Arrived Homes Raises $25M to Expand Rental Property Investments

Rental property investment startup arrived homes raises 25m to fund further expansion – Arrived Homes, a rental property investment startup, has secured $25 million in funding to fuel its expansion plans. This significant investment signifies the growing popularity of fractional real estate ownership, a trend that allows individuals to invest in rental properties without needing to buy the entire property outright.

Arrived Homes, with its innovative approach, has captured the attention of investors seeking to diversify their portfolios and capitalize on the lucrative rental market.

The company’s business model centers around facilitating fractional ownership of rental properties. Investors can purchase shares in a property, earning passive income through rental revenue. This allows for greater accessibility to real estate investment, particularly for those who may not have the capital for a traditional whole-property purchase.

Arrived Homes carefully selects and manages properties, providing investors with a hands-off approach to real estate investing.

Arrived Homes: Rental Property Investment Startup Arrived Homes Raises 25m To Fund Further Expansion

Arrived Homes is a real estate investment startup that allows individuals to invest in rental properties in a fractional ownership model. This innovative approach aims to make real estate investing more accessible to a wider audience, breaking down barriers to entry that traditionally existed for this asset class.

Target Audience

Arrived Homes caters to a diverse group of individuals seeking alternative investment opportunities. The company’s target audience includes:

- Millennials and Gen Z:These demographics are increasingly interested in passive income streams and building wealth through real estate, but often face challenges due to high housing costs and limited capital.

- First-time investors:Arrived Homes provides a low-barrier entry point for individuals new to real estate investing, offering a more affordable and manageable way to participate in the market.

- Individuals seeking diversification:The platform allows investors to diversify their portfolios by adding real estate assets alongside stocks, bonds, and other traditional investments.

- Passive income seekers:Arrived Homes simplifies the process of generating passive income from rental properties, handling property management and tenant relations.

Fractional Ownership of Rental Properties

Arrived Homes facilitates fractional ownership of rental properties through a unique and streamlined process:

