Analysis: Dont Look at Your 401k, Good Luck With That

Analysis dont look at your 401k good luck with that – “Analysis: Don’t Look at Your 401k, Good Luck With That” – a phrase that resonates with a chilling truth for many. It captures the frustration and fear of facing a financial future shrouded in uncertainty. This phrase, often thrown around with a mixture of sarcasm and resignation, speaks to a deep-seated anxiety about the future of retirement security.

The sentiment behind this statement is a complex one, reflecting a combination of factors, including a lack of financial literacy, distrust in financial institutions, and a sense of powerlessness in the face of a seemingly insurmountable financial challenge. It highlights the growing disconnect between individuals and their financial well-being, particularly when it comes to retirement planning.

The Sentiment Behind the Phrase: Analysis Dont Look At Your 401k Good Luck With That

The phrase “analysis don’t look at your 401k good luck with that” carries a strong sentiment of cynicism and a lack of faith in traditional financial advice. It suggests that the speaker believes the typical approach to retirement planning, which often involves investing in a 401k, is flawed or doomed to fail.

It’s easy to get caught up in the daily grind, obsessing over numbers and investments, but sometimes we need to step back and acknowledge the human cost of these systems. The recent tragedy in Buffalo serves as a stark reminder of the deep-rooted racism and violence that plague our society.

It’s a painful truth that many African Americans are experiencing trauma in the wake of this horrific event, as experts have noted in this article: african americans experiencing trauma after buffalo shooting experts say. While it’s important to plan for our financial future, it’s equally important to remember that our humanity and the well-being of our communities must always come first.

Target Audience and Emotional Responses

The target audience for this phrase is likely individuals who are disillusioned with the current economic climate and feel uncertain about their financial future. The phrase can evoke a range of emotions, including:

- Frustration:The speaker might be expressing frustration with the perceived inadequacy of traditional financial advice, particularly in the face of economic challenges.

- Cynicism:The phrase reflects a cynical view of the financial system and the likelihood of achieving financial security through traditional means.

It’s almost comical, isn’t it? The same folks who tell you to “stop looking at your 401k” are the ones who seem most concerned with imposing their religious views on everyone else. This whole “analysis, don’t look at your 401k, good luck with that” mentality seems to go hand-in-hand with the rise of christian nationalism in some GOP campaigns.

Maybe it’s just a coincidence, but it’s hard to ignore the unsettling connection between those who advocate for blind faith in the market and those who preach a rigid, often intolerant, brand of religious ideology.

- Resignation:The phrase might convey a sense of resignation, suggesting that the speaker believes there is little hope for a secure financial future.

- Defiance:The phrase could also express a defiant attitude, rejecting the conventional wisdom and suggesting an alternative path to financial independence.

Situations Where the Phrase Might Be Used

This phrase might be used in a variety of situations, including:

- Conversations about retirement planning:The phrase could be used in a conversation about retirement planning, where the speaker is expressing skepticism about the effectiveness of traditional approaches.

- Online forums and social media:The phrase might be used in online forums or social media discussions about personal finance, where individuals are sharing their experiences and perspectives.

- Articles and blog posts:The phrase could be used in articles or blog posts that critique traditional financial advice and advocate for alternative approaches.

- Political discourse:The phrase might be used in political discourse, where individuals are expressing concerns about the economic system and its impact on individuals’ financial well-being.

