The Pushback on ESG Investing: A Growing Debate

The pushback on e s g investing – The pushback on ESG investing is a growing debate, with critics questioning its effectiveness and legitimacy. While proponents argue that ESG investing aligns investments with ethical values and promotes sustainable practices, opponents raise concerns about its impact on shareholder value and the potential for conflicts of interest.

This pushback is fueled by a complex interplay of political ideologies, economic interests, and corporate governance concerns.

At the heart of the debate lies the question of whether incorporating environmental, social, and governance factors into investment decisions can truly drive positive change or simply serves as a marketing ploy. Critics argue that ESG investing can lead to “greenwashing,” where companies prioritize appearances over real action.

They also question the reliability and consistency of ESG ratings, which can vary significantly across different providers.

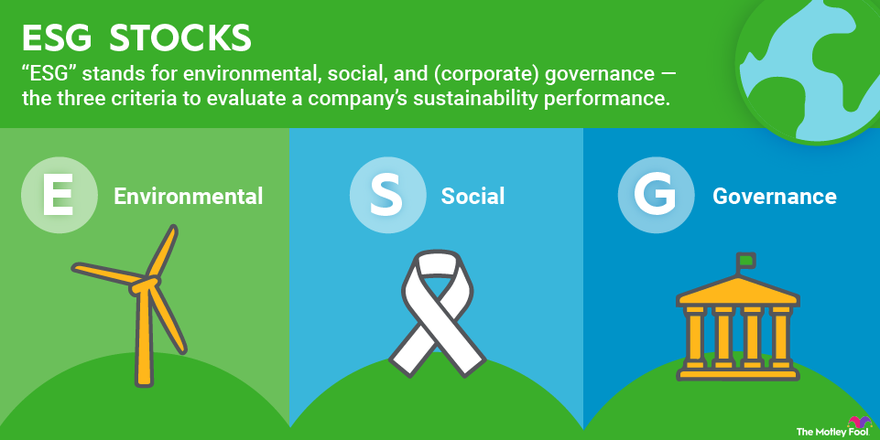

Defining ESG Investing

ESG investing, also known as sustainable investing, is an investment approach that considers environmental, social, and governance (ESG) factors in addition to financial returns. This approach aims to create a positive impact on the world while generating competitive financial returns.

The pushback on ESG investing is heating up, with some arguing that it’s more about virtue signaling than actual impact. But initiatives like farmers in England burying burnt wood in fields to capture CO2 show that innovative solutions are emerging.

While these projects may not always align with traditional ESG criteria, they demonstrate the commitment to finding practical ways to address climate change, which is ultimately what ESG investing aims to achieve.

Core Principles of ESG Investing

ESG investing incorporates three key principles:

- Environmental factorsfocus on a company’s impact on the environment, including its carbon emissions, water usage, and waste management practices.

- Social factorsassess a company’s impact on society, encompassing its labor practices, human rights record, and community engagement.

- Governance factorsexamine a company’s corporate governance structure, including board diversity, executive compensation, and transparency in financial reporting.

History of ESG Investing

ESG investing has evolved over time, with its roots tracing back to the early 20th century. Here’s a brief timeline:

- Early 20th Century:Early forms of socially responsible investing emerged, often focusing on avoiding investments in companies involved in harmful industries like tobacco or weapons.

- 1970s and 1980s:The rise of environmentalism and social activism led to increased awareness of the social and environmental impacts of business. This spurred the development of ethical investment funds and the adoption of ESG criteria by some investors.

- 1990s and 2000s:The United Nations Principles for Responsible Investment (UN PRI) was launched in 2006, providing a framework for integrating ESG considerations into investment decision-making. This marked a significant step towards mainstreaming ESG investing.

- 2010s and Present:ESG investing has gained widespread recognition, with increasing investor demand and regulatory support. The growth of ESG data providers, investment funds, and indices has further facilitated the integration of ESG factors into investment strategies.

ESG Investment Strategies

Various ESG investment strategies are employed to achieve specific objectives. Some prominent approaches include:

- Exclusionary Screening:This strategy involves avoiding investments in companies that fail to meet certain ESG standards. For example, an investor might exclude companies involved in fossil fuel extraction or those with poor labor practices.

