National Debt Hits 100% of GDP: A First Since the 1960s

National debt at 100 of gdp for first time since 1960s – National debt at 100% of GDP for the first time since the 1960s is a significant milestone, raising concerns about the long-term health of the US economy. This level of debt wasn’t seen since the Vietnam War era, a time of significant social and political upheaval.

The current situation is a result of a complex interplay of factors, including decades of fiscal policies, global economic shifts, and recent events like the COVID-19 pandemic.

While the national debt has been steadily climbing for years, its recent acceleration has sparked debate about its potential consequences. Some experts warn of a looming economic crisis, citing the risks of inflation, higher interest rates, and reduced economic growth.

Others argue that the debt is manageable, pointing to the government’s ability to borrow at low interest rates and the potential for economic growth to offset the debt burden.

Historical Context

The recent news that the US national debt has surpassed 100% of GDP for the first time since the 1960s is a significant milestone, prompting many to wonder about the historical context and implications of this event. While it’s a concerning threshold, it’s essential to understand the historical context of this event and its impact on the economy.

Debt Levels in the 1960s

The 1960s witnessed a surge in national debt due to various factors, including the Cold War, the Vietnam War, and the expansion of social programs like Medicare and Medicaid. These events led to substantial government spending, pushing the debt levels to unprecedented heights.

The national debt surpassed 100% of GDP for the first time in the 1960s, reaching a peak of 106% in 1969. This was primarily driven by the increasing costs of the Vietnam War and the growing social welfare programs.

The news that the US national debt has surpassed 100% of GDP for the first time since the 1960s is a stark reminder of the economic challenges we face. This coincides with a period of heightened global tension, as the US intensifies the war of words with its adversaries.

While these geopolitical tensions are certainly concerning, the looming shadow of our national debt adds another layer of complexity to the economic landscape, requiring careful and strategic solutions.

Economic and Political Conditions in the 1960s

The 1960s were a period of economic expansion and prosperity. The post-World War II economic boom fueled consumer spending and investment, contributing to a robust economy. However, the increasing costs of the Vietnam War and the expansion of social programs led to a significant rise in government spending.The government’s decision to finance these expenses through borrowing led to a substantial increase in the national debt.

It’s hard to believe the national debt has reached 100% of GDP for the first time since the 1960s, a stark reminder of the economic challenges we face. But hey, who’s got time to worry about that when the Wolverines face off against the Trojans on Saturday?

For a little distraction, check out these five last-minute predictions for Michigan vs USC on Saturday – hopefully, the game will be more exciting than the economic news.

This decision was driven by the political climate of the time, where the Cold War and the Vietnam War were considered crucial national priorities.

Economic Consequences of High Debt Levels

While the 1960s saw a period of economic growth, the rising national debt also had some negative consequences. The high levels of borrowing contributed to increased interest rates, which made it more expensive for businesses to borrow money and invest.

Furthermore, the increased government spending led to inflationary pressures, as the increased money supply chasing the same amount of goods and services drove prices higher. The combination of higher interest rates and inflation could potentially slow down economic growth and make it more challenging for businesses to operate and for individuals to save money.

Current Economic Situation

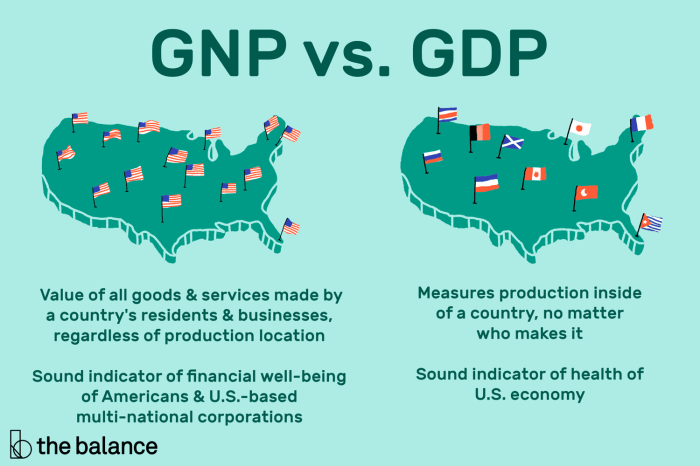

The national debt reaching 100% of GDP is a significant milestone, reflecting the culmination of various economic factors and government policies. This section examines the key economic drivers behind this development, analyzes the government’s fiscal policies, and identifies the major spending categories contributing to the debt.

