let’s not forget about the upcoming Ryder Cup! It’s a reminder that even amidst global uncertainty, there’s still room for friendly competition, like the US team’s warm-up at the Presidents Cup.

Whether it’s the financial markets or the golf course, the stakes are high, and we’re all watching with bated breath to see who comes out on top.

Impact on European Markets

The Federal Reserve’s jumbo rate cut, while primarily aimed at boosting the US economy, will have significant ripple effects on European markets. The move could lead to a decrease in European interest rates, impact the euro’s exchange rate, and affect economic growth in different ways depending on the level of debt and economic vulnerability of each country.

Potential Effects on European Interest Rates and Financial Markets

The Federal Reserve’s rate cut could trigger a similar move by the European Central Bank (ECB). The ECB might lower interest rates to remain competitive with the US and to stimulate economic growth in Europe. This could lead to a decrease in borrowing costs for businesses and consumers, potentially boosting investment and spending.

The Fed’s jumbo rate cut sends ripples across the globe, impacting everything from European bond yields to the value of the Euro. While economists debate the long-term implications, it’s worth checking out transcript sen marco rubio on the potential economic fallout, as his insights often offer a valuable perspective on the US’s role in global markets.

This move by the Fed could have a significant impact on international trade and investment, making it a topic worth keeping a close eye on.

However, it could also lead to lower returns on savings and investments.

Impact on the Euro’s Exchange Rate

A jumbo rate cut in the US could weaken the euro against the US dollar. A weaker euro would make European exports more competitive globally, potentially boosting economic growth. However, it could also make imports more expensive, leading to higher inflation.

The Fed’s jumbo rate cut is sending ripples across the globe, impacting everything from European bond yields to global commodity prices. It’s a complex issue, and it’s hard to predict the long-term effects. But one thing’s for sure, we need to be mindful of the interconnectedness of our world.

For example, the debate on the safety of genetically modified foods, is ge food safe , highlights how seemingly disparate issues can have global ramifications. Understanding these connections is crucial as we navigate the evolving landscape of global finance.

Effects on European Economies with Different Levels of Debt and Economic Vulnerability

The impact of the rate cut on European economies will vary depending on their levels of debt and economic vulnerability. Countries with high levels of debt may benefit from lower interest rates, reducing their debt servicing costs. However, countries with weak economies may see limited benefits or even negative consequences, as lower interest rates could lead to further depreciation of their currencies and increase their borrowing costs.

For example, countries like Italy and Greece, with high debt levels and fragile economies, might face challenges in managing their debt burdens and stimulating growth. Conversely, countries with strong economies and low debt levels, like Germany, might experience a more positive impact from the rate cut.

Global Market Implications: What The Feds Jumbo Rate Cut Means For European And Global Markets

The Federal Reserve’s jumbo rate cut will likely have significant ripple effects on global financial markets. While intended to stimulate the US economy, it could lead to unforeseen consequences for other countries, particularly emerging markets.

Impact on Emerging Markets

The jumbo rate cut could lead to capital flight from emerging markets. Investors may seek higher returns in the US, leading to a depreciation of emerging market currencies and potentially destabilizing their economies. This could further exacerbate existing vulnerabilities, particularly in countries with high debt levels and weak economic fundamentals.

Increased Volatility in Global Financial Markets, What the feds jumbo rate cut means for european and global markets

The rate cut could introduce increased volatility in global financial markets. Investors may adjust their portfolios, seeking higher returns in the US, leading to fluctuations in asset prices and potentially disrupting market stability. This volatility could make it challenging for businesses to plan and invest, potentially hindering economic growth.

Long-Term Considerations

The jumbo rate cut, while potentially offering short-term relief, raises significant concerns about long-term economic consequences. The potential for unintended consequences and risks associated with this policy decision requires careful analysis.

Potential Long-Term Consequences for the Global Economy

The jumbo rate cut could lead to several long-term consequences for the global economy. One significant concern is the potential for inflation. When interest rates are lowered, it becomes cheaper to borrow money, which can lead to increased spending and investment.

This increased demand can put upward pressure on prices, leading to inflation. Additionally, the rate cut could weaken the value of the US dollar, making imports more expensive and potentially fueling inflation further. The impact on the global economy will depend on how these factors play out.