The Role of Financial Advice

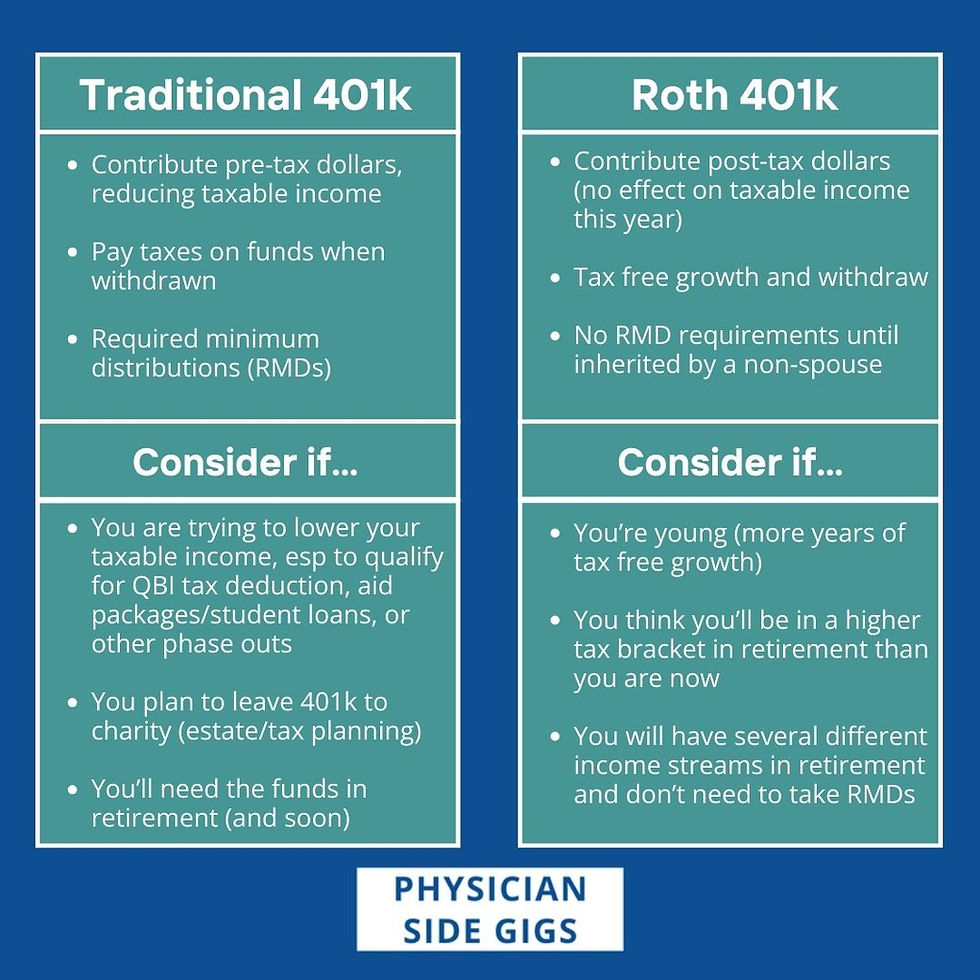

Navigating the complex world of personal finance can be daunting, especially when it comes to long-term financial planning like retirement savings. While some individuals may feel confident in their ability to make informed decisions based on their own intuition, seeking professional financial advice can offer valuable insights and strategies that may not be readily apparent.

Comparing Professional Advice and Personal Intuition

The decision to seek professional financial advice is a personal one, and the benefits of doing so should be carefully weighed against the potential costs. Here’s a comparison of the advantages and disadvantages of relying on personal intuition versus seeking professional guidance:

- Personal Intuition:

- Advantages:Personal intuition can be a powerful tool, especially when it comes to understanding your own risk tolerance and financial goals. It can also be a source of motivation, encouraging you to take control of your finances and make proactive decisions.

It’s ironic, isn’t it? We’re told to “just look at our 401k” and “worry about ourselves,” but when the very foundations of our rights are under attack, we’re expected to just shrug and accept it. It’s time to ask, “Will the pro-abortion rights billionaires please stand up” will the pro abortion rights billionaires please stand up and fight for the future we deserve?

Maybe then we can actually focus on our 401ks without the constant fear of losing everything else.

- Disadvantages:Personal intuition can be influenced by biases and emotions, leading to suboptimal financial decisions. Without the necessary knowledge and experience, it can be difficult to accurately assess complex financial products and strategies. Moreover, relying solely on intuition can lead to procrastination and inaction, which can have a significant impact on long-term financial outcomes.

