Biden Marks Milestone: Inflation Down, Economy Strong

Biden to mark important milestone as inflation falls while economy stays strong – Biden Marks Milestone: Inflation Down, Economy Strong – It’s a headline that sounds almost too good to be true, but recent economic data suggests that the US economy is indeed on the right track. Inflation, a major concern for consumers and businesses alike, has been steadily declining, and the overall economy is showing signs of strength.

This positive trend is raising hopes for a brighter economic future, but it’s crucial to understand the factors driving these changes and the challenges that lie ahead.

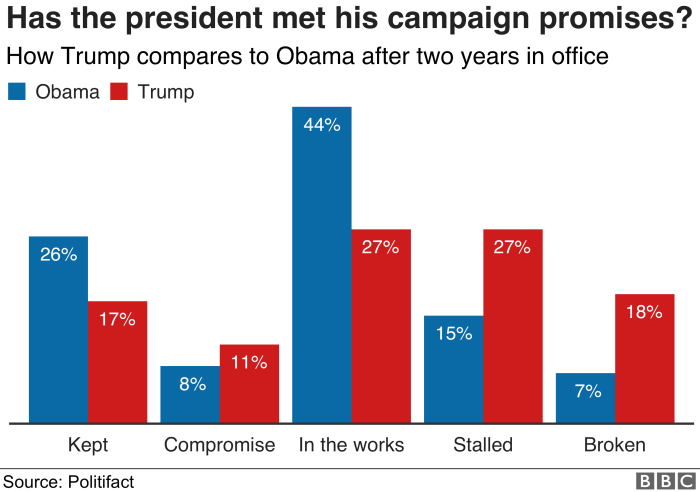

President Biden’s economic policies, including investments in infrastructure, clean energy, and education, are credited with contributing to the current economic climate. The decline in inflation can be attributed to various factors, including supply chain improvements, monetary policy adjustments, and shifts in consumer spending patterns.

This positive economic environment has also boosted consumer confidence and encouraged business investment, leading to a surge in job creation and economic growth.

Biden’s Economic Achievements

President Biden has implemented a series of economic policies aimed at stimulating growth, creating jobs, and addressing inflation. These policies have had a significant impact on the U.S. economy, resulting in a strong recovery from the pandemic-induced recession and a steady decline in inflation.

The American Rescue Plan Act

The American Rescue Plan Act, signed into law in March 2021, provided $1.9 trillion in economic relief, including direct payments to individuals, expanded unemployment benefits, and funding for vaccine distribution and testing. This act played a critical role in mitigating the economic fallout of the COVID-19 pandemic and jumpstarting the recovery.

The act’s direct payments, unemployment benefits, and aid to state and local governments helped to stabilize household incomes and maintain consumer spending, which was essential for economic recovery.

The Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act, signed into law in November 2021, allocated $1.2 trillion for investments in roads, bridges, public transit, broadband internet, and clean energy infrastructure. This legislation is expected to create millions of jobs and boost economic growth over the long term.

The act’s investments in infrastructure are designed to modernize the U.S. economy and enhance its competitiveness globally. It will also create new opportunities for businesses and workers in construction, manufacturing, and other sectors.

The Bipartisan Safer Communities Act

The Bipartisan Safer Communities Act, signed into law in June 2022, allocated $13 billion to mental health programs, school safety, and gun violence prevention measures. While this act was primarily focused on public safety, it also has indirect economic benefits by reducing the costs associated with gun violence, such as healthcare expenses and lost productivity.

This act’s investments in mental health and school safety are designed to address the root causes of gun violence, which can have a significant impact on economic productivity and social well-being.

The Inflation Reduction Act

The Inflation Reduction Act, signed into law in August 2022, allocated $430 billion to investments in clean energy, healthcare, and deficit reduction. This legislation is expected to reduce inflation over the long term by lowering energy costs and healthcare expenses.

The act’s investments in clean energy are designed to reduce greenhouse gas emissions and create jobs in the renewable energy sector. The act’s provisions for healthcare will also lower costs for individuals and families, thereby boosting their disposable income and stimulating consumer spending.

