Will Bitcoin Succeed in the Central African Republic? Probably Not.

Will bitcoin succeed in the central african republic probably not – Will Bitcoin Succeed in the Central African Republic? Probably Not. The Central African Republic, a nation grappling with poverty, political instability, and limited infrastructure, presents a unique challenge for Bitcoin adoption. While Bitcoin holds the promise of financial inclusion and economic empowerment, its success hinges on overcoming a multitude of obstacles, from internet access and electricity to financial literacy and trust in digital currencies.

This article explores the complex landscape of Bitcoin adoption in the Central African Republic, examining the economic context, technological infrastructure, and social and cultural factors that could either facilitate or hinder its widespread acceptance. We delve into the potential benefits and risks, compare the Central African Republic’s situation with other African nations, and ultimately assess the likelihood of Bitcoin becoming a dominant force in the country’s financial ecosystem.

Central African Republic’s Economic Context

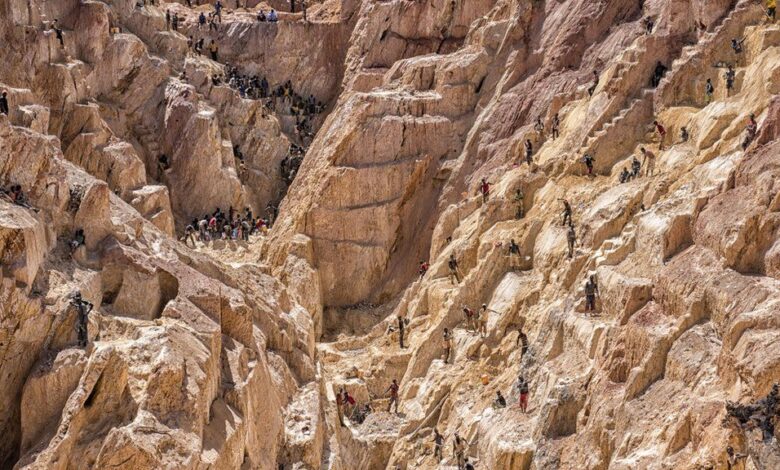

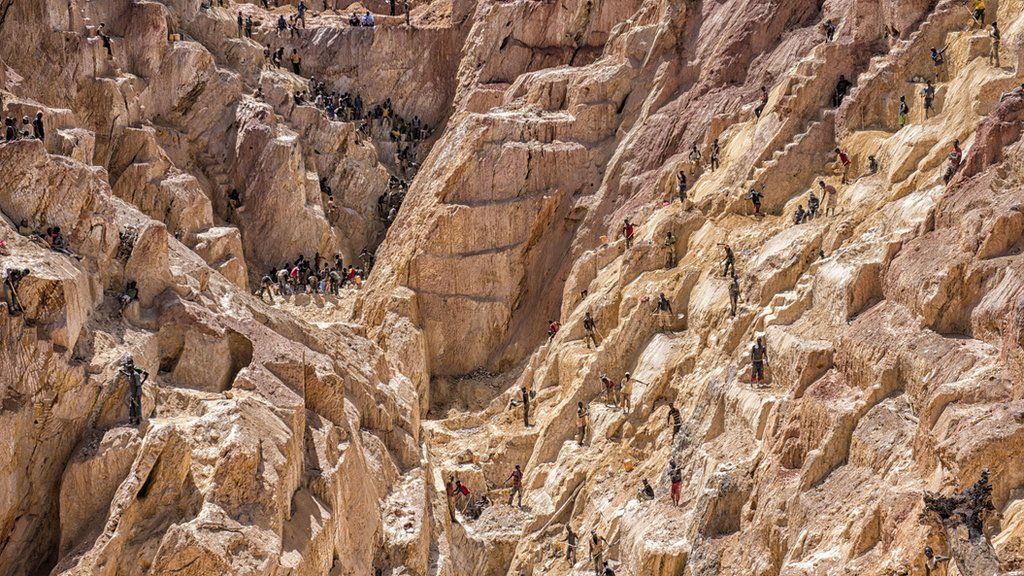

The Central African Republic (CAR) faces significant economic challenges, characterized by widespread poverty, limited infrastructure, and dependence on a few primary industries. Despite its rich natural resources, the country has struggled to achieve sustainable economic growth and development.

Economic Overview

The CAR’s economy is heavily reliant on agriculture, which employs about 80% of the workforce and accounts for a significant portion of GDP. The country’s primary exports include coffee, cotton, diamonds, and timber. However, its economic structure remains fragile, vulnerable to external shocks such as fluctuations in commodity prices and political instability.

