6 Smart Print & Go Money Math Games for Grades 6-12

6 smart print and go money math games for gr 6 12 that teach financial literacy – Teaching financial literacy to kids can be a challenge, but it’s essential for their future success. Introducing them to money management early on can set them up for a lifetime of smart financial decisions. That’s where these 6 engaging print-and-go money math games come in! These games are designed for students in grades 6-12 and make learning about money fun and interactive.

From budgeting basics to investing and credit, these games cover a wide range of essential financial topics.

Each game is designed to be simple to set up and play, making them perfect for classrooms, homeschooling, or even family game night. They use real-world scenarios and engaging activities to help students understand key financial concepts and develop practical skills.

So, are you ready to make learning about money fun and impactful? Let’s dive into these games!

Engaging Kids with Financial Literacy

Financial literacy is a crucial life skill that empowers individuals to make informed decisions about their money. It encompasses understanding concepts like budgeting, saving, investing, and debt management. Equipping children with these skills early on can set them up for a brighter financial future.

However, traditional methods of teaching financial literacy can be dry and unengaging, especially for young learners.Games provide a fun and interactive way to make learning about money enjoyable and effective. By transforming financial concepts into playful activities, children can develop essential skills while having fun.

Print-and-Go Money Math Games

The six print-and-go money math games are designed to introduce and reinforce fundamental financial literacy concepts in a hands-on, engaging way. Each game focuses on a specific aspect of financial literacy, providing a comprehensive learning experience.

Teaching kids about money matters is crucial, and these 6 smart print-and-go money math games for grades 6-12 make learning fun and engaging. From budgeting basics to investing strategies, these games empower students to make informed financial decisions. It’s especially important now, with the political climate heating up – check out this article about how Mitch McConnell’s worst nightmare came true as Biden annihilates GOP for wanting to raise your taxes – and how these games can help students navigate the complex world of personal finance.

Game 1: Budgeting Basics

This game introduces students to the fundamental concept of budgeting by allowing them to allocate a fictional monthly income to different categories, fostering an understanding of financial management and the importance of responsible spending.

Creating a Budget Chart

The budget chart helps students visualize their income and expenses. The chart should have four columns:

- Category: This column lists the different categories of expenses, such as housing, food, transportation, entertainment, and savings.

- Estimated Cost: This column reflects the student’s initial estimate of how much they will spend in each category.

- Actual Cost: This column tracks the actual amount spent in each category throughout the month.

- Difference: This column calculates the difference between the estimated cost and the actual cost, highlighting areas where spending is higher or lower than anticipated.