The news that the national debt has surpassed 100% of GDP for the first time since the 1960s is a stark reminder of the economic challenges we face. It’s a complex issue with no easy solutions, and while the news cycle may be focused on the latest golf tournament, like the rory mcilroy is box office but he isnt tiger woods says sky sports wayne riley after wentworth play off loss , the long-term implications of a soaring national debt are far more consequential.

We need to have a serious national conversation about how to address this growing problem, and it’s a conversation that needs to happen sooner rather than later.

Impact of Economic Factors

The current economic situation is a complex interplay of factors that have contributed to the rise in national debt.

- Recessions and Economic Slowdowns:Economic downturns, such as the 2008 financial crisis and the COVID-19 pandemic, have led to significant revenue shortfalls for the government. To stimulate economic activity and support businesses and individuals, governments often resort to increased spending and tax cuts, which can increase the national debt.

For instance, the 2009 American Recovery and Reinvestment Act, aimed at mitigating the impact of the financial crisis, significantly increased government spending.

- Demographic Shifts:Aging populations, with increasing numbers of retirees, put pressure on social security and healthcare spending. As the population ages, the ratio of working-age individuals to retirees decreases, leading to higher social security and healthcare expenditures. The US Social Security program, for example, faces long-term solvency challenges due to demographic shifts.

- Interest Rates:Low interest rates can encourage borrowing by both the government and individuals. While low interest rates can stimulate economic growth, they can also lead to increased borrowing and potentially higher debt levels.

- Globalization and Trade:Increased global competition and trade can lead to job losses and lower wages in some sectors, potentially impacting tax revenue and increasing the need for government assistance. For example, the decline of manufacturing jobs in the US due to globalization has been a factor contributing to income inequality and potentially higher government spending on social programs.

Government Fiscal Policies

Government fiscal policies play a significant role in influencing national debt levels.

- Tax Policies:Tax cuts, while potentially stimulating economic growth, can reduce government revenue and contribute to higher deficits. For example, the Tax Cuts and Jobs Act of 2017, which reduced taxes for businesses and individuals, is estimated to have significantly increased the national debt.

- Spending Policies:Government spending on social programs, infrastructure, defense, and other areas can impact the national debt. Increased spending on social programs, such as Medicare and Medicaid, has been a major contributor to the growth of the national debt.

- Debt Management:The government’s ability to manage its debt, including refinancing and interest payments, can influence debt levels. High interest rates on government debt can increase the cost of borrowing and contribute to higher deficits.

Major Spending Categories

Several spending categories contribute significantly to the national debt.

- Social Security:Social Security, providing retirement, disability, and survivor benefits, is a major expenditure for the US government. As the population ages, the cost of Social Security is projected to increase, further contributing to the national debt.

- Medicare and Medicaid:These healthcare programs provide health insurance to the elderly, disabled, and low-income individuals. The rising cost of healthcare, coupled with an aging population, has significantly increased spending on these programs, contributing to the national debt.

- Defense:The US defense budget is one of the largest in the world. Spending on defense, including military personnel, equipment, and operations, is a significant contributor to the national debt.

- Interest on Debt:The government incurs significant costs in paying interest on its outstanding debt. As the national debt increases, so does the cost of interest payments, further adding to the debt burden.

Potential Impacts: National Debt At 100 Of Gdp For First Time Since 1960s

The prospect of the national debt exceeding 100% of GDP for the first time since the 1960s raises significant concerns about the potential economic consequences. While historical precedents offer some insights, the current situation is unique, demanding careful analysis of the risks and potential impacts.

Impact on Inflation

High debt levels can contribute to inflation. When the government borrows heavily, it increases the demand for funds, potentially pushing up interest rates. This can lead to higher borrowing costs for businesses and consumers, ultimately feeding into higher prices for goods and services.

Impact on Interest Rates

As the national debt rises, the government may need to offer higher interest rates to attract investors, increasing the cost of borrowing. This can crowd out private investment, as businesses find it more expensive to secure loans. Furthermore, higher interest rates can lead to slower economic growth as businesses and individuals reduce spending and investment due to the increased cost of borrowing.

