Economic Doom: Is There Anything We Can Do?

Analysis a feeling of economic doom is going around and there isnt much we can do other than sit back and watch – Analysis of a feeling of economic doom is going around and there isn’t much we can do other than sit back and watch. This sense of impending financial crisis isn’t just a gut feeling, it’s a palpable anxiety that’s spreading like wildfire.

News headlines scream of inflation, recession, and job losses, leaving many feeling powerless and uncertain about the future. But is this doom and gloom justified? Are we truly on the brink of an economic apocalypse, or are we simply succumbing to the hype?

To understand this pervasive feeling of economic doom, we need to delve into its psychological roots, analyze the current economic indicators, and examine the role of media in shaping public perception. Only then can we begin to assess the validity of our fears and develop strategies for navigating this uncertain economic landscape.

Economic Indicators and Reality: Analysis A Feeling Of Economic Doom Is Going Around And There Isnt Much We Can Do Other Than Sit Back And Watch

The recent rise in economic anxieties, coupled with a sense of impending doom, is a palpable sentiment. While the economic landscape is undeniably complex, a closer look at key indicators and their historical context can help us navigate this feeling of uncertainty.

Sometimes, when the world feels like it’s spinning out of control, the only thing left to do is find a little escape. With all the talk of economic doom, I find myself daydreaming about sipping a perfectly crafted cocktail at the world’s best hotel bars, The Omnia in Zermatt, Switzerland.

Maybe it’s the stunning mountain views, or the cozy atmosphere, but something about that place just makes me feel like everything will be alright, even if it’s just for a little while.

It is crucial to separate fact from perception, and understand the current economic situation in a nuanced way.

Economic Indicators: A Closer Look

A comprehensive assessment of the economy requires considering a range of indicators. These provide valuable insights into the health of the economy, including:

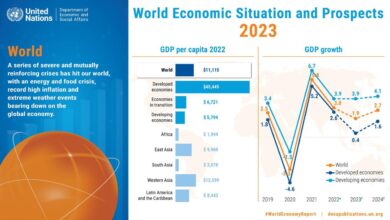

- Gross Domestic Product (GDP):The GDP is a key indicator of economic output. It measures the total value of goods and services produced within a country’s borders. Recent data indicates that the GDP has been growing at a moderate pace, suggesting that the economy is not in a state of collapse.

However, it is important to note that growth rates have slowed down compared to previous years.

- Unemployment Rate:The unemployment rate measures the percentage of the labor force that is unemployed. While the unemployment rate has been relatively low in recent years, it has been creeping up in some sectors. This suggests that the job market is not as strong as it once was, and some workers may be facing difficulties finding employment.

It’s hard not to feel a sense of impending economic doom these days. With rising inflation, interest rates, and a general sense of uncertainty, it feels like we’re all just along for the ride. It’s even more disheartening to see how seemingly reckless behavior can have such a drastic impact on the markets, like in the case of how a trash talking crypto bro caused a 40 billion crash.

It’s a reminder that even with all the sophisticated analysis and predictions, sometimes it’s the unpredictable human factor that throws everything off balance.

- Inflation:Inflation refers to the rate at which prices for goods and services increase over time. Currently, inflation is running at a relatively high rate, driven by factors such as supply chain disruptions and increased energy costs. This can put pressure on household budgets and reduce consumer spending.

It’s hard not to feel a sense of impending doom when the economy feels like it’s teetering on the edge. And while we might not be able to control the bigger forces at play, the erosion of trust in our democratic processes, fueled by the rise of influential election deniers, is a major contributing factor.

Read more about how these individuals are driving a fight to control elections here , and how it’s impacting our collective sense of security and stability. Ultimately, until we address these underlying issues, the feeling of economic doom is likely to linger.

- Consumer Confidence:Consumer confidence measures the level of optimism that consumers have about the economy. Surveys show that consumer confidence has been declining in recent months, reflecting concerns about inflation, rising interest rates, and potential economic instability.

Historical Context and Perspective

Comparing current economic indicators to historical data can provide valuable context and perspective. For example, while inflation is currently high, it is not as high as it was during the 1970s and early 1980s. Similarly, unemployment rates have been much higher in the past, such as during the Great Recession of 2008-2009.

This historical perspective helps us understand that economic challenges are not necessarily unprecedented, and that the economy has the capacity to adapt and recover.

Potential Factors Contributing to the Perception of Doom, Analysis a feeling of economic doom is going around and there isnt much we can do other than sit back and watch

Several factors may be contributing to the perception of economic doom, even though the overall economic picture is not as bleak as some might believe. These include:

- Media Coverage:News outlets often focus on negative economic news, which can create a sense of pessimism and amplify fears about the future. This can lead to a perception that the economy is in worse shape than it actually is.

- Social Media:Social media platforms can be breeding grounds for negativity and fear-mongering. Individuals may share anecdotal evidence or exaggerated claims about the economy, contributing to a sense of panic.

- Political Rhetoric:Political leaders and commentators may use economic anxieties to their advantage, exaggerating economic challenges or blaming certain groups for them. This can further fuel public concerns and contribute to a sense of economic doom.

- Uncertainty and Volatility:The global economy is facing a number of challenges, including geopolitical tensions, supply chain disruptions, and climate change. This uncertainty and volatility can make it difficult to predict the future and can lead to increased anxiety.

The Role of Media and Information

The media plays a crucial role in shaping public perception of the economy, acting as a conduit for information and a platform for shaping narratives. The way economic news is presented, the emphasis placed on certain data points, and the framing of economic events can significantly influence how people feel about the state of the economy.

The Impact of Sensationalized or Biased Reporting

Sensationalized or biased reporting can have a significant impact on economic sentiment, potentially leading to a self-fulfilling prophecy. For example, if media outlets consistently highlight negative economic indicators, it can create a sense of pessimism among consumers and businesses, leading to decreased spending and investment.

This, in turn, can contribute to a decline in economic activity.

- Example:A 2017 study by the National Bureau of Economic Research found that negative news coverage of the stock market can lead to a decrease in stock prices, even when the underlying economic fundamentals are strong. This suggests that media coverage can influence investor sentiment and impact market behavior.

Conclusion

The feeling of economic doom is a powerful force, capable of shaping our behaviors and influencing our decisions. However, it’s important to remember that economic cycles are inherently cyclical, and periods of hardship are often followed by periods of growth and prosperity.

While the current economic climate may be challenging, it’s crucial to maintain a long-term perspective, engage in proactive financial planning, and embrace the opportunities that may emerge amidst the uncertainty. By understanding the psychological, economic, and media factors at play, we can navigate this turbulent period with a greater sense of clarity and resilience.