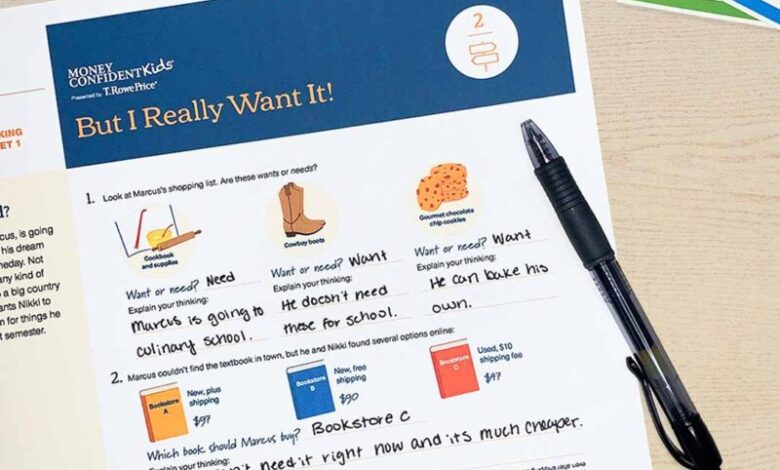

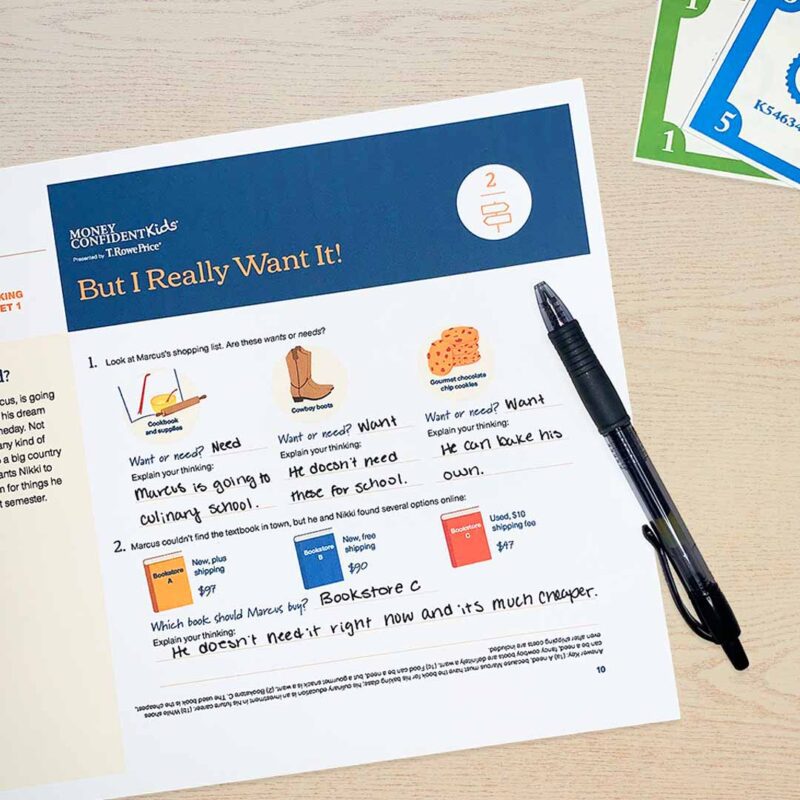

Teaching Needs vs. Wants

The game effectively demonstrates the distinction between needs and wants.

These 6 smart print and go money math games for grades 6-12 are a fun way to introduce financial literacy to your students. They’re easy to use and require minimal prep, perfect for busy teachers. It’s exciting to see how edtech is transforming the classroom, especially with the rise of engaging tools like these.

To learn more about the latest trends in edtech, check out this article: 7 facts about the state of edtech in schools. With the right resources and innovative approaches, we can empower our students to be financially savvy individuals.

- Needs are essential items that are required for survival, such as food, shelter, and clothing.

- Wants are items that are desirable but not essential for survival, such as entertainment, luxury items, and travel.

By allocating their fictional income, students learn to prioritize needs over wants and understand how limited resources necessitate making choices about spending.

Teaching Saving

The game emphasizes the importance of saving by including a savings category.

- Students are encouraged to allocate a portion of their income to savings, demonstrating the value of setting aside money for future goals.

- The game can explore different saving strategies, such as setting short-term and long-term savings goals.

Teaching Responsible Spending

The game encourages responsible spending by prompting students to consider their spending choices.

- Students are encouraged to compare their estimated costs with their actual costs, identifying areas where they might be overspending.

- The game can incorporate real-world examples of budgeting challenges, such as unexpected expenses or fluctuating income.

By engaging in this game, students develop a deeper understanding of budgeting principles, fostering financial literacy and responsible spending habits.

Game 3: Investing in Your Future

This game introduces the fundamental concepts of investing, such as stocks, bonds, and mutual funds. It provides a hands-on experience for students to understand the potential for growth and the risks associated with different investment strategies.

Simulating the Stock Market

This game allows students to experience the ups and downs of the stock market in a safe and controlled environment. It can be implemented by creating a simple stock market simulation where students buy and sell virtual shares of various companies.

Creating a Stock Market Simulation

- Choose a set of companies:Select a few well-known companies with varying levels of risk and potential for growth. These could include technology giants, established retailers, or emerging startups.

- Assign initial stock prices:Start with a realistic price for each company based on current market conditions or historical data.

- Determine stock price fluctuations:Introduce a system to randomly fluctuate stock prices based on various factors, such as market trends, company performance, or news events. This can be done through dice rolls, random number generators, or pre-determined scenarios.

- Set up a virtual trading platform:Create a simple spreadsheet or online platform where students can track their virtual portfolios, buy and sell shares, and monitor their performance.

- Provide starting capital:Give each student a virtual budget to start with, ensuring a fair and engaging experience for everyone.

Understanding Investment Options, 6 smart print and go money math games for gr 6 12 that teach financial literacy

Investing involves choosing where to allocate your money to potentially grow it over time. Different investment options carry varying levels of risk and reward.

Stocks

Stocks represent ownership in a company. When you buy a stock, you become a shareholder and have the right to share in the company’s profits and losses.

- Risk:Stocks are considered a higher-risk investment than bonds because their value can fluctuate significantly based on market conditions, company performance, and economic factors.

- Reward:Stocks have the potential for higher returns than bonds, especially over the long term. This is because companies can grow and increase their profits, leading to higher stock prices.

Bonds

Bonds are loans that you make to a company or government. When you buy a bond, you are lending money to the issuer in exchange for regular interest payments and the return of your principal at maturity.