Poverty and Financial Infrastructure

The CAR has one of the highest poverty rates in the world, with over 70% of the population living below the poverty line. This is largely attributed to the country’s protracted civil conflict, which has disrupted economic activity and infrastructure development.

The lack of access to financial services further exacerbates poverty, hindering economic participation and opportunities.

Limited Financial Infrastructure

The CAR’s financial infrastructure is underdeveloped, with limited access to banking services, particularly in rural areas. The absence of a robust financial system hampers economic growth by limiting access to credit and investment opportunities.

Statistics on Poverty and Financial Infrastructure

- The World Bank estimates that 72.7% of the CAR’s population lived below the international poverty line of $1.90 per day in 2018.

- Only 12% of the population has access to a bank account, according to the World Bank’s Global Findex database.

- The CAR’s financial sector is dominated by a few commercial banks, with limited reach and services in rural areas.

Bitcoin Adoption Challenges

The Central African Republic’s (CAR) ambition to adopt Bitcoin as legal tender faces significant hurdles. The country’s limited infrastructure, financial literacy, and economic vulnerabilities pose challenges that could hinder the success of this bold move.

Limited Internet Access and Electricity Infrastructure

The CAR’s underdeveloped infrastructure poses a significant obstacle to Bitcoin adoption. With limited internet access and unreliable electricity supply, accessing and using Bitcoin becomes a major challenge for most citizens.

- According to the International Telecommunication Union (ITU), only 11% of the CAR population had access to the internet in 2021.

- Frequent power outages and limited electricity access in rural areas make it difficult to run Bitcoin wallets and engage in transactions.

This lack of infrastructure creates a barrier to widespread adoption, limiting Bitcoin’s potential as a viable payment method.

Potential Risks of Bitcoin Volatility

Bitcoin’s volatile nature poses a significant risk to the CAR’s already fragile economy.

- Fluctuations in Bitcoin’s value could lead to economic instability, especially for those who rely on it as a store of value or for daily transactions.

- The CAR’s economy is heavily reliant on agriculture and foreign aid, making it susceptible to external shocks.

- A sharp decline in Bitcoin’s value could negatively impact the country’s currency, the CFA Franc, and undermine economic growth.

The government needs to implement robust measures to mitigate these risks and ensure that Bitcoin adoption does not destabilize the economy.

Lack of Financial Literacy and Cryptocurrency Understanding

A significant portion of the CAR population lacks financial literacy and understanding of cryptocurrency. This knowledge gap presents a major challenge to widespread Bitcoin adoption.

- Many people are unfamiliar with the concepts of blockchain technology, digital currency, and the risks associated with cryptocurrency.

- This lack of understanding could lead to widespread scams and financial losses, undermining public trust in Bitcoin.

The government needs to prioritize financial education programs to address this gap and foster a better understanding of cryptocurrency among the population.

Alternative Financial Systems

The Central African Republic (CAR) presents a unique case for Bitcoin adoption, given its underdeveloped traditional financial system and reliance on informal channels for financial transactions. This section explores the existing financial landscape in the CAR and compares it with the potential of Bitcoin as an alternative.

Mobile Money and Alternative Financial Services

Mobile money services have become increasingly popular in the CAR, offering a more accessible and convenient way for people to send and receive money. The dominance of mobile money services like Orange Money and MTN Mobile Money has significantly contributed to financial inclusion in the country.

These services provide a platform for people to make payments, transfer money, and access financial services without relying on traditional banks.

Comparison of Traditional Banking and Bitcoin

| Feature | Traditional Banking | Bitcoin |

|---|---|---|

| Accessibility | Limited access due to high costs, limited infrastructure, and bureaucratic processes. | Potentially more accessible, especially for unbanked populations, due to its decentralized nature and ease of use. |

| Security | Vulnerable to fraud, theft, and corruption. | Secure, with transactions recorded on a public ledger and protected by cryptography. |

| Fees | High transaction fees and charges for services. | Lower transaction fees compared to traditional banking, though subject to fluctuations in network fees. |

| Transparency | Limited transparency, with information controlled by institutions. | Highly transparent, with all transactions publicly viewable on the blockchain. |

| Regulation | Subject to strict regulations and oversight by central banks. | Decentralized and not subject to direct control by any government or institution. |

| Speed | Transactions can be slow and require multiple steps. | Transactions are typically faster than traditional banking methods. |

Government Regulations and Policies

The Central African Republic (CAR) government’s stance on Bitcoin and cryptocurrencies is complex and evolving. The government has embraced Bitcoin as legal tender, but regulations remain underdeveloped, leaving the cryptocurrency landscape somewhat uncertain. This section will delve into the current regulatory landscape, explore the potential impact of government regulations on Bitcoin adoption, and propose a hypothetical policy framework that could encourage or discourage Bitcoin adoption in the country.

