Chinas Central Bank Chief to Hold Press Conference After Fed Rate Cut

Chinas central bank chief set to hold press conference days after fed rate cut – China’s central bank chief is set to hold a press conference just days after the Federal Reserve cut interest rates, raising questions about the potential impact on the global economy. This event comes at a time when both China and the US are grappling with economic challenges, and the decisions made by their respective central banks could have far-reaching consequences.

The Fed’s rate cut, intended to stimulate the US economy, has sparked speculation about how China’s central bank might respond. The press conference provides an opportunity for the central bank chief to address these concerns and shed light on China’s economic outlook.

Analysts will be closely watching for any hints about potential policy changes or statements regarding the country’s currency and trade relations with the US.

Context and Background: Chinas Central Bank Chief Set To Hold Press Conference Days After Fed Rate Cut

The upcoming press conference by the head of China’s central bank, the People’s Bank of China (PBOC), comes at a pivotal moment in the global economic landscape. This event follows closely on the heels of the US Federal Reserve’s decision to cut interest rates, a move that has sent ripples through financial markets worldwide.

Understanding the context surrounding this press conference requires examining the recent Fed rate cut, the current state of the Chinese economy, and the historical relationship between the US and Chinese central banks.

The Recent Fed Rate Cut and its Implications

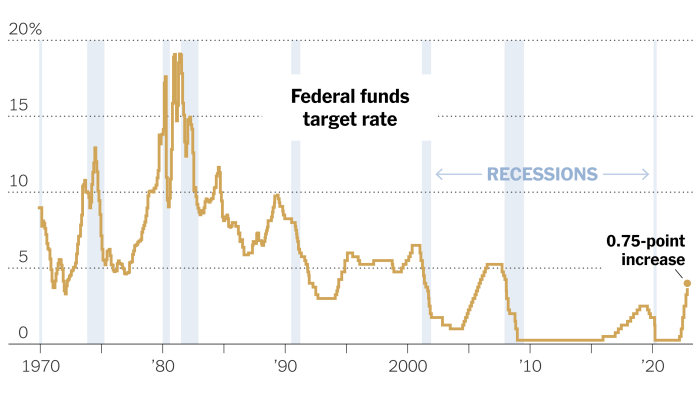

The US Federal Reserve’s decision to cut interest rates in July 2023 was a significant move aimed at mitigating the risks of a potential economic slowdown. The Fed’s actions were driven by concerns about global trade tensions, weakening economic growth in key economies, and the potential impact of rising inflation.

This rate cut is expected to have several implications for the global economy:

- Stimulating Economic Growth:Lower interest rates can encourage borrowing and investment, leading to increased economic activity and potentially boosting growth.

- Impact on Currency Exchange Rates:A rate cut can weaken a country’s currency relative to other currencies. In the case of the US, a weaker dollar could make US exports more competitive but also make imports more expensive.

- Potential for Inflation:While rate cuts can stimulate growth, they also carry the risk of fueling inflation. Lower interest rates can lead to increased borrowing and spending, potentially pushing up prices.

The Current State of the Chinese Economy

China’s economy has been experiencing a period of slowing growth in recent years. This slowdown is attributed to several factors, including the trade war with the United States, the country’s ongoing efforts to transition to a more sustainable growth model, and the impact of the COVID-19 pandemic.

- Trade Tensions:The trade war between the US and China has significantly impacted Chinese exports and economic growth.

- Shifting Growth Model:China is moving away from a reliance on heavy industry and investment towards a more consumer-driven economy. This transition has been challenging and has contributed to the slowdown in growth.

- COVID-19 Pandemic:The COVID-19 pandemic has had a significant impact on China’s economy, disrupting supply chains, reducing consumer spending, and slowing economic activity.

Historical Relationship Between the US Federal Reserve and the People’s Bank of China

The US Federal Reserve and the People’s Bank of China have a complex and evolving relationship. Both central banks play a crucial role in shaping the global financial landscape.

- Currency Management:The two central banks have historically coordinated on issues related to currency management and exchange rate stability.

- Financial Cooperation:The US and China have engaged in various forms of financial cooperation, including joint efforts to address global financial crises.