- Risk:Bonds are considered a lower-risk investment than stocks because they are less volatile and have a fixed interest rate. However, there is still a risk of default, where the issuer may not be able to repay the principal or interest.

- Reward:Bonds offer a more predictable return than stocks, making them a good option for investors who prioritize stability and income.

Mutual Funds

Mutual funds are investment pools that allow investors to diversify their portfolio by investing in a variety of stocks, bonds, or other assets.

- Risk:The risk of investing in a mutual fund depends on the underlying assets in the fund. Some funds are more diversified and may carry lower risk, while others may focus on specific sectors or industries and have higher risk.

- Reward:Mutual funds can provide diversification and professional management, which can help investors achieve their financial goals. They also offer flexibility and accessibility, allowing investors to invest in a wide range of asset classes with a single investment.

Understanding Risk and Reward

Investing always involves a degree of risk. However, it is important to understand that risk and reward are interconnected. Higher-risk investments have the potential for higher returns, but they also carry a greater chance of loss. Lower-risk investments offer more stability and predictable returns, but they may not grow as quickly.

“The higher the risk, the higher the potential reward, but also the higher the potential loss.”

It is essential for investors to carefully consider their risk tolerance, investment goals, and time horizon before making any investment decisions.

Game 4: Credit and Debt

This game will help students understand the basics of credit cards, loans, and interest rates, and how these concepts can impact their financial well-being. Students will learn about the different types of credit, how to use credit responsibly, and the importance of managing debt effectively.

Understanding Credit

Credit is a financial tool that allows individuals to borrow money for purchases, with the promise to repay the borrowed amount, plus interest, over time. Credit is available in different forms, including credit cards, personal loans, and mortgages. Credit cards are widely used for everyday purchases, allowing individuals to pay for goods and services now and pay later.

Personal loans are typically used for larger purchases, such as home renovations or medical expenses. Mortgages are loans used to finance the purchase of a home.

Interest Rates

Interest is the cost of borrowing money. It is expressed as a percentage of the borrowed amount and is charged over a specific period. The higher the interest rate, the more expensive it is to borrow money.The amount of interest charged on a loan depends on several factors, including the loan amount, the interest rate, and the length of the loan term.

Credit Scenarios

The game can include scenarios that simulate different credit situations, such as:

- Purchasing a new smartphone with a credit card.

- Taking out a personal loan to consolidate debt.

- Getting a mortgage to buy a home.

Students can use calculators to calculate interest charges and compare different credit options.

Managing Debt

Managing debt responsibly is crucial for financial stability. Here are some key tips for managing debt:

- Pay your bills on time:Late payments can damage your credit score and increase your interest rates.

- Keep track of your spending:Monitor your credit card statements and loan balances regularly to avoid overspending.

- Make more than the minimum payment:Paying more than the minimum payment can help you pay off your debt faster and save on interest charges.

- Consider debt consolidation:If you have multiple debts with high interest rates, consolidating them into a single loan with a lower interest rate can save you money.

Avoiding High-Interest Rates

High-interest rates can significantly increase the cost of borrowing. To avoid high-interest rates, students can:

- Build a good credit score:A good credit score makes you a more attractive borrower, which can lead to lower interest rates.

- Shop around for the best rates:Compare interest rates from different lenders before taking out a loan.

- Negotiate lower rates:If you have a good credit score and a solid financial history, you may be able to negotiate a lower interest rate with your lender.

Game 5: Financial Decision-Making: 6 Smart Print And Go Money Math Games For Gr 6 12 That Teach Financial Literacy

This game simulates real-world scenarios where students need to make informed financial decisions, like choosing between different car loans or insurance policies. It helps them understand the factors to consider and how to compare options to make the best choice for their situation.

Teaching financial literacy to kids is crucial, and these 6 smart print and go money math games for grades 6-12 are a fun way to get them thinking about budgeting, investing, and saving. It’s great to see media outlets holding political campaigns accountable for spreading misinformation, like in the case of the recent inflammatory GOP ad about North Carolina Democratic Senate candidate Cheri Beasley that was pulled due to inaccuracies.

These games are a great tool for helping kids learn about finances in a way that’s engaging and accessible, which is just as important as holding politicians accountable for their actions.

Decision-Making Matrix

A decision-making matrix is a helpful tool for comparing different options based on various factors. It allows students to visualize the pros and cons of each choice and make a more informed decision.Here’s how to create and use a decision-making matrix:

- Identify the Decision:Clearly define the financial decision students need to make, such as choosing a car loan or an insurance policy.