Current Stance of the CAR Government on Bitcoin and Cryptocurrencies

The CAR government’s stance on Bitcoin and cryptocurrencies is marked by a combination of openness and ambiguity. The government has demonstrated a willingness to embrace Bitcoin, recognizing its potential to address financial inclusion and economic development challenges. However, the regulatory framework surrounding cryptocurrencies is still under development, leaving room for uncertainty and potential challenges.In April 2022, the CAR became the first African nation to adopt Bitcoin as legal tender.

This move was driven by the government’s desire to attract foreign investment, promote financial inclusion, and diversify the economy. However, the adoption of Bitcoin as legal tender has been met with mixed reactions. Some see it as a positive step towards financial innovation and economic development, while others remain skeptical about the long-term implications of such a move.The government has also taken steps to regulate the cryptocurrency sector.

In 2022, the CAR’s central bank, the Bank of Central African States (BEAC), released a circular outlining its stance on cryptocurrencies. The circular acknowledged the growing popularity of cryptocurrencies but cautioned against their use as legal tender. The BEAC also warned against the risks associated with cryptocurrencies, such as price volatility, security breaches, and the potential for money laundering.

Potential Impact of Government Regulations on Bitcoin Adoption

Government regulations can significantly impact Bitcoin adoption in the CAR. Clear and supportive regulations can foster confidence in the cryptocurrency market and encourage greater participation. Conversely, restrictive or ambiguous regulations can create uncertainty and discourage adoption.One key area where regulations can impact Bitcoin adoption is in the area of taxation.

If the government imposes high taxes on Bitcoin transactions or profits, it could deter individuals and businesses from using the cryptocurrency. Conversely, favorable tax policies could incentivize Bitcoin adoption by making it more attractive from a financial perspective.Another area where regulations can have a significant impact is in the area of financial inclusion.

If the government implements regulations that make it easier for people to access and use Bitcoin, it could help to promote financial inclusion and provide access to financial services for those who are currently excluded. However, if the government implements regulations that make it difficult or expensive to access and use Bitcoin, it could undermine the potential benefits of the cryptocurrency for financial inclusion.

Hypothetical Policy Framework

A hypothetical policy framework that could encourage Bitcoin adoption in the CAR could include the following elements:

- Tax Incentives:The government could provide tax incentives for businesses and individuals who use Bitcoin for transactions or investments. This could include tax breaks for Bitcoin-related activities or the exemption of Bitcoin from capital gains taxes.

- Regulatory Clarity:The government could provide clear and transparent regulations for the cryptocurrency sector, outlining licensing requirements, consumer protection measures, and anti-money laundering guidelines. This would create a more stable and predictable environment for Bitcoin adoption.

- Financial Inclusion:The government could implement policies that make it easier for people to access and use Bitcoin, such as promoting the use of Bitcoin wallets and supporting the development of Bitcoin-based financial services. This would help to promote financial inclusion and provide access to financial services for those who are currently excluded.

- Public Education:The government could launch public education campaigns to raise awareness about Bitcoin and its potential benefits. This would help to dispel misconceptions about Bitcoin and encourage greater adoption.

Conversely, a hypothetical policy framework that could discourage Bitcoin adoption in the CAR could include the following elements:

- High Taxes:The government could impose high taxes on Bitcoin transactions or profits, making it less attractive for individuals and businesses to use the cryptocurrency.

- Restrictive Regulations:The government could implement restrictive regulations that make it difficult or expensive to access and use Bitcoin, such as banning Bitcoin exchanges or imposing strict KYC/AML requirements.

- Negative Public Statements:The government could issue negative public statements about Bitcoin, warning about its risks and discouraging its use. This could create uncertainty and discourage adoption.

Social and Cultural Factors

The success of Bitcoin in the Central African Republic (CAR) hinges not just on economic and technological factors, but also on the intricate interplay of social and cultural dynamics. Understanding these nuances is crucial for gauging Bitcoin’s potential impact and navigating its adoption challenges.