Impact on Economic Growth

Excessive debt can weigh down economic growth. When a significant portion of government spending is directed towards debt servicing, it leaves fewer resources for public investments in infrastructure, education, and research, which are crucial for long-term economic prosperity. Additionally, high debt levels can create uncertainty and discourage investment, leading to slower growth.

Historical Comparisons

While the current situation is unique, historical experiences provide valuable insights. For instance, Japan’s experience with a high national debt in the 1990s highlights the potential for prolonged economic stagnation. However, it’s important to note that the specific impacts of high debt levels can vary depending on factors such as the level of economic development, the structure of the debt, and the government’s fiscal policies.

Policy Options

Addressing the national debt exceeding 100% of GDP requires a comprehensive approach involving a combination of policy options. The primary options involve reducing spending, raising taxes, or a blend of both. Each approach presents unique advantages and disadvantages, influencing the economy’s growth and stability.

Comparing Policy Options

The following table compares the pros and cons of different policy options, highlighting their potential impact on the economy.

| Policy Option | Pros | Cons | Impact on Economy |

|---|---|---|---|

| Reducing Spending |

|

|

|

| Raising Taxes |

|

|

|

| Combination of Spending Cuts and Tax Increases |

|

|

|

Policy Recommendations, National debt at 100 of gdp for first time since 1960s

Addressing the national debt requires a multi-pronged approach. Policy recommendations include:

- Prioritizing Spending:Focus on essential programs and eliminate wasteful spending.

- Tax Reform:Implement a comprehensive tax reform that promotes economic growth and fairness.

- Long-Term Fiscal Planning:Develop a long-term fiscal plan that ensures debt sustainability.

- Promoting Economic Growth:Implement policies that encourage investment, job creation, and productivity.

Public Perception and Debate

The national debt reaching 100% of GDP has sparked a heated debate among the public and policymakers. While some view it as a looming crisis, others argue that it is manageable with appropriate measures. This section explores the public perception of the national debt and the different perspectives on how to address it.

Public Perception of the National Debt

Public perception of the national debt is complex and often influenced by political affiliations and economic circumstances. A significant portion of the population is concerned about the long-term implications of a large national debt, fearing potential consequences like higher interest rates, reduced economic growth, and a diminished standard of living.

They argue that unchecked borrowing could lead to a financial crisis, similar to the one experienced in Greece in 2010. However, there are also those who believe that the national debt is not an immediate threat and that focusing on economic growth is more important than debt reduction.

They argue that the government can manage the debt through responsible spending and revenue generation.

Political Debate Surrounding the National Debt

The political debate surrounding the national debt is highly polarized, with different political parties advocating for contrasting approaches.

Conservative Perspectives

Conservatives generally advocate for a balanced budget and fiscal responsibility. They argue that reducing the national debt should be a top priority and that it can be achieved through spending cuts and tax increases. They often cite the potential negative consequences of high debt, such as increased interest rates and inflation, as justification for their stance.

They may support measures like:

- Significant cuts to social programs and government spending.

- Tax cuts for businesses and individuals to stimulate economic growth.

- A balanced budget amendment to the Constitution.

Liberal Perspectives

Liberals often prioritize social programs and government investments, arguing that they are essential for economic growth and social well-being. They view the national debt as a tool for financing these programs and believe that it can be managed through responsible spending and revenue generation.

They may support measures like:

- Increased taxes on corporations and wealthy individuals.

- Investing in infrastructure, education, and research and development.

- Maintaining or expanding social programs like Social Security and Medicare.

Key Arguments and Potential Impacts

The debate surrounding the national debt involves a range of arguments, each with its own potential benefits and drawbacks.

Arguments for Debt Reduction

Proponents of debt reduction argue that it is essential for long-term economic stability. They cite the potential negative consequences of high debt, such as:

- Higher interest rates, which can stifle economic growth by making borrowing more expensive for businesses and consumers.

- Increased inflation, which can erode the purchasing power of consumers and lead to economic instability.

- A reduced ability for the government to respond to future economic crises.

Arguments for Continued Borrowing

Supporters of continued borrowing argue that it is necessary to finance essential government programs and investments. They believe that the government can manage the debt through responsible spending and revenue generation. They also point out that:

- The national debt has historically been high in the United States, and the economy has continued to grow.

- Reducing the debt too quickly could stifle economic growth and lead to job losses.

- The government can use borrowing to fund infrastructure projects and social programs that can boost economic growth in the long term.