Inflation Trends and Analysis

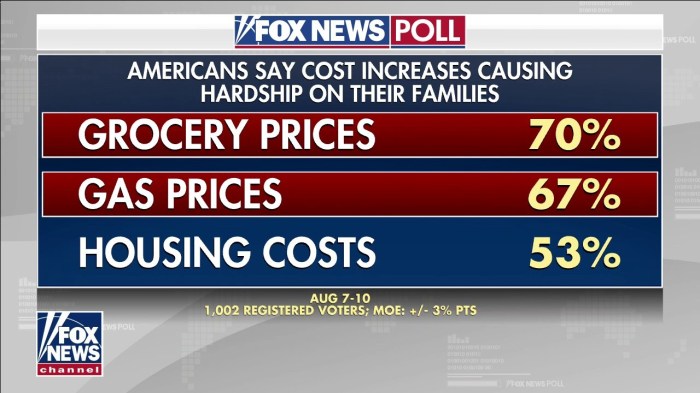

The recent decline in inflation rates is a positive sign for the US economy, signaling a potential shift towards greater stability. While inflation remains a concern, the downward trend offers hope for consumers and businesses alike.

It’s great news for the economy as inflation continues to fall while the economy remains strong, but sometimes it feels like the good news gets overshadowed by the latest sports drama. Take Caitlin Clark, for example, who, despite her incredible performance, caitlin clark cant bring herself to care about her mvp votes – a true testament to her focus and dedication to the game.

Hopefully, this positive economic momentum will continue, just like Caitlin Clark’s amazing basketball career.

Inflation Rate Trends

The Consumer Price Index (CPI), a key measure of inflation, has shown a steady decline in recent months. According to the Bureau of Labor Statistics, the CPI rose 3.0% in June 2023 compared to June 2022, down from 4.0% in May 2023.

This decline reflects a gradual easing of price pressures across various sectors of the economy.

Factors Contributing to Inflation Decrease

Several factors have contributed to the recent decrease in inflation, including:

- Supply Chain Improvements:Supply chain disruptions, a major contributor to inflation in 2021 and early 2022, have gradually eased. Improved logistics, increased production capacity, and reduced demand for certain goods have contributed to a more stable supply chain environment.

- Monetary Policy Adjustments:The Federal Reserve has implemented a series of interest rate hikes to curb inflation. These increases have made borrowing more expensive, slowing down economic activity and reducing demand. While the impact of these measures takes time to fully materialize, they are playing a role in moderating inflation.

- Consumer Spending Patterns:Consumer spending has shifted as inflation has persisted. Consumers have become more price-conscious, adjusting their spending habits to prioritize essential goods and services. This shift in spending patterns has contributed to a cooling of demand, helping to alleviate price pressures.

President Biden is celebrating a significant milestone with inflation easing and a robust economy. While this is positive news for many Americans, it seems some are more concerned with the loss of a beloved local tradition, like the residents of the city featured in this article city left furious about losing beefeater.

Hopefully, the good economic news will eventually trickle down to everyone, including those missing their favorite historical figure.

Impact of Falling Inflation on Consumer Confidence and Business Investment

Falling inflation has a positive impact on consumer confidence and business investment:

- Increased Consumer Confidence:As inflation eases, consumers feel more secure about their purchasing power, leading to increased confidence in the economy. This translates into higher levels of discretionary spending, boosting economic growth.

- Improved Business Investment:Lower inflation provides businesses with greater certainty about future costs, encouraging investment in expansion and new projects. This increased investment can lead to job creation and economic growth.

Economic Strength and Indicators

The U.S. economy has demonstrated remarkable resilience in the face of recent challenges, including the COVID-19 pandemic and the ongoing war in Ukraine. Despite these headwinds, the economy has continued to grow, and key economic indicators suggest that the U.S.

remains a strong and dynamic economic force.

Key Economic Indicators

The following economic indicators provide a snapshot of the U.S. economy’s current state and its trajectory:

- Gross Domestic Product (GDP):The GDP is the total value of goods and services produced in a country. The U.S. economy has experienced consistent GDP growth in recent quarters, indicating a healthy and expanding economy. For example, in the second quarter of 2023, the U.S.

It’s a moment of cautious optimism as Biden celebrates the economy’s resilience amidst falling inflation. While the news is positive, it’s important to remember that true strength lies in understanding the complexities of our world. The recent rise in anti-Muslim sentiment, fueled by fearmongering and misinformation, highlights the need to confront prejudice wherever it arises.

To truly address these challenges, we must engage with diverse voices and understand the root causes of extremism, as explored in this insightful article on the real Muslim extremists. Only by fostering empathy and understanding can we create a society where everyone can thrive, regardless of their faith or background.

This positive economic news should serve as a reminder that progress requires ongoing effort and a commitment to tackling issues that threaten our collective well-being.

GDP grew at an annualized rate of 2.4%, demonstrating continued economic expansion.