Cultural Attitudes towards Financial Innovation

The CAR’s cultural landscape presents a unique mix of traditional values and evolving modern aspirations. While traditional financial systems, often based on informal networks and trust-based relationships, have long prevailed, a growing segment of the population, particularly the younger generation, is embracing digital technologies and seeking innovative solutions to financial challenges.

This presents a fertile ground for Bitcoin’s potential adoption, particularly among those seeking alternatives to traditional financial institutions.

The Central African Republic’s adoption of Bitcoin as legal tender is a bold move, but its success hinges on several factors, including infrastructure and financial literacy. It’s a similar situation to job sharing – while it can be a good solution for some, others find it’s not the right fit.

If you’re in that position, check out this advice from We Are Teachers: ask weareteachers help i dont want to job share anymore. Just like job sharing, Bitcoin’s adoption will take time and adaptation, and only then will we truly know if it’s the right solution for the Central African Republic.

Potential Social Barriers to Bitcoin Adoption

Despite the potential for Bitcoin adoption, several social barriers exist that could hinder its widespread acceptance. One prominent barrier is the ingrained trust in traditional institutions, particularly among older generations who have long relied on established systems. Furthermore, limited access to technology and internet connectivity in rural areas can pose significant challenges to Bitcoin’s accessibility.

While I’m not sure if Bitcoin will truly take off in the Central African Republic, I’m pretty sure I can make you laugh with some hilarious dog jokes! Check out these 40 paws itively hilarious dog jokes for kids and see if you can resist a chuckle.

Back to Bitcoin, I think it’s a long shot for the Central African Republic, but hey, who knows, maybe it’ll surprise us all.

The CAR’s high levels of poverty and financial exclusion further complicate the adoption process, as many individuals may lack the resources or financial literacy to fully comprehend and utilize Bitcoin.

Bitcoin’s Potential to Address Social Issues

While social barriers exist, Bitcoin’s potential to address specific social issues in the CAR is undeniable. Its decentralized nature and ability to facilitate peer-to-peer transactions can empower individuals and communities by bypassing traditional financial intermediaries, fostering financial inclusion and empowering those excluded from formal financial systems.

For example, Bitcoin can facilitate remittances, enabling CAR citizens working abroad to send money back home more efficiently and affordably than traditional channels. Moreover, Bitcoin’s transparency and immutability can enhance accountability and trust in financial transactions, particularly in sectors vulnerable to corruption.

Its potential to foster economic development and empower marginalized communities is particularly noteworthy, especially in the context of the CAR’s ongoing humanitarian crisis.

Economic Impact and Potential Benefits

The adoption of Bitcoin in the Central African Republic (CAR) could have a significant impact on the country’s economy, both positive and negative. The potential benefits of Bitcoin adoption are numerous, particularly for businesses and individuals, but the challenges are also considerable.

Impact on the Economy

Bitcoin adoption could potentially stimulate economic growth in the CAR by increasing financial inclusion, reducing transaction costs, and attracting foreign investment. Bitcoin could provide a more efficient and secure alternative to traditional financial systems, particularly for businesses and individuals who lack access to traditional banking services.

The increased financial inclusion could lead to greater economic activity and job creation.

Benefits for Businesses and Individuals

- Reduced Transaction Costs:Bitcoin transactions are typically cheaper than traditional bank transfers, especially for cross-border payments. This could be particularly beneficial for businesses in the CAR that rely on international trade.

- Access to Financial Services:Bitcoin can provide a way for individuals and businesses without access to traditional banking services to participate in the financial system. This could lead to increased financial inclusion and economic empowerment.

- Increased Investment Opportunities:Bitcoin could attract foreign investment into the CAR, as investors may be drawn to the country’s potential as a Bitcoin hub. This could lead to increased economic activity and job creation.

- Protection Against Inflation:Bitcoin is a decentralized digital currency that is not subject to government control or inflation. This could be a valuable asset for individuals and businesses in the CAR who are concerned about the value of their local currency.