- Professional Financial Advice:

- Advantages:Professional financial advisors have the expertise and experience to provide objective guidance and tailored strategies based on your individual circumstances. They can help you develop a comprehensive financial plan, identify potential risks and opportunities, and make informed decisions about your investments.

Additionally, they can provide ongoing support and guidance as your financial needs evolve.

- Disadvantages:The cost of professional financial advice can be a barrier for some individuals. It’s also important to choose a qualified and reputable advisor who has your best interests at heart. A lack of trust or communication can lead to frustration and a feeling of being misled.

Hypothetical Scenario of Conflicting Advice

Imagine a young professional named Sarah who is trying to decide how to allocate her 401k contributions. She receives conflicting advice from two sources:

- Friend:Her friend, who is also a 401k participant, recommends investing in a high-risk growth stock fund, hoping for a quick return on her investment. He argues that the stock market is on an upward trend and that Sarah should take advantage of this opportunity to maximize her potential returns.

- Financial Advisor:Sarah’s financial advisor, on the other hand, recommends a more conservative approach, suggesting she diversify her portfolio across different asset classes, including bonds and real estate. He emphasizes the importance of long-term financial planning and the need to mitigate risk, especially in the early stages of her career.

Key Factors to Consider in Retirement Savings Decisions, Analysis dont look at your 401k good luck with that

When faced with such conflicting advice, it’s crucial for Sarah to carefully consider the following factors before making a decision:

- Time Horizon:Sarah’s time horizon is long, as she is still early in her career and has many years until retirement. This gives her the opportunity to ride out market fluctuations and potentially earn higher returns over time. However, it’s also important to remember that the longer the time horizon, the greater the potential for unexpected events that could impact her investments.

- Risk Tolerance:Sarah’s risk tolerance is a key factor to consider. If she is comfortable with the possibility of losing some of her investment, she may be more inclined to invest in higher-risk assets. However, if she is risk-averse, she may prefer a more conservative approach.

- Financial Goals:Sarah’s financial goals will influence her investment decisions. If she is saving for a specific goal, such as buying a house or paying for her child’s education, she may need to consider investments that provide a steady stream of income.

However, if her primary goal is to maximize her retirement savings, she may be more willing to take on higher risk.

- Investment Knowledge:Sarah’s level of investment knowledge is also a critical factor. If she is unfamiliar with different investment strategies and asset classes, she may benefit from seeking professional advice. However, if she is confident in her understanding of the market, she may feel comfortable making her own investment decisions.

The Importance of Long-Term Planning

Financial security is not something that happens overnight. It’s the result of consistent effort and strategic planning, especially when it comes to retirement. Long-term financial planning is crucial for securing your future and achieving your financial goals. It involves a comprehensive approach to managing your finances, taking into account your current financial situation, your future aspirations, and potential risks.

The Benefits of Long-Term Financial Planning

Long-term financial planning offers numerous benefits, including:

- Increased Financial Security:By planning ahead, you can create a solid foundation for your financial future. You can make informed decisions about saving, investing, and managing your debt, which can help you avoid financial stress and achieve your goals.

- Achieving Financial Goals:Whether it’s buying a home, funding your children’s education, or retiring comfortably, long-term planning helps you set realistic goals and develop strategies to achieve them. It allows you to track your progress and make adjustments as needed.

- Minimizing Risk:Financial planning helps you identify and mitigate potential risks, such as unexpected expenses, market volatility, or inflation. By diversifying your investments and having an emergency fund, you can better protect yourself from financial setbacks.

- Building a Legacy:Long-term planning can also help you leave a legacy for your loved ones. By establishing trusts, wills, and other estate planning documents, you can ensure your assets are distributed according to your wishes and protect your family’s financial future.

Last Recap

Ultimately, ignoring your 401k might seem tempting in the short term, but the long-term consequences can be devastating. Taking control of your financial future requires proactive planning, a willingness to learn, and a commitment to building a secure foundation for your retirement years.

It’s a journey that requires a shift in mindset, embracing financial literacy, and seeking professional guidance when needed. Remember, your future self will thank you for taking the time to invest in your financial well-being today.