Mortgage Rates Jump Again, Pushing Homebuyers Aside

Mortgage rates jump again sending home buyers to the sideline – Mortgage Rates Jump Again, Pushing Homebuyers Aside, and the housing market is feeling the heat. This latest surge in rates has sent shockwaves through the industry, leaving many potential buyers wondering if they’ll ever be able to achieve their dream of homeownership.

The impact of rising rates is undeniable, and its ripple effects are being felt across the board, from first-time homebuyers struggling to qualify for a loan to seasoned investors re-evaluating their strategies.

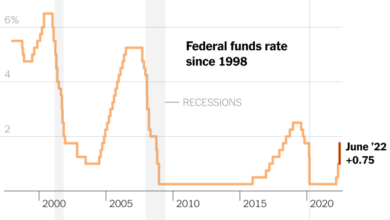

The recent jump in mortgage rates is a complex issue with multiple contributing factors. The Federal Reserve’s aggressive interest rate hikes, designed to curb inflation, are a major driver. Additionally, economic uncertainty and the ongoing war in Ukraine are contributing to market volatility, further impacting borrowing costs.

Current Mortgage Rate Landscape

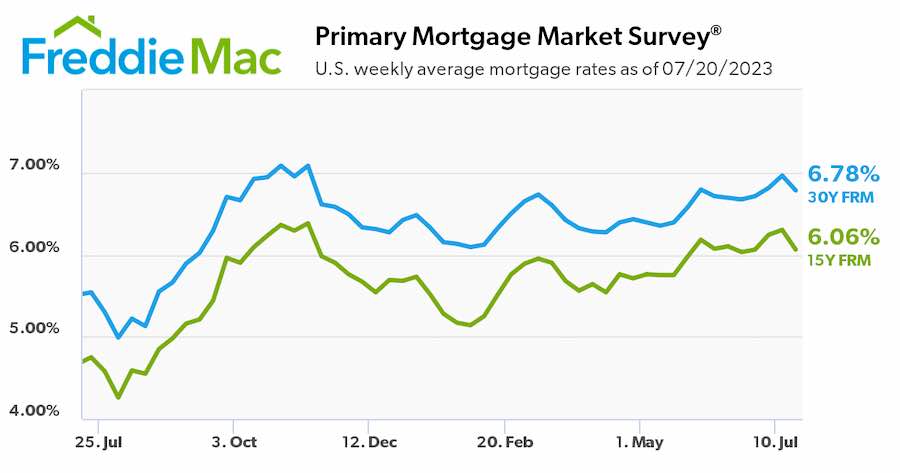

The recent surge in mortgage rates has sent shockwaves through the housing market, leaving many potential buyers on the sidelines. This dramatic shift has significantly impacted affordability and the pace of home sales, raising concerns about the future of the real estate market.

Factors Contributing to the Rise in Mortgage Rates

The recent increase in mortgage rates is primarily attributed to the Federal Reserve’s aggressive monetary policy tightening. The Fed has been raising interest rates in an attempt to combat inflation, which has reached a 40-year high. These rate hikes have a direct impact on mortgage rates, as they increase the cost of borrowing money.

The Federal Reserve’s monetary policy tightening has a direct impact on mortgage rates.

- Inflation:The Federal Reserve’s primary mandate is to control inflation. As inflation has surged, the Fed has been raising interest rates to cool down the economy and curb price increases. This has led to a rise in mortgage rates as lenders adjust their pricing to reflect the higher cost of borrowing.

- Economic Uncertainty:The global economy is facing a number of challenges, including the war in Ukraine, supply chain disruptions, and rising energy prices. This uncertainty has made lenders more cautious about lending, leading to higher mortgage rates.

- Investor Demand:Increased demand for bonds by investors has also contributed to rising mortgage rates. When investors buy bonds, they drive down bond yields, making mortgages more expensive. This is because mortgage rates are typically tied to the yield on 10-year Treasury bonds.

Impact on Home Buyers

The recent surge in mortgage rates has significantly impacted home buyers, making the dream of homeownership more challenging. The higher rates translate to increased monthly payments, reducing affordability and purchasing power. This situation presents significant challenges for both first-time homebuyers and existing homeowners seeking to refinance.

