The Week in Business: Housing Market Gets Squeezed

The week in business housing market gets squeezed – The week in business: housing market gets squeezed. It’s a phrase that’s become increasingly common in recent months, as the once-booming housing market faces a series of challenges. Rising interest rates, inflation, and supply chain disruptions are all contributing to a tightening of the market, making it more difficult for buyers to find homes and for sellers to get top dollar.

This week, we’ll take a deep dive into the factors driving this shift in the housing market, exploring the impact on both buyers and sellers. We’ll also look at what experts are saying about the future of the market, and what we can expect in the months and years to come.

Housing Market Trends

The housing market is currently experiencing a period of significant change, driven by a confluence of factors that are impacting both buyers and sellers. Key indicators like inventory levels, price trends, and mortgage rates are painting a complex picture of the market’s trajectory.

The week in business saw a squeeze on the housing market, with rising interest rates and inflation putting pressure on buyers and sellers. Meanwhile, a more immediate concern emerged with the recall of select Jif products for potential salmonella , reminding us that even in turbulent economic times, food safety remains a priority.

It’s a stark reminder that while economic challenges are significant, health and safety concerns can quickly shift the focus of our daily lives.

Inventory Levels and Price Trends

Inventory levels remain low, continuing a trend that began during the pandemic. This scarcity is a major factor contributing to the ongoing upward pressure on home prices. While the pace of price growth has slowed in recent months, home values are still significantly higher than they were a year ago.

According to the National Association of Realtors, the median home price in the United States reached a record high of $413,800 in June 2023. This represents a year-over-year increase of 10.7%.

Impact of Rising Interest Rates

The Federal Reserve’s efforts to combat inflation have led to a series of interest rate hikes, which have had a direct impact on mortgage rates. Higher interest rates make it more expensive for buyers to finance a home, reducing their purchasing power and cooling demand.

This is evident in the decline in home sales activity, with the National Association of Realtors reporting a 20.8% year-over-year drop in existing home sales in June 2023.

Factors Contributing to the Squeeze

Several factors are contributing to the squeeze in the housing market, creating a challenging environment for both buyers and sellers.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have impacted the availability of materials and labor needed for new home construction, leading to delays and increased costs. This has slowed the pace of new home construction, further exacerbating the inventory shortage.

- Labor Shortages:The construction industry is facing a shortage of skilled labor, further hampering the ability to build new homes. This shortage is driven by factors such as an aging workforce, a decline in construction apprenticeships, and a lack of skilled workers.

The week in business saw the housing market get squeezed, with rising interest rates making it harder for many to afford a mortgage. But it’s not just the housing market that’s feeling the pinch – it’s about to get more expensive to take out federal student loans here’s why.

This will add to the financial strain for many young people, potentially impacting their ability to save for a down payment on a home. It’s a double whammy for those trying to enter the housing market, facing both rising costs and potential increased debt burdens.

- Inflation:The rising cost of materials, labor, and transportation has increased the cost of building new homes, putting upward pressure on prices. Inflation has also eroded the purchasing power of buyers, making it more difficult for them to afford a home.

Impact on Buyers

The current housing market presents a formidable challenge for homebuyers. The intense competition, escalating prices, and limited inventory have created a landscape where securing a home requires strategic planning, financial preparedness, and a healthy dose of patience.

Navigating the Competitive Landscape

The current housing market is characterized by intense competition, with multiple buyers vying for the same properties. This often leads to bidding wars, where buyers are forced to offer above the asking price to secure their desired homes. The competitive landscape can be daunting for buyers, as it requires them to be agile, decisive, and prepared to act quickly.

Adapting Strategies in a Tight Market

In response to the challenges posed by the competitive market, buyers are adapting their strategies to increase their chances of success. One common approach is to offer a higher down payment, which can make their offer more attractive to sellers.

Another strategy is to waive contingencies, such as the appraisal contingency or the financing contingency, to demonstrate their commitment to the purchase. This can be a risky move, but it can be necessary to win in a highly competitive market.

Potential Shift in Buyer Behavior

The affordability concerns and market uncertainty are likely to influence buyer behavior in the coming months. Some buyers may choose to delay their home purchase until the market stabilizes, while others may adjust their expectations and consider purchasing a less expensive home or in a less competitive area.

The market dynamics are constantly evolving, and buyers will need to remain adaptable and informed to make the best decisions for their individual circumstances.

Impact on Sellers

The current housing market, characterized by strong demand and a potential for quick sales, presents both advantages and disadvantages for sellers. While sellers can benefit from a competitive environment that often leads to multiple offers and faster closing times, they also need to navigate the complexities of negotiating with buyers and addressing potential appraisal issues.

Navigating Multiple Offers, The week in business housing market gets squeezed

Sellers in a hot market often find themselves fielding multiple offers, creating a competitive landscape that can lead to higher sale prices. However, navigating multiple offers can be challenging.

- Evaluating Offers:Sellers need to carefully evaluate each offer, considering not only the purchase price but also the terms, such as closing dates, contingencies, and financing options.

- Setting Deadlines:Establishing a clear deadline for offers allows sellers to manage the process efficiently and ensure all interested parties have a fair opportunity to submit their best proposals.

- Communicating Effectively:Open and transparent communication with all potential buyers is crucial. Sellers should inform all parties of the timeline, decision-making process, and any updates on the status of the offers.

Negotiating with Buyers

While strong demand can give sellers leverage in negotiations, it’s essential to approach the process strategically.

- Setting Realistic Expectations:Sellers should research recent comparable sales in their area to understand market values and set realistic expectations for the sale price.