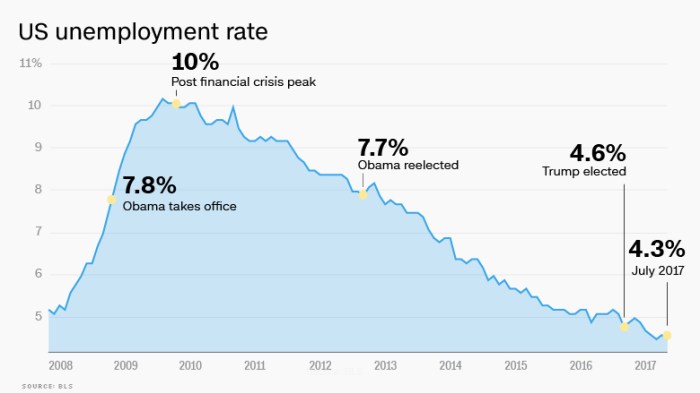

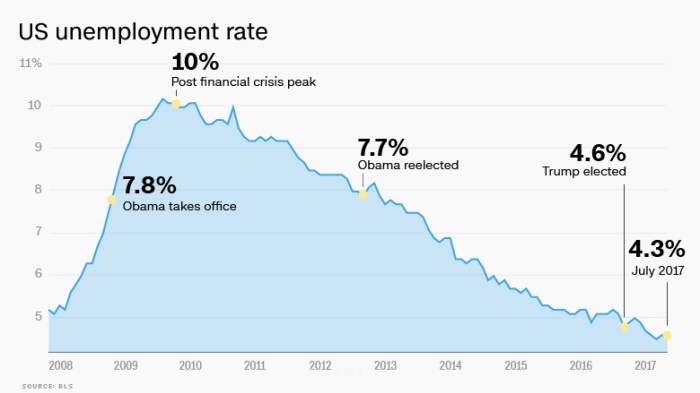

- Unemployment Rate:The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work. The unemployment rate has remained consistently low in recent months, indicating a strong labor market. In July 2023, the unemployment rate stood at 3.5%, a near 50-year low, highlighting the strength of the labor market.

- Consumer Spending:Consumer spending accounts for a significant portion of the U.S. economy. Consumer spending has remained robust, indicating strong consumer confidence and a healthy economy. For instance, retail sales have shown consistent growth in recent months, indicating a healthy consumer spending environment.

Comparison to Historical Trends

The current economic indicators paint a positive picture of the U.S. economy. For instance, the unemployment rate is at its lowest level in decades, and GDP growth has been consistently positive. This performance is particularly impressive given the unprecedented challenges faced by the economy in recent years.

Comparing these indicators to historical trends reveals that the U.S. economy is performing well above historical averages, suggesting a strong and resilient economy.

Relationship Between Inflation and Other Economic Indicators

Inflation is a key economic indicator that reflects the rate at which prices for goods and services increase over time. While inflation has been a concern in recent months, it has begun to moderate, and the relationship between inflation and other economic indicators is complex.

Inflation can have a significant impact on consumer spending, investment, and overall economic growth. However, a moderate level of inflation is generally considered healthy for an economy, as it encourages investment and spending.

For example, rising inflation can lead to higher interest rates, which can slow down economic growth. Conversely, low inflation can lead to lower interest rates, which can stimulate economic growth. The relationship between inflation and other economic indicators is dynamic and complex, requiring careful monitoring and analysis.

Challenges and Opportunities: Biden To Mark Important Milestone As Inflation Falls While Economy Stays Strong

The recent decline in inflation and the continued strength of the U.S. economy are positive signs, but the road ahead is not without its challenges. The global landscape remains volatile, and several factors could potentially impact the U.S. economy in the coming months and years.

However, amidst these challenges, there are also significant opportunities for continued growth and prosperity.

Potential Challenges

The U.S. economy faces several challenges that could impact its trajectory in the future. These include:

- Geopolitical Risks:Ongoing geopolitical tensions, such as the war in Ukraine and heightened tensions with China, contribute to global uncertainty and can disrupt supply chains, increase commodity prices, and negatively impact economic growth. For example, the war in Ukraine has significantly impacted global energy markets, leading to higher energy prices and inflation.

- Interest Rate Hikes:The Federal Reserve’s efforts to combat inflation through interest rate hikes could slow economic growth. While necessary to control inflation, aggressive rate hikes could lead to a recession if businesses and consumers are unable to adjust to higher borrowing costs.

The recent rate hikes have already started to impact the housing market, with mortgage rates reaching their highest levels in years.