- Trade Tensions:The trade war between the US and China has strained the relationship between the two central banks.

Potential Topics for the Press Conference

The timing of the press conference, coming just days after the Fed’s rate cut, suggests a potential focus on China’s monetary policy response to global economic developments. The central bank chief is likely to address key economic indicators and potential policy actions, providing insights into China’s stance on supporting growth amidst global uncertainties.

With the Chinese central bank chief set to hold a press conference days after the Fed rate cut, it’s clear the global financial landscape is in a state of flux. Meanwhile, domestic politics are also making headlines, as house speaker johnson axes trump voting restrictions in new government funding bill , potentially signaling a shift in the political landscape.

It’ll be interesting to see how these events play out and what impact they have on the global economy.

Economic Indicators

The central bank chief will likely discuss key economic indicators reflecting China’s current economic performance and outlook. These indicators may include:

- Gross Domestic Product (GDP) growth:The central bank chief might discuss the latest GDP figures, providing insights into the pace of economic growth and potential adjustments to policy to achieve the targeted growth rate. For instance, the central bank might highlight the impact of external factors like global trade tensions on GDP growth and Artikel potential policy measures to mitigate these impacts.

- Inflation:The central bank chief might discuss the latest inflation figures, providing insights into the level of price pressures in the economy. For instance, the central bank might discuss the impact of rising commodity prices on inflation and potential policy measures to manage inflation expectations.

- Unemployment rate:The central bank chief might discuss the latest unemployment figures, providing insights into the labor market conditions. For instance, the central bank might highlight the impact of structural changes in the economy on unemployment and potential policy measures to support job creation.

- Trade data:The central bank chief might discuss the latest trade data, providing insights into the performance of China’s exports and imports. For instance, the central bank might highlight the impact of global trade tensions on trade flows and potential policy measures to support trade growth.

Potential Policy Actions

The central bank chief might announce policy actions or statements aimed at supporting economic growth and managing inflation. These actions might include:

- Interest rate adjustments:The central bank chief might announce a reduction in interest rates to encourage borrowing and investment, stimulating economic activity. For instance, the central bank might lower the benchmark lending rate to reduce borrowing costs for businesses and consumers, promoting investment and consumption.

- Reserve requirement ratio (RRR) adjustments:The central bank chief might announce a reduction in the RRR, injecting more liquidity into the banking system. For instance, the central bank might lower the RRR to allow banks to lend more freely, boosting credit growth and supporting economic activity.

The timing of China’s central bank chief’s press conference, coming just days after the Fed’s rate cut, is certainly intriguing. It’s almost as if the world’s major economies are playing a game of economic chess, with each move carefully considered.

Meanwhile, across the Atlantic, France is experiencing its own political drama, with French President Emmanuel Macron announcing a new right-wing government that will likely have a significant impact on the country’s future. It will be interesting to see how these events unfold and how they ultimately affect the global economy.

- Targeted support for specific sectors:The central bank chief might announce targeted support measures for specific sectors facing challenges, such as small and medium-sized enterprises (SMEs). For instance, the central bank might provide preferential lending rates or other financial support to SMEs to mitigate the impact of economic slowdowns.

Market Reactions and Analysis

The central bank chief’s press conference will likely have a significant impact on financial markets, particularly in China and the US. Investors and analysts will closely scrutinize the statements for clues about the direction of monetary policy and its potential implications for economic growth and asset prices.

Impact on Financial Markets

The central bank chief’s comments will be analyzed for any signals about the future trajectory of interest rates and the overall stance of monetary policy.

- A hawkish stance, indicating a potential tightening of monetary policy, could lead to a sell-off in equities and a rise in bond yields. This is because higher interest rates make borrowing more expensive, which can slow down economic growth and reduce corporate profits.

The upcoming press conference by China’s central bank chief, coming just days after the Fed’s rate cut, is sure to spark global interest. It’s a critical time to understand the interplay of economic forces, especially given the recent instability in the Middle East.

For more context on the region’s current landscape, check out more information on the middle east. The central bank’s response to these global shifts will be closely watched, as it could have significant implications for China’s economic trajectory and the global financial system.