Potential Economic Impact on Various Sectors

The following table illustrates the potential economic impact of Bitcoin adoption on various sectors in the CAR:

| Sector | Potential Impact | Example |

|---|---|---|

| Financial Services | Increased competition and innovation in the financial sector, leading to greater financial inclusion and access to financial services. | The emergence of Bitcoin-based financial service providers could offer alternative payment methods and lending services to underserved populations. |

| Trade and Commerce | Reduced transaction costs and increased efficiency in cross-border trade, leading to increased economic activity and job creation. | Businesses in the CAR could use Bitcoin to make and receive payments from international partners, reducing transaction fees and processing times. |

| Tourism | Increased tourism revenue as visitors from countries with high Bitcoin adoption rates could use Bitcoin to pay for goods and services. | Tourist destinations in the CAR could accept Bitcoin payments, making it more convenient for travelers from countries where Bitcoin is widely used. |

| Agriculture | Improved access to financing for farmers, leading to increased agricultural production and economic growth. | Bitcoin-based lending platforms could provide farmers with access to capital, enabling them to invest in new technologies and expand their operations. |

| Remittances | Reduced costs and increased speed for sending and receiving remittances, benefiting families and businesses. | Families living abroad could send remittances to their loved ones in the CAR using Bitcoin, saving on traditional remittance fees and processing times. |

Comparison with Other African Countries: Will Bitcoin Succeed In The Central African Republic Probably Not

The Central African Republic’s (CAR) journey towards Bitcoin adoption is a unique one, and comparing it to other African nations sheds light on the potential challenges and opportunities. Examining the experiences of countries like Kenya and Nigeria provides valuable insights into the factors that could influence the success or failure of Bitcoin adoption in the CAR.

Bitcoin Adoption Experiences in Kenya and Nigeria

The adoption of digital currencies in Africa has been gaining momentum, with Kenya and Nigeria emerging as frontrunners. These countries have witnessed significant growth in the use of mobile money platforms and cryptocurrencies.

The Central African Republic’s adoption of Bitcoin as legal tender is an interesting experiment, but it’s unlikely to be a success story. While some see it as a way to escape the shackles of a weak currency, the reality is that Bitcoin’s volatility and lack of widespread adoption make it a risky proposition for a country already struggling with economic instability.

It’s a similar situation to the labor movement, which is seeing a resurgence in some sectors while shrinking in others, as explored in this insightful article why unions are growing and shrinking at the same time. Just like unions, Bitcoin’s success depends on a confluence of factors, including strong infrastructure, widespread acceptance, and a stable regulatory environment, all of which are currently lacking in the Central African Republic.

- Kenya: Kenya’s mobile money platform, M-Pesa, has revolutionized financial services, making it a leader in digital payments. This established infrastructure has facilitated the adoption of cryptocurrencies, with platforms like BitPesa and other cryptocurrency exchanges gaining traction.

- Nigeria: Nigeria has also seen a surge in cryptocurrency adoption, driven by factors such as economic instability and the need for alternative financial systems. The country is home to a vibrant cryptocurrency ecosystem, with numerous exchanges and peer-to-peer trading platforms.

Factors Influencing Bitcoin Adoption in the Central African Republic

The CAR’s journey with Bitcoin will be influenced by a confluence of factors, some mirroring those seen in Kenya and Nigeria, while others present unique challenges.

- Existing Financial Infrastructure: The CAR’s financial system is underdeveloped, with limited access to traditional banking services. This presents an opportunity for Bitcoin to offer alternative financial services, particularly for the unbanked population.

- Economic Instability: The CAR has experienced prolonged political instability and economic hardship, leading to a depreciation of its currency, the CFA franc. Bitcoin could potentially serve as a hedge against inflation and currency fluctuations, attracting those seeking a store of value.

- Technological Infrastructure: Limited internet access and unreliable electricity supply pose significant challenges to the adoption of Bitcoin in the CAR.

- Government Regulation: The CAR’s stance on Bitcoin remains unclear, and regulatory clarity is crucial for attracting investors and promoting widespread adoption.

- Social and Cultural Factors: Trust in new technologies and financial systems is essential for Bitcoin’s success. Public education and awareness campaigns are vital to overcome skepticism and foster adoption.

Technological Infrastructure

The success of Bitcoin adoption in the Central African Republic (CAR) hinges heavily on the availability and reliability of internet infrastructure. The CAR faces significant challenges in this area, with limited access and inconsistent connectivity posing significant obstacles to widespread Bitcoin adoption.

Internet Access and Connectivity

The CAR has a low internet penetration rate, with only around 10% of the population having access to the internet. This is significantly lower than the average internet penetration rate in Africa, which is around 40%. This limited access is primarily due to a lack of infrastructure, including limited fiber optic networks and insufficient mobile network coverage.