Potential Unintended Consequences and Risks

The jumbo rate cut could also have unintended consequences. One concern is the potential for asset bubbles. Lower interest rates can encourage speculation in asset markets, such as real estate and stocks. This can lead to inflated asset prices, which can be unsustainable and ultimately lead to a market crash.

Another concern is the potential for moral hazard. When interest rates are low, businesses and individuals may be encouraged to take on more risk, knowing that the Federal Reserve will be there to bail them out if things go wrong.

This can lead to a weakening of the financial system and increase the risk of future financial crises.

Economic Outcomes under Different Scenarios

The following table illustrates potential economic outcomes under different scenarios:| Scenario | Potential Economic Outcomes ||—|—|| Scenario 1: Inflationary Spiral|

- Increased inflation, leading to higher prices and reduced purchasing power.

- Potential for wage-price spiral, where higher prices lead to higher wages, which lead to even higher prices. |

| Scenario 2: Asset Bubble Burst|

- Rapid decline in asset prices, leading to financial instability and economic recession.

- Potential for systemic risk, where the failure of one financial institution can trigger a cascade of failures throughout the system. |

| Scenario 3: Moderate Economic Growth|

- Gradual increase in economic activity, with moderate inflation and stable asset prices.

- Potential for sustainable growth and job creation. |

“The long-term consequences of the jumbo rate cut are uncertain, but they could be significant. It is essential to monitor the situation closely and be prepared for potential risks.”

Investor Strategies

The jumbo rate cut by the Federal Reserve presents a complex landscape for investors. While it may seem like a boon for certain sectors, it’s crucial to understand the nuances and potential risks involved. This section explores potential investment strategies, risk management techniques, and specific opportunities that might arise from this shift in monetary policy.

Strategies for Navigating the Market

The rate cut can influence investment decisions in various ways. Here’s a breakdown of strategies:

- Equity Investments:The rate cut could boost stock valuations, particularly in sectors sensitive to interest rates like technology and consumer discretionary. Investors may consider increasing their equity exposure, focusing on companies with strong growth prospects and robust balance sheets. However, it’s crucial to exercise caution, as market volatility could persist.

- Fixed Income:The rate cut might lead to lower bond yields, making fixed income investments less attractive. However, investors seeking stability and income might consider diversifying their portfolios with short-term bonds or investment-grade corporate bonds.

- Real Estate:The rate cut could stimulate the housing market, making real estate investments more attractive. Investors may consider investing in residential or commercial properties, keeping in mind local market conditions and potential risks.

- Currency Trading:The rate cut could weaken the US dollar, creating opportunities for currency traders. Investors might consider buying currencies of countries with strong economic fundamentals and higher interest rates.

Managing Risk and Maximizing Returns

In the current market environment, managing risk is paramount. Here are some strategies:

- Diversification:Spreading investments across different asset classes, sectors, and geographies can help mitigate risk. A diversified portfolio can reduce the impact of any single investment performing poorly.

- Risk Tolerance Assessment:Investors should assess their risk tolerance and invest accordingly. Those with a higher risk tolerance may choose to invest in more volatile assets, while those with a lower risk tolerance may prefer more conservative investments.

- Active Portfolio Management:Regularly reviewing and adjusting the portfolio based on market conditions and individual goals is crucial. This may involve rebalancing the portfolio, selling underperforming investments, and adding new investments with potential.

- Professional Advice:Seeking advice from a qualified financial advisor can help investors navigate the complex market landscape and develop a personalized investment strategy.

Specific Investment Opportunities

The rate cut could create opportunities in specific sectors:

- Technology:The rate cut could benefit tech companies, as lower borrowing costs can fuel innovation and expansion. Investors might consider investing in companies with strong growth potential and a competitive edge in their respective markets.

- Consumer Discretionary:The rate cut could boost consumer spending, benefiting companies in the consumer discretionary sector. Investors might consider investing in companies with strong brand recognition, a loyal customer base, and a track record of profitability.

- Emerging Markets:The rate cut could lead to increased capital flows to emerging markets, benefiting companies in these regions. Investors might consider investing in companies with strong growth prospects and exposure to emerging markets.