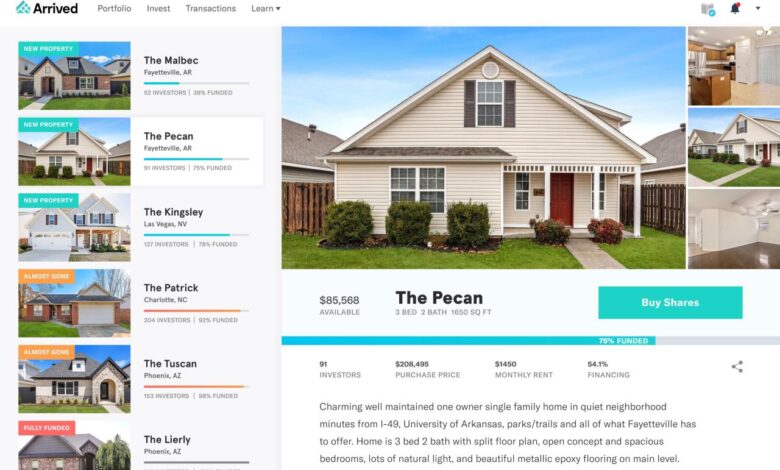

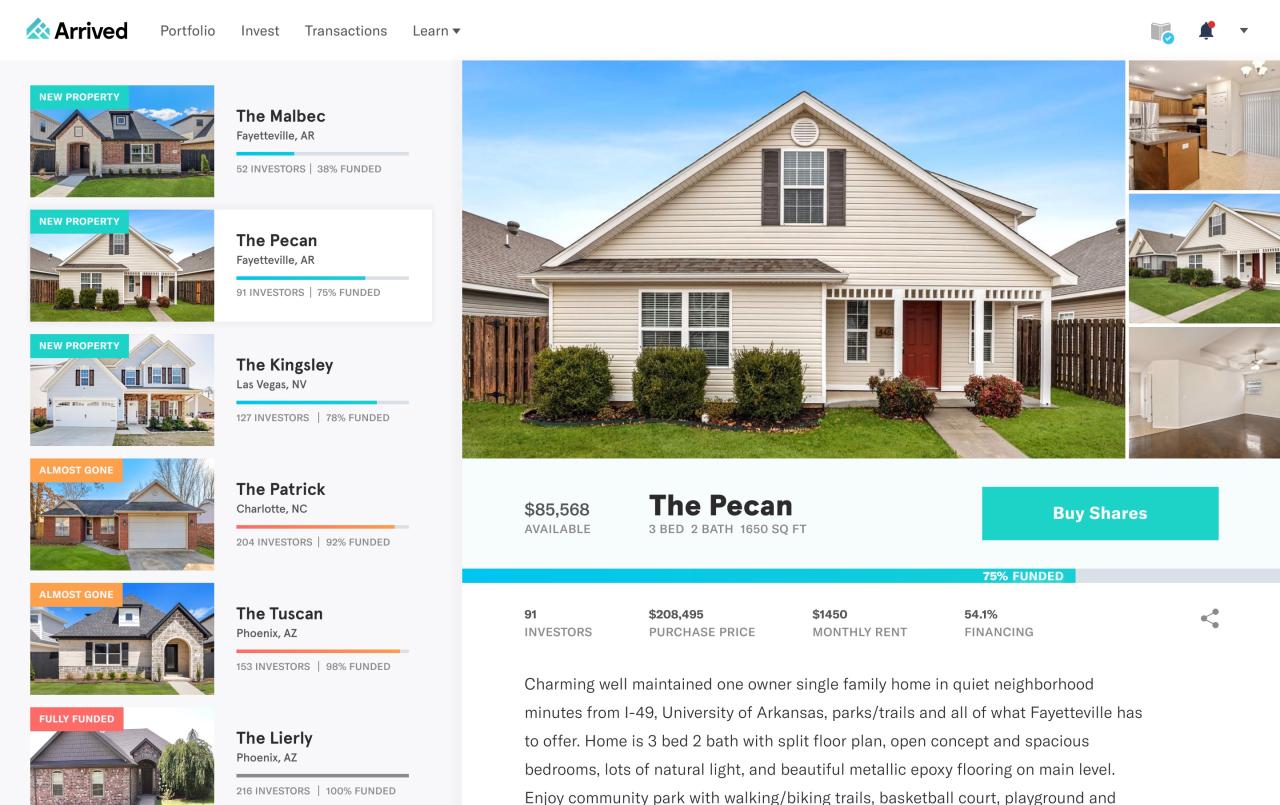

- Property Selection:Arrived Homes meticulously curates a portfolio of carefully vetted rental properties located in high-growth markets with strong rental demand. These properties undergo thorough due diligence to ensure quality and profitability.

- Fractional Ownership:Investors can purchase fractional shares of a property, starting as low as $100. This allows for greater accessibility and affordability compared to traditional whole-property ownership.

- Property Management:Arrived Homes handles all aspects of property management, including tenant screening, rent collection, maintenance, and repairs. This frees investors from the day-to-day responsibilities of managing rental properties.

- Income Distribution:Rental income generated from the property is distributed proportionally to fractional owners, providing a consistent passive income stream. Investors receive regular reports detailing rental income and expenses.

- Liquidity:While Arrived Homes does not currently offer a secondary market for trading fractional shares, they are exploring options to enhance liquidity in the future. This would allow investors to sell their shares if they wish to exit their investment.

$25 Million Funding Round and Expansion Plans

Arrived Homes, a startup that allows individuals to invest in rental properties, recently secured $25 million in funding. This significant investment underscores the growing interest in fractional real estate ownership and the potential of Arrived Homes to disrupt the traditional rental property market.

Key Areas of Expansion

The funding will enable Arrived Homes to expand its operations in several key areas.

- Expanding the Property Portfolio: The company plans to increase the number of rental properties available on its platform, offering investors a wider selection of investment opportunities across various locations and property types.

- Enhancing Technology Infrastructure: Arrived Homes will invest in upgrading its technology infrastructure to improve the user experience, streamline the investment process, and enhance data analytics capabilities.

- Expanding Marketing and Outreach: The funding will support increased marketing efforts to reach a wider audience of potential investors and raise awareness of fractional real estate ownership.

- Building Partnerships: Arrived Homes will explore strategic partnerships with real estate professionals, financial institutions, and other stakeholders to expand its reach and offer investors a more comprehensive suite of services.

Impact on the Rental Property Investment Market

The expansion of Arrived Homes is expected to have a significant impact on the rental property investment market.

It’s interesting to see how the housing market is booming, with companies like Arrived Homes raising $25 million to expand their rental property investment platform. It makes me wonder how this impacts other sectors, like the academic world, where Ph.D.

students are demanding wage increases amid the rising cost of living. While these investments might create opportunities, it’s crucial to ensure everyone benefits from the economic growth, especially those who are most vulnerable to rising costs.

- Increased Accessibility: By lowering the entry barrier to rental property investment, Arrived Homes makes this asset class accessible to a broader range of individuals who may not have the capital or expertise to invest in traditional real estate.

- Diversification of Investment Portfolios: Arrived Homes provides investors with the opportunity to diversify their investment portfolios by investing in rental properties across different locations and property types.

- Increased Liquidity: Arrived Homes’ platform allows investors to buy and sell their fractional shares in rental properties, providing greater liquidity compared to traditional real estate investments.

- Potential for Higher Returns: While not guaranteed, the potential for higher returns on rental property investments is a key driver for many investors. Arrived Homes aims to offer investors access to properties that generate consistent rental income and potentially appreciate in value over time.