Furthermore, the existing infrastructure is often unreliable, with frequent outages and slow speeds. This unreliable connectivity makes it difficult for individuals and businesses to use Bitcoin effectively, especially for transactions that require real-time confirmation.

Challenges of Providing Reliable Internet Connectivity

The CAR faces several challenges in providing reliable internet connectivity, which are crucial for Bitcoin adoption. These include:

- Limited infrastructure:The CAR lacks a robust and extensive fiber optic network, which is essential for high-speed internet connectivity. This limits the availability of reliable internet services, particularly in rural areas.

- High costs:Internet services in the CAR are often expensive, making it difficult for individuals and businesses to afford reliable access. This is particularly challenging for low-income populations, who are often the most in need of alternative financial systems like Bitcoin.

- Security concerns:Cybersecurity threats are a significant concern in the CAR, with limited resources available to combat them. This makes it challenging to ensure the security of online transactions, including Bitcoin transactions.

- Political instability:The CAR has experienced prolonged periods of political instability, which has often disrupted infrastructure development and hindered the expansion of internet services.

Technological Advancements for Bitcoin Adoption

Despite the challenges, there are several technological advancements that could potentially improve Bitcoin adoption in the CAR:

- Expansion of fiber optic networks:Investing in the expansion of fiber optic networks can provide high-speed and reliable internet connectivity to more people, particularly in rural areas. This would make it easier for individuals and businesses to access and use Bitcoin.

- Satellite internet:Satellite internet offers an alternative solution to provide internet access in areas with limited terrestrial infrastructure. While satellite internet can be more expensive, it can offer a reliable and consistent connection, which is crucial for Bitcoin adoption.

- Mobile money services:Mobile money services are already widely used in the CAR, providing a platform for financial inclusion. Integrating Bitcoin with mobile money services can make it easier for individuals to access and use Bitcoin without needing a traditional bank account.

- Decentralized applications (DApps):DApps can be used to develop various applications that leverage the benefits of blockchain technology, including secure and transparent transactions, identity management, and supply chain tracking. These applications can contribute to Bitcoin adoption by providing practical use cases and value propositions for individuals and businesses.

Security and Privacy Concerns

The adoption of Bitcoin in the Central African Republic, like any other country, raises concerns about security and privacy. While Bitcoin offers potential economic benefits, it’s crucial to address these concerns to ensure responsible and sustainable adoption.

Security Risks

Bitcoin transactions are secured through cryptography, but they are not immune to security risks. Hackers and fraudsters can exploit vulnerabilities in the system to steal Bitcoin.

- Phishing attacks:Fraudsters can trick users into revealing their private keys or login credentials through fake websites or emails, leading to theft of their Bitcoin.

- Malware:Malicious software can be installed on devices to steal Bitcoin wallets or private keys, granting access to funds.

- Exchange hacks:Bitcoin exchanges, platforms where users buy and sell Bitcoin, are vulnerable to hacking attempts, leading to loss of funds.

Data Protection and Privacy, Will bitcoin succeed in the central african republic probably not

Bitcoin transactions are recorded on the public blockchain, making them transparent and traceable. This transparency can raise privacy concerns, as anyone can access the transaction history.

- Transaction history:The public nature of the blockchain allows anyone to see the sender and receiver of each Bitcoin transaction, potentially compromising privacy.

- Data breaches:If a Bitcoin exchange or wallet provider suffers a data breach, user information, including transaction history and private keys, could be exposed.

Addressing Security and Privacy Concerns

Several measures can be taken to mitigate security and privacy risks and promote responsible Bitcoin adoption.

- Strong security practices:Users should employ strong passwords, enable two-factor authentication, and use reputable Bitcoin wallets and exchanges.

- Privacy-enhancing technologies:Techniques like mixing services and coinjoin can obscure the origin and destination of Bitcoin transactions, enhancing privacy.

- Regulation and oversight:Governments and regulatory bodies can play a role in setting standards for Bitcoin exchanges and wallets, promoting responsible practices and protecting users.

End of Discussion

Despite the potential benefits of Bitcoin, the Central African Republic faces a long road ahead before it can fully embrace this digital currency. Overcoming the challenges of limited infrastructure, financial literacy, and trust in decentralized systems will require a concerted effort from the government, businesses, and individuals.

While the future of Bitcoin in the Central African Republic remains uncertain, its potential impact on the country’s economic and social development cannot be ignored. As the world continues to grapple with the implications of digital currencies, the Central African Republic serves as a case study for the complexities of adopting Bitcoin in a developing nation.