- Impact Investing:Impact investing aims to generate both financial returns and positive social or environmental impact. This approach typically focuses on investments in companies or projects that address specific social or environmental challenges, such as renewable energy or affordable housing.

- Thematic Investing:Thematic investing focuses on specific ESG themes, such as climate change, clean energy, or sustainable agriculture. Investors select companies that align with these themes and contribute to addressing the related challenges.

Arguments Against ESG Investing

ESG investing has gained significant traction in recent years, with investors increasingly incorporating environmental, social, and governance factors into their investment decisions. However, this approach has also faced criticism, with some arguing that it undermines shareholder value and profitability.

Effectiveness and Legitimacy of ESG Investing

Critics argue that ESG investing is often based on subjective and arbitrary criteria, making it difficult to assess its effectiveness. They point to the lack of standardized metrics and the potential for “greenwashing,” where companies make misleading claims about their sustainability efforts.

For instance, some critics highlight the difficulty in accurately measuring a company’s environmental impact or its commitment to social responsibility, making it challenging to determine whether an ESG-focused investment truly aligns with an investor’s values.

Potential Conflicts of Interest

Another concern raised by critics is the potential for conflicts of interest within the ESG investment landscape. They argue that some investment managers may prioritize their own financial interests over those of their clients, potentially leading to biased recommendations or investments in companies with questionable ESG practices.

This concern is particularly relevant given the growing number of ESG-focused funds and investment products, where the potential for conflicts of interest can be more pronounced.

Impact on Shareholder Value and Profitability

Critics also question whether ESG investing can truly generate returns for shareholders. They argue that prioritizing ESG factors may come at the expense of profitability, as companies may need to invest more in sustainability initiatives or face higher regulatory costs.

Some argue that ESG investments may lead to a lower return on investment compared to traditional investments that prioritize financial performance.

The pushback on ESG investing is growing, with some arguing that it’s more about virtue signaling than real impact. But is it really about finding a balance between profits and principles? A recent analysis of Warren Buffett and Charlie Munger’s investment in BYD raises questions about whether ESG considerations can truly align with shareholder value.

The debate about ESG investing isn’t going away anytime soon, and it’s likely to continue to be a key factor in shaping investment decisions for years to come.

Economic and Political Pushback: The Pushback On E S G Investing

The debate surrounding ESG investing has transcended purely financial considerations and become entangled with broader political and economic ideologies. This pushback is fueled by concerns about the potential for ESG investing to negatively impact economic growth, erode shareholder value, and undermine free-market principles.

Conservative and Liberal Perspectives on ESG Investing, The pushback on e s g investing

Conservative and liberal perspectives on ESG investing often clash, reflecting fundamental differences in their economic and political philosophies.

- Conservative Perspective:Conservatives tend to view ESG investing as a form of “woke capitalism” that prioritizes social and environmental goals over maximizing shareholder returns. They argue that ESG investing can lead to higher costs for businesses, potentially hindering their competitiveness and economic growth.

Additionally, they express concerns about the potential for ESG criteria to be used as a tool for political activism, arguing that it could lead to businesses being pressured to adopt specific political stances.

- Liberal Perspective:Liberals generally support ESG investing, seeing it as a way to align investments with ethical and sustainable values. They argue that ESG investing can contribute to a more just and equitable society by promoting environmental protection, social responsibility, and good governance.

Liberals also contend that ESG investing can be a driver of innovation and economic growth, by encouraging companies to adopt sustainable practices and address social issues.

Lobbying Groups and Industry Associations

Lobbying groups and industry associations play a significant role in shaping the debate surrounding ESG investing, often advocating for specific policies and regulations.

- Conservative Lobbying Groups:Conservative-leaning groups, such as the American Legislative Exchange Council (ALEC) and the Heritage Foundation, have actively opposed ESG investing, arguing that it represents a form of government overreach and interferes with free-market principles. They have lobbied for legislation that would restrict the use of ESG criteria in investment decisions and have criticized companies that prioritize ESG factors over maximizing shareholder returns.