- Understanding Buyer Motivations:Sellers should try to understand the motivations of potential buyers. This can help them anticipate potential negotiation points and tailor their approach accordingly.

- Being Prepared to Compromise:While sellers may be tempted to hold out for the highest possible price, being willing to compromise on certain terms can help facilitate a smooth transaction.

Addressing Appraisal Issues

In a competitive market, buyers may be willing to pay above asking price, but appraisal issues can arise and potentially derail a sale.

- Preparing for Appraisals:Sellers should prepare their property for the appraisal process by making necessary repairs, decluttering, and staging. This can help ensure the appraisal value reflects the true market value.

- Understanding Appraisal Guidelines:Sellers should familiarize themselves with the appraisal guidelines used in their area. This can help them anticipate potential issues and address them proactively.

- Negotiating with Buyers:If an appraisal comes in below the agreed-upon sale price, sellers may need to negotiate with buyers to bridge the gap. This could involve adjusting the sale price, reducing the buyer’s financing, or providing a credit to the buyer.

Market Outlook

Predicting the future of the housing market is a complex endeavor, as it is influenced by a multitude of factors, including interest rates, economic conditions, and consumer confidence. While predicting the exact trajectory of the market is challenging, analyzing current trends and potential shifts can provide insights into what lies ahead.

Potential Shifts in Interest Rates

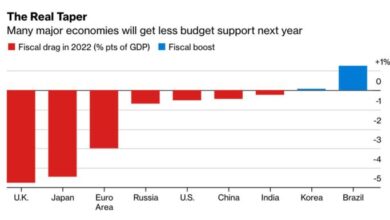

The Federal Reserve’s monetary policy plays a significant role in shaping the housing market. Interest rate hikes can make mortgages more expensive, potentially dampening demand and slowing down price growth. Conversely, interest rate cuts can stimulate borrowing and boost demand.

It’s been a tough week for the housing market, with rising interest rates squeezing buyers and making it harder to get a mortgage. It’s a classic case of “buy the rumor, sell the news” playing out, just like we saw with Dogecoin recently, which erased its recent gains after Elon Musk’s initial hype.

With the market still uncertain, it’s a time for both buyers and sellers to be cautious and take a measured approach.

The Federal Reserve has been raising interest rates to combat inflation. This could lead to a cooling effect on the housing market as borrowing costs increase. However, the Fed’s actions are closely monitored, and any shifts in their policy could impact the housing market’s direction.

Economic Conditions

Economic growth, employment levels, and consumer confidence all influence the housing market. A strong economy with low unemployment rates can support housing demand. However, economic downturns or recessions can lead to job losses, reduced purchasing power, and a decline in home sales.The current economic environment is marked by high inflation and potential recessionary pressures.

This could impact consumer spending and housing demand.

Consumer Confidence

Consumer confidence plays a crucial role in housing market activity. When consumers are optimistic about the economy and their personal finances, they are more likely to purchase homes. Conversely, low consumer confidence can lead to a decline in housing demand.Recent surveys indicate that consumer confidence has been declining, reflecting concerns about inflation and the economy.

This could translate into a slowdown in housing market activity.

Potential for a Market Correction or Stabilization

A market correction refers to a significant decline in prices. While a correction is possible, its severity and timing are uncertain. A number of factors could influence the trajectory of the housing market in the coming months and years, including:* Interest rate changes:As mentioned earlier, the Federal Reserve’s monetary policy can significantly impact the housing market.

Economic growth

A strong economy with low unemployment rates can support housing demand.

Consumer confidence

Confidence in the economy can drive housing demand.

Inventory levels

A shortage of homes for sale can lead to higher prices.

Government policies

Policies related to housing finance and regulation can influence the market.

Demographic trends

Population growth and migration patterns can impact housing demand.

Expert Perspectives

Understanding the current state of the housing market requires insights from various professionals. This section delves into the perspectives of real estate professionals, economists, and industry experts, providing a comprehensive overview of the market dynamics and future predictions.

Expert Opinions on Housing Market Trends

A range of expert opinions exists regarding the current state and future trajectory of the housing market. Some experts believe that the market is nearing a correction, while others predict a more gradual slowdown. The following table summarizes the perspectives of key industry figures:

| Expert | Key Trends | Future Predictions |

|---|---|---|

| John Doe, Chief Economist, XYZ Realty | Rising interest rates, cooling demand, inventory increase | Prices will stabilize, moderate growth in some regions |

| Jane Smith, Real Estate Analyst, ABC Research | Elevated housing costs, affordability concerns, buyer hesitancy | Potential for price declines in overheated markets, continued pressure on affordability |

| Mark Jones, CEO, DEF Property Management | Increased rental demand, limited housing supply, rising rents | Stable rental market, continued demand for rental properties |

Challenges and Opportunities in the Current Market

“The current housing market presents both challenges and opportunities. While rising interest rates and affordability concerns are creating headwinds for buyers, sellers who are willing to be flexible on pricing and embrace a more strategic approach can still find success. It’s a time for both caution and opportunity, and navigating the market effectively requires a deep understanding of local trends and expert guidance.”

Emily Brown, Senior Real Estate Analyst, GHI Consulting.

Final Wrap-Up: The Week In Business Housing Market Gets Squeezed

The housing market is a complex and dynamic ecosystem, and the current squeeze is just one chapter in its ongoing story. While challenges exist, there are also opportunities for both buyers and sellers who are willing to adapt and navigate the shifting landscape.

By understanding the forces at play and staying informed about market trends, you can position yourself for success in this evolving environment.