- List the Options:Identify the different options available for the decision. For example, different car loan offers or various insurance policy options.

- Determine the Factors:List the important factors to consider for each option. These factors could include cost, interest rate, benefits, risks, and other relevant criteria.

- Assign Weights:Determine the relative importance of each factor. This is subjective and depends on individual priorities. For example, a student might prioritize a lower interest rate over a shorter loan term.

- Rate Each Option:Evaluate each option based on the chosen factors and assign a score. For example, a car loan with a lower interest rate might receive a higher score for the “cost” factor.

- Calculate the Total Score:Multiply the score for each factor by its assigned weight and add the scores for each option. This provides a numerical comparison of the different options.

- Make the Decision:Consider the total scores and other relevant factors to make an informed decision. The option with the highest total score might not always be the best choice, depending on individual circumstances and priorities.

Weighing Factors

Students need to learn how to weigh different factors when making financial decisions. This involves considering the relative importance of each factor and assigning a weight to it. For example, when choosing a car loan, a student might weigh the interest rate more heavily than the loan term.

Factors like interest rates, loan terms, and insurance coverage are important considerations, but students should also consider their financial goals and circumstances.

Game 6: Money Management Skills

This game immerses students in the real-world experience of managing their finances. They will learn how to create a budget, track their income and expenses, pay bills, and make informed financial decisions. This hands-on approach helps them understand the importance of financial planning and the consequences of irresponsible financial behavior.

Budgeting Basics

Budgeting is a crucial skill that allows individuals to manage their finances effectively. It involves creating a plan for how to spend and save money based on income and expenses. Here are some steps for creating a budget:

- Track income: Identify all sources of income, such as allowance, earnings from a part-time job, or gifts.

- List expenses: Categorize expenses into essential needs (like food, rent, utilities) and discretionary wants (like entertainment, clothing, or hobbies).

- Calculate net income: Subtract total expenses from total income to determine the amount of money available for saving or spending.

- Allocate funds: Divide the net income into different categories, such as savings, bills, and discretionary spending.

- Monitor spending: Regularly review spending habits to ensure adherence to the budget and make adjustments as needed.

Conclusion

These engaging print-and-go games provide a fun and interactive way to reinforce financial literacy concepts. By incorporating game-based learning, students can actively participate in scenarios that simulate real-world financial situations. This hands-on approach helps them develop essential skills that will benefit them throughout their lives.

Applying Financial Literacy Skills in Real-World Situations

The games encourage students to apply their knowledge to real-world scenarios. For example, in the “Budgeting Basics” game, students learn to prioritize needs versus wants, create a budget, and track their spending. This knowledge can be applied to their personal finances, such as planning for a trip, managing their allowance, or saving for a desired item.

Students can use their newfound financial literacy skills in a variety of personal finance decisions:

- Saving for the Future:Students can apply their knowledge of investing to understand the concept of compound interest and the importance of long-term savings. They can explore various investment options, such as stocks, bonds, or mutual funds, to understand how to grow their money over time.

- Making Informed Purchases:By understanding credit and debt, students can make informed decisions about borrowing money. They can compare interest rates, loan terms, and fees to find the best deals. They can also learn about the consequences of excessive debt and develop strategies for managing their credit responsibly.

- Financial Planning:Students can use their financial literacy skills to plan for their future. They can create a budget, set financial goals, and develop a plan to achieve them. This can include saving for retirement, buying a house, or paying for education.

Encouraging Continued Learning

Financial literacy is a lifelong learning process. Encourage students to continue exploring financial topics beyond the games. Here are some ways to promote continued learning:

- Financial Literacy Resources:Introduce students to online resources, such as websites, apps, and videos, that provide valuable information and tools for financial management. Encourage them to explore these resources and learn more about personal finance topics that interest them.

- Real-World Experiences:Encourage students to engage in real-world experiences that enhance their financial literacy. This could include opening a bank account, getting a part-time job, or volunteering at a financial literacy organization.

- Family Discussions:Encourage students to have open and honest conversations with their families about finances. This can help them understand their family’s financial situation and learn about their parents’ financial decisions.

Final Wrap-Up

These six smart print-and-go money math games provide a fun and effective way to teach financial literacy to students in grades 6-12. By incorporating these games into your curriculum or family activities, you can empower young people with the knowledge and skills they need to make informed financial decisions throughout their lives.

Remember, it’s never too early to start building a strong financial foundation, and these games are a fantastic tool for doing just that. So, grab your pencils, dice, and game boards, and get ready to have some fun while learning about money!