The pushback on ESG investing is a complex issue, with arguments ranging from concerns about “woke capitalism” to the difficulty of accurately measuring a company’s social and environmental impact. But in the midst of this debate, it’s important to remember that investing in our workforce is equally crucial.

As Adam Grant argues , retaining experienced employees should be a top priority, and companies should consider retention raises to show their commitment. Ultimately, a strong workforce is a valuable asset, and fostering a positive and supportive work environment can contribute to both company success and a sustainable future.

- Industry Associations:Some industry associations, particularly those representing fossil fuel companies and other industries that face significant environmental and social challenges, have also pushed back against ESG investing. They argue that ESG criteria can be used to unfairly target their industries and discourage investment in traditional energy sources.

For example, the American Petroleum Institute (API) has been a vocal critic of ESG investing, arguing that it is a “political agenda” that threatens the energy security of the United States.

Impact on Corporate Governance

ESG investing, with its focus on environmental, social, and governance factors, has a significant influence on corporate governance practices. This approach encourages companies to adopt sustainable and responsible business practices, which in turn can impact their board composition, executive compensation, and stakeholder engagement.

Board Composition

ESG investing emphasizes the importance of diverse and qualified board members who possess expertise in environmental, social, and governance issues. Investors who prioritize ESG factors often scrutinize the composition of a company’s board, looking for individuals with relevant experience and a commitment to sustainable practices.

This scrutiny can lead to increased pressure on companies to appoint directors with expertise in areas such as climate change, human rights, and corporate social responsibility.

Executive Compensation

ESG investing can also influence executive compensation practices. Investors who prioritize ESG factors may be more likely to support companies that link executive compensation to performance on environmental, social, and governance metrics. This can incentivize executives to prioritize long-term sustainability and responsible business practices, rather than focusing solely on short-term financial gains.

Stakeholder Engagement

ESG investing promotes greater stakeholder engagement. Companies that prioritize ESG factors are more likely to engage with a broader range of stakeholders, including employees, customers, suppliers, and local communities. This increased engagement can lead to improved transparency, accountability, and responsiveness to stakeholder concerns.

The Future of ESG Investing

The recent pushback against ESG investing has raised questions about its long-term viability. However, despite the challenges, ESG investing is likely to remain a significant force in the financial landscape, adapting and evolving to address criticisms and capitalize on emerging opportunities.

The Role of Regulation and Industry Standards

Regulation and industry standards will play a crucial role in shaping the future of ESG investing. Currently, there is a lack of standardization and consistency in ESG data and reporting, leading to concerns about greenwashing and the reliability of ESG claims.

- Increased Regulatory Scrutiny:Regulatory bodies are increasingly focusing on ESG investing, with initiatives aimed at standardizing ESG data, enhancing transparency, and combating greenwashing. For example, the Securities and Exchange Commission (SEC) in the United States is proposing new rules for climate-related disclosures, requiring companies to report their greenhouse gas emissions and climate-related risks.

- Development of Industry Standards:Industry organizations are working to develop robust ESG standards and frameworks. The Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI) are examples of organizations setting standards for ESG reporting. The adoption of these standards can help improve data quality and comparability, making it easier for investors to assess ESG performance.

Innovative ESG Investment Strategies

The pushback against ESG investing has also sparked innovation, leading to the development of new investment strategies that address concerns about bias and politicization.

- Data-Driven ESG Investing:There is an increasing focus on using data-driven approaches to assess ESG performance, relying on objective metrics and quantitative analysis rather than subjective assessments. This involves leveraging advanced analytics and artificial intelligence (AI) to identify companies with strong ESG practices based on verifiable data.

- Impact Investing:Impact investing, which focuses on generating both financial returns and positive social and environmental impact, is gaining traction. Impact investors prioritize investments in companies and projects that address specific social or environmental challenges, such as renewable energy, affordable housing, or healthcare access.

Final Wrap-Up

The future of ESG investing remains uncertain, with the pushback highlighting the need for greater transparency, accountability, and a robust framework for measuring its impact. While some argue that ESG investing is a passing fad, others believe it represents a fundamental shift in how investors prioritize values alongside financial returns.

The ongoing debate will likely shape the evolution of ESG investing, pushing for greater rigor and clarity in its implementation and measurement.