The Future of Fractional Real Estate Ownership

Fractional real estate ownership is gaining traction as a more accessible and diversified way to invest in real estate. This trend is driven by several factors, including the increasing demand for alternative investments, the desire for passive income, and the need for greater liquidity in real estate investments.

The Trends Driving the Popularity of Fractional Real Estate Ownership

The growing popularity of fractional real estate ownership is driven by several trends:

- Increased Demand for Alternative Investments:Investors are seeking alternative investments beyond traditional stocks and bonds to diversify their portfolios and potentially generate higher returns. Fractional real estate ownership provides an opportunity to invest in a tangible asset with potential for appreciation and rental income.

- Desire for Passive Income:Many investors are seeking passive income streams to supplement their existing income or build wealth over time. Fractional real estate ownership allows investors to participate in rental income generated by the property without the hassle of managing tenants or maintenance.

- Need for Greater Liquidity in Real Estate Investments:Traditional real estate investments are often illiquid, requiring significant time and effort to sell. Fractional real estate ownership platforms provide a more liquid option, allowing investors to sell their shares more easily and quickly.

- Growing Affordability:Fractional ownership makes real estate investing more accessible to a wider range of investors, including those with limited capital. Investors can participate in high-value properties by investing smaller amounts, making it a more attainable option for those who might not be able to afford a whole property.

Arrived Homes’ Approach to Fractional Real Estate Ownership

Arrived Homes distinguishes itself from other fractional real estate platforms in several ways:

- Focus on Single-Family Rentals:Arrived Homes primarily focuses on single-family rental properties, a segment of the real estate market that offers strong rental demand and appreciation potential. This focus allows the company to leverage its expertise in this specific niche and provide investors with access to high-quality rental properties.

Arrived Homes, the rental property investment startup, has secured $25 million in funding to fuel its expansion. This move comes at a time when the agricultural landscape of California is undergoing a transformation due to declining illegal immigration, as reported in this recent article.

With the changing demographics and labor needs, Arrived Homes aims to capitalize on the evolving housing market by offering a more accessible path to real estate ownership.

- Technology-Driven Platform:Arrived Homes utilizes technology to streamline the investment process, making it easier for investors to browse properties, invest, and track their returns. The platform provides a user-friendly interface and transparent reporting, enabling investors to make informed decisions.

- Professional Property Management:Arrived Homes partners with experienced property managers to handle all aspects of property management, including tenant screening, rent collection, and maintenance. This allows investors to benefit from professional management without the hassle of managing the property themselves.

- Community-Focused Approach:Arrived Homes aims to build a community of investors by providing educational resources and fostering connections among its members. The platform offers insights into the real estate market and provides opportunities for investors to network and share experiences.

Advantages and Disadvantages of Fractional Real Estate Ownership

Here’s a table showcasing the advantages and disadvantages of fractional real estate ownership for investors:

| Advantages | Disadvantages |

|---|---|

| Increased accessibility to real estate investments | Limited control over the property |

| Diversification of investment portfolio | Potential for lower returns compared to whole property ownership |

| Potential for passive income | Potential for illiquidity if the platform is not well-established |

| Professional property management | Fees associated with the platform |

| Community of investors | Potential for conflicts with other investors |

The Role of Technology in Rental Property Investment

The rise of technology is revolutionizing the rental property investment landscape, making it more accessible and efficient for both investors and property managers. Arrived Homes, a platform for fractional ownership of rental properties, is a prime example of how technology is driving this transformation.

Technology Streamlining Investment Process

Arrived Homes utilizes technology to streamline the investment process, making it easier for individuals to participate in real estate ownership. The platform simplifies several aspects of the investment journey:

- Online Property Selection and Investment:Investors can browse and select properties from a curated list of attractive rental properties across the United States. They can invest in a fraction of a property, making it more accessible than traditional real estate investment.

- Digital Due Diligence:Arrived Homes provides detailed property information, including financial performance, market analysis, and property management details, allowing investors to conduct thorough due diligence online.

- Automated Investment Management:The platform automates the investment management process, including rent collection, property maintenance, and distribution of rental income to investors. This eliminates the need for manual tasks and reduces the administrative burden on investors.

Technological Advancements Transforming the Rental Property Investment Landscape

The following technological advancements are transforming the rental property investment landscape:

- Property Management Software:Platforms like Buildium, AppFolio, and Rent Manager offer property management tools that streamline communication, automate tasks, and provide real-time data on property performance. These tools enhance efficiency and reduce administrative overhead for property managers and investors.

- Artificial Intelligence (AI) for Predictive Analytics:AI-powered algorithms can analyze vast amounts of data to predict rental demand, market trends, and property valuations. This enables investors to make more informed decisions and optimize their portfolio performance. For instance, AI algorithms can identify emerging neighborhoods with high rental demand or predict future property values based on economic indicators.

