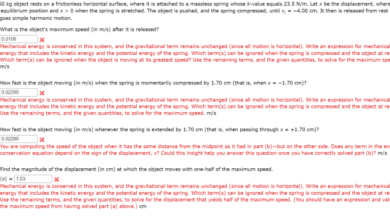

Tax Day Throwdown: Biden vs. Republicans on Middle Class Taxes

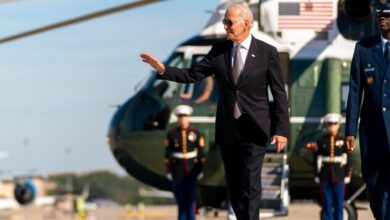

Tax day throwdown biden rips republicans for planning to raise taxes on the middle class – Tax Day Throwdown: Biden rips republicans for planning to raise taxes on the middle class takes center stage, a political battleground where the future of middle-class finances hangs in the balance. With tax season upon us, the debate over how to tax the middle class has intensified, pitting President Biden’s vision of fairness and economic growth against Republican proposals aimed at boosting the economy through tax cuts.

This clash of ideologies has sparked heated arguments, leaving many wondering who will ultimately benefit from the proposed tax changes.

At the heart of this debate lie two distinct approaches to taxation. President Biden advocates for a progressive tax system, arguing that the wealthy should contribute more to support social programs and infrastructure projects. He proposes raising taxes on corporations and high-income earners while offering tax breaks for middle-class families.

Republicans, on the other hand, favor a tax system that incentivizes economic growth through lower taxes for all, including corporations. They argue that reducing taxes on businesses and individuals will stimulate investment, job creation, and economic prosperity.

Biden’s Tax Plan: Tax Day Throwdown Biden Rips Republicans For Planning To Raise Taxes On The Middle Class

President Biden’s tax plan aims to address income inequality and stimulate economic growth, with a particular focus on the middle class. This plan proposes various changes to the tax code, aiming to make the system fairer and more progressive.

Tax Cuts and Credits for Middle-Class Families

The Biden administration’s tax plan proposes several measures designed to provide tax relief to middle-class families.

- Expansion of the Child Tax Credit:The plan proposes to extend and expand the existing Child Tax Credit, providing a larger tax credit for families with children. This expanded credit would be fully refundable, meaning even families with no tax liability could benefit. This measure is intended to reduce child poverty and provide financial support to families struggling to make ends meet.

- Increased Earned Income Tax Credit:The Biden plan seeks to increase the amount of the Earned Income Tax Credit (EITC), a tax credit for low- and moderate-income working individuals and families. This expansion would benefit a larger number of working families, providing them with additional financial resources.

- Tax Credits for Education and Healthcare:The plan proposes to increase tax credits for education and healthcare expenses. This includes expanding the American Opportunity Tax Credit, which helps families pay for college, and expanding the premium tax credit, which helps families afford health insurance through the Affordable Care Act.

These credits are intended to reduce the financial burden of education and healthcare costs for middle-class families.

Raising Taxes on Corporations and High-Income Earners

To offset the cost of these tax cuts and credits, the Biden administration proposes raising taxes on corporations and high-income earners. This includes:

- Increasing the Corporate Tax Rate:The plan proposes raising the corporate tax rate from 21% to 28%. This increase is intended to ensure that corporations pay their fair share of taxes and to generate revenue for the government.

- Raising Taxes on High-Income Earners:The plan proposes raising the top marginal income tax rate for high-income earners. This would affect individuals earning over $400,000 and couples earning over $800,000. The rationale behind this proposal is to ensure that the wealthiest Americans contribute a larger share of their income to the government.

Impact on the Middle Class, Tax day throwdown biden rips republicans for planning to raise taxes on the middle class

The impact of Biden’s tax plan on the middle class is a subject of ongoing debate. Supporters argue that the tax cuts and credits will provide significant financial relief to middle-class families, while opponents argue that the plan will increase taxes on the middle class through higher prices for goods and services.

“The Biden administration’s tax plan is designed to create a fairer and more equitable tax system, with a focus on providing relief to middle-class families.”

The actual impact of the tax plan will depend on how it is implemented and on the broader economic context.

Final Thoughts

As the Tax Day Throwdown unfolds, the political landscape is shifting. Public opinion is divided, with some supporting Biden’s vision of a fairer tax system while others favor the Republican approach of tax cuts for economic growth. The outcome of this debate will have far-reaching consequences, impacting not only the middle class but also the direction of the American economy.

Only time will tell whether Biden’s focus on fairness or the Republican emphasis on economic growth will prevail, leaving a lasting impact on the future of American taxation.

The Tax Day throwdown between Biden and the Republicans is heating up, with accusations flying about who’s really planning to hit the middle class hardest. It’s all part of what some are calling “the bad vibes economy” – a sense of uncertainty and anxiety that’s making people nervous about their finances.

Amidst all the finger-pointing, one thing’s clear: we need some solid economic policies that benefit everyone, not just the wealthy.

It’s a real head-scratcher, isn’t it? While President Biden is calling out Republicans for their tax plans that could hurt the middle class, some top Texas Republicans are focusing on a different kind of solution: more guns in schools.

You can read about their proposal for fortified schools and armed teachers in this article: top texas republicans call for more guns fortified schools armed teachers after attack. It seems like we’re dealing with two very different approaches to national issues, and it’s hard to see how they’ll be reconciled in the current political climate.

The political drama surrounding tax day is heating up, with Biden and the Republicans clashing over proposed tax increases on the middle class. It’s a reminder that in business, too, you can’t always chase after elusive opportunities – sometimes, you need to focus on attracting them to you.

Check out this council post on 6 ways to stop chasing rabbits in business and bring them to you instead for some valuable insights. The tax debate is just another reminder that we need to be strategic in our approach to both politics and business, focusing on attracting the right opportunities instead of chasing after every fleeting possibility.