- Conversely, a dovish stance, suggesting a continuation of accommodative policies, could boost stock markets and lower bond yields. This is because lower interest rates make borrowing cheaper, which can stimulate economic activity and increase corporate profits.

Investor and Analyst Reactions, Chinas central bank chief set to hold press conference days after fed rate cut

Investors and analysts will react to the press conference based on their individual investment strategies and market outlook.

- Investors with a short-term focus may adjust their portfolio positions based on the perceived immediate impact of the central bank’s statements on asset prices.

- Analysts will dissect the central bank chief’s remarks to assess the potential long-term implications for the economy and financial markets. They may revise their forecasts for economic growth, inflation, and interest rates.

Comparison of Chinese and US Market Responses

The reactions of the Chinese and US markets may differ depending on their respective economic conditions and monetary policy stances.

- The Chinese market is likely to be more sensitive to the central bank chief’s statements, given the government’s significant role in guiding the economy.

- The US market, with its more independent central bank, may react less dramatically, although investors will still pay close attention to the signals about the future direction of monetary policy.

Global Economic Implications

The central bank chief’s statements will likely have significant repercussions on the global economic landscape, impacting various economies and sectors differently. Understanding these implications is crucial for investors, policymakers, and businesses alike.

Impact on Major Economies and Key Sectors

The potential impact of the central bank chief’s statements on major economies and key sectors can be summarized in the following table:

| Economy | Potential Impact | Key Sectors Affected |

|---|---|---|

| United States | Increased economic growth, potentially leading to higher inflation. | Technology, Manufacturing, Real Estate |

| China | Reduced export competitiveness due to a stronger US dollar. | Manufacturing, Exports, Trade |

| European Union | Mixed impact, with potential benefits for exporters but also risks for inflation. | Manufacturing, Tourism, Agriculture |

| Japan | Weakening yen, potentially boosting exports but also increasing import costs. | Electronics, Automobiles, Tourism |

| Emerging Markets | Increased capital outflows and currency depreciation, potentially leading to economic instability. | Financial Services, Commodities, Manufacturing |

Geopolitical Implications

The central bank chief’s statements could also have significant geopolitical implications, potentially affecting global power dynamics and international relations. For instance, a stronger US dollar could exacerbate tensions between the US and China, as it may hinder Chinese exports and economic growth.

Furthermore, the statements could influence the global currency landscape, potentially leading to increased competition among major economies to devalue their currencies and gain a competitive edge.

Long-Term Perspectives

The Fed’s rate cut and the upcoming press conference by China’s central bank chief offer a glimpse into the evolving global economic landscape. While the immediate implications are significant, the long-term effects will depend on a complex interplay of factors, including the trajectory of the US economy, China’s policy response, and global trade dynamics.

Potential Future Actions and Policy Shifts by the People’s Bank of China

The People’s Bank of China (PBOC) has a range of policy tools at its disposal to navigate the economic challenges ahead.

- Further Rate Cuts:The PBOC could lower interest rates further to stimulate borrowing and investment. This would aim to reduce borrowing costs for businesses and consumers, encouraging economic activity. However, excessive rate cuts could lead to asset bubbles and financial instability.

- Reserve Requirement Ratio (RRR) Adjustments:The PBOC can adjust the RRR, which is the amount of funds banks must hold in reserve. Lowering the RRR injects liquidity into the banking system, potentially leading to increased lending and economic growth. However, this could also exacerbate inflation if not managed carefully.

- Targeted Fiscal Stimulus:The PBOC could coordinate with the Chinese government to implement targeted fiscal stimulus measures, such as infrastructure projects or tax cuts, to boost specific sectors of the economy.

- Currency Management:The PBOC could intervene in the foreign exchange market to manage the value of the yuan. This could be done to support exports or to prevent excessive appreciation of the yuan, which could hurt Chinese competitiveness.

- Structural Reforms:The PBOC could focus on structural reforms, such as improving financial market efficiency, enhancing regulatory oversight, and fostering innovation, to promote long-term economic growth.