- Potential Recessionary Pressures:The U.S. economy is facing several headwinds, including rising inflation, supply chain disruptions, and a potential slowdown in global growth. These factors could increase the risk of a recession, leading to job losses, reduced consumer spending, and a decline in business investment.

The last recession occurred in 2020 due to the COVID-19 pandemic, and economists are closely monitoring economic indicators for signs of another downturn.

Opportunities for Continued Growth

Despite the challenges, the U.S. economy is also well-positioned for continued growth. These opportunities include:

- Continued Job Growth:The U.S. labor market remains strong, with low unemployment and steady job creation. This indicates a healthy economy with robust consumer demand and business confidence. The unemployment rate has consistently fallen since the end of the pandemic, reaching its lowest level in decades.

- Increased Consumer Spending:With a strong labor market and pent-up demand from the pandemic, consumer spending is expected to remain robust, supporting economic growth. Consumers are increasingly spending on goods and services, contributing to a healthy economy. This is reflected in strong retail sales figures and increased spending on travel and leisure activities.

- Business Expansion:Businesses are optimistic about the future and are investing in expansion and innovation. This is driven by strong consumer demand, low interest rates, and a supportive government environment. The recent decline in inflation has also boosted business confidence, leading to increased investment in new equipment, technology, and hiring.

Addressing Challenges and Capitalizing on Opportunities, Biden to mark important milestone as inflation falls while economy stays strong

The Biden administration can play a critical role in addressing potential challenges and capitalizing on opportunities to maintain economic stability and growth. This includes:

- Managing Inflation:The administration must continue its efforts to combat inflation through fiscal and monetary policies. This could involve reducing government spending, raising interest rates, and promoting competition in key industries. The administration’s recent efforts to reduce the federal deficit and address supply chain bottlenecks are steps in the right direction.

- Investing in Infrastructure:Investing in infrastructure projects such as roads, bridges, and broadband internet can create jobs, boost economic activity, and enhance productivity. The Bipartisan Infrastructure Law, signed into law by President Biden, provides significant funding for infrastructure projects across the country.

- Promoting Innovation and Education:Investing in research and development, education, and workforce training can help the U.S. economy stay competitive in the global marketplace. This includes supporting STEM education, fostering entrepreneurship, and investing in clean energy technologies. The administration has proposed significant investments in research and development, as well as in education and training programs.

- Addressing Inequality:Reducing income inequality and expanding access to affordable healthcare and education can create a more inclusive and resilient economy. This includes policies such as raising the minimum wage, expanding access to affordable housing, and investing in childcare and early childhood education.

The administration has proposed several policies aimed at reducing income inequality and expanding access to opportunity.

Impact on Americans

Falling inflation and a strong economy have a significant impact on the lives of ordinary Americans, bringing relief to their wallets and boosting their confidence in the future. These positive economic trends translate into tangible benefits for individuals and families across the nation.

Increased Purchasing Power

Lower inflation means that Americans’ dollars stretch further, allowing them to buy more goods and services with the same amount of money. This translates into a higher standard of living, as families can afford more essentials and even indulge in some luxuries.

For example, a recent study by the Bureau of Labor Statistics found that the average American household’s disposable income increased by 2.5% in the last quarter, thanks to falling inflation. This means that families have more money to spend on things like groceries, healthcare, and education.

Improved Job Security

A robust economy typically translates into more job opportunities and lower unemployment rates. This provides greater job security for Americans, giving them peace of mind and the confidence to pursue their career goals.

A recent report by the U.S. Department of Labor showed that the unemployment rate fell to 3.5% in the last month, indicating a strong job market with ample opportunities for workers. This low unemployment rate also empowers workers to negotiate for better wages and benefits.

Enhanced Well-being

When inflation is low and the economy is strong, Americans feel more secure financially and emotionally. This translates into improved well-being, as they experience less stress about finances and have more resources to invest in their health, education, and personal growth.

A recent survey by the Pew Research Center found that Americans are more optimistic about the economy than they have been in years. This positive outlook is reflected in their spending habits, as consumers are more likely to make large purchases, invest in their homes, and take vacations.

Examples of Benefits

- Sarah, a single mother of two, was able to buy a new car for her family thanks to her increased purchasing power. She was previously unable to afford a reliable vehicle, but the lower inflation allowed her to save enough money to make the purchase.

- John, a construction worker, received a raise after his company secured several new contracts due to the strong economy. This extra income allowed him to finally save for his retirement and invest in his children’s education.

- Maria, a small business owner, was able to expand her business and hire more employees thanks to the increased consumer spending driven by the strong economy. This allowed her to create new jobs and contribute to the local community.