It’s exciting to see Arrived Homes securing funding to expand their rental property investment platform. The company is tackling a crucial issue in the housing market, but it’s important to remember that even amidst exciting news like this, we need to be mindful of consumer safety.

A recent recall of select peanut butter products by Albanese Confectionery Group Inc. due to a potential health risk highlights the importance of staying informed and prioritizing well-being. With Arrived Homes’ focus on providing affordable housing options, it’s crucial that their expansion is accompanied by robust safety measures and responsible practices.

- Blockchain Technology:Blockchain technology can enhance transparency and security in rental property transactions. It enables secure and efficient record-keeping, reduces the risk of fraud, and facilitates faster and more transparent transactions. This technology has the potential to revolutionize the way rental properties are bought, sold, and managed.

- Internet of Things (IoT) Devices:Smart home technology, such as smart locks, thermostats, and security systems, can improve property management efficiency and enhance tenant experiences. These devices can be remotely monitored and controlled, allowing for proactive maintenance and improved security.

The Impact of AI and Data Analytics, Rental property investment startup arrived homes raises 25m to fund further expansion

Artificial intelligence (AI) and data analytics are playing an increasingly significant role in rental property investment, enabling more informed decision-making and improved investment outcomes.

- Predictive Maintenance:AI can analyze sensor data from IoT devices to predict potential maintenance issues before they occur, minimizing downtime and reducing repair costs. By identifying patterns in data, AI algorithms can anticipate potential problems and schedule preventive maintenance, leading to fewer unexpected breakdowns and improved tenant satisfaction.

- Personalized Marketing and Tenant Screening:AI-powered marketing tools can personalize outreach to potential tenants, tailoring messages based on their preferences and needs. AI algorithms can also analyze tenant data to predict creditworthiness and rental behavior, improving tenant screening accuracy and reducing the risk of bad tenants.

- Automated Valuation Models:AI algorithms can analyze vast amounts of data, including property characteristics, market trends, and economic indicators, to generate more accurate and timely property valuations. This provides investors with a more realistic understanding of property value and helps them make informed investment decisions.

The Impact of Arrived Homes on the Rental Market

Arrived Homes, a platform that allows individuals to invest in fractional ownership of rental properties, has the potential to significantly impact the rental market. By increasing the number of investors in rental properties, Arrived Homes could influence both the availability and pricing of rental units.

Potential Impact on Rental Property Availability

The influx of fractional ownership could lead to an increase in the supply of rental properties. This is because more investors would be incentivized to purchase rental properties, leading to a greater number of units available for rent. This increased supply could potentially lead to lower rental prices, as competition among landlords intensifies.

- Increased Supply:Arrived Homes’ model could attract a wider range of investors who might not have considered purchasing a whole rental property, thereby increasing the number of properties available for rent. This could lead to a more competitive rental market, potentially benefiting tenants.

- Potential for Affordable Housing:Fractional ownership could enable more individuals to invest in affordable housing units, leading to an increase in their availability and potentially mitigating the affordability crisis in some areas.

Potential Implications for Landlords and Tenants

The emergence of fractional ownership platforms like Arrived Homes could present both opportunities and challenges for landlords and tenants.

- Landlords:Landlords could potentially benefit from increased access to capital through fractional ownership, enabling them to acquire more properties or invest in renovations. However, they may also face increased scrutiny from multiple fractional owners, leading to more complex management and communication challenges.

- Tenants:Tenants might benefit from a wider range of rental options and potentially lower rental prices due to increased competition among landlords. However, they might also encounter challenges in dealing with multiple fractional owners, potentially leading to more complex lease agreements and communication issues.

Long-Term Implications of Arrived Homes’ Business Model

The long-term impact of Arrived Homes’ business model on the rental market remains to be seen. However, it could potentially lead to a more diversified ownership structure in the rental market, with a greater emphasis on passive investment strategies.

- Diversification of Ownership:The fractional ownership model could lead to a more diversified ownership structure in the rental market, with a wider range of investors participating. This could potentially lead to more sustainable and long-term rental investments.

- Increased Institutional Investment:The fractional ownership model could attract institutional investors who might not have considered investing in individual rental properties before. This could lead to increased capital flows into the rental market, potentially impacting pricing and availability.

Outcome Summary

The $25 million funding round will enable Arrived Homes to expand its property portfolio, enhance its technology platform, and reach a wider audience. This expansion is poised to further disrupt the traditional real estate market, making rental property investment more accessible and attractive to a broader range of individuals.

As the demand for fractional ownership continues to grow, Arrived Homes is well-positioned to become a leading player in the evolving real estate investment landscape.