The latest spike in mortgage rates has sent shockwaves through the housing market, leaving many buyers on the sidelines. It’s a tough time for anyone hoping to enter the market, but it’s a good time to reflect on leadership skills that can help us navigate these challenges.

Check out this insightful article on 10 most important leadership skills for the 21st century workplace and how to develop them – it’s a great resource for anyone seeking to develop their leadership abilities, which are crucial for navigating the uncertainties of the current market.

The housing market may be in a state of flux, but strong leadership can help us find our way through the storm.

Impact on Affordability and Purchasing Power

Rising mortgage rates directly affect affordability by increasing the monthly mortgage payment. For example, a 1% increase in interest rates on a $300,000 mortgage can result in an additional $200-$300 in monthly payments. This increased financial burden can significantly impact a buyer’s ability to qualify for a mortgage or afford the desired property.

Moreover, the higher rates reduce purchasing power, meaning buyers can afford less house for the same monthly payment. For instance, a buyer with a $3,000 monthly budget might have qualified for a $400,000 home with a 3% interest rate. However, with a 6% interest rate, the same budget might only allow them to purchase a $300,000 home.

Challenges Faced by First-Time Homebuyers

First-time homebuyers are particularly vulnerable to rising mortgage rates. Many are already facing challenges with saving for a down payment and navigating the complex home buying process. Increased rates add another layer of difficulty, making it harder to qualify for a loan and afford their desired home.

In some cases, they may have to compromise on location, size, or amenities to stay within their budget.

Challenges Faced by Existing Homeowners Seeking to Refinance

Existing homeowners seeking to refinance their mortgages are also affected by rising rates. Refinance rates have been increasing, making it less attractive to refinance and lock in lower rates. In some cases, refinancing might even result in higher monthly payments if the new rate is higher than the existing rate.

This can be a significant setback for homeowners who were hoping to lower their monthly expenses or access equity for other purposes.

Comparison to Previous Periods of High Mortgage Rates

While the current increase in mortgage rates is concerning, it’s important to compare it to previous periods of high rates. For instance, during the 1980s, mortgage rates reached over 18%, leading to a significant decline in home sales. The current rates, while higher than recent years, are still relatively low compared to historical levels.

This suggests that the impact on the housing market might be less severe than in the past, but it’s still a significant factor affecting buyer behavior.

Housing Market Trends

The recent surge in mortgage rates has undoubtedly sent ripples through the housing market, prompting a wave of adjustments and uncertainty. Understanding how the market is responding to these changes is crucial for both buyers and sellers.

Impact on Housing Inventory

The rising interest rates have had a significant impact on housing inventory levels. As affordability shrinks, potential sellers are hesitant to list their homes, fearing they won’t receive the desired price in a market where buyers are more cautious. This reluctance to sell has led to a decrease in inventory, further tightening the market and potentially pushing prices upwards due to limited supply.

It’s a tough time to be a homebuyer. Mortgage rates keep jumping, pushing many to the sidelines. While everyone’s focused on housing, it’s interesting to see how Warren Buffett and Charlie Munger analyzed BYD’s one big problem in this article.

Maybe there’s a lesson there for the housing market too. With interest rates rising, it’s no wonder many are opting to wait and see what happens next.

A recent report by the National Association of Realtors (NAR) showed that the number of homes for sale in July 2023 was down by 10% compared to the same period last year.

It’s a tough time to be a home buyer. Mortgage rates are jumping again, pushing many would-be buyers to the sidelines. And while the housing market is in turmoil, there are other pressing issues. The recent discovery of a possible noose near a CIA facility has prompted a warning from the agency’s director , reminding us that even amidst economic anxieties, the fight for social justice and equality remains crucial.

With so much uncertainty in the air, it’s understandable that home buyers might be hesitant to take the plunge. But hopefully, these challenges will soon pass, allowing everyone to focus on building a brighter future.

Impact on Sales Volume, Mortgage rates jump again sending home buyers to the sideline

The decrease in affordability, coupled with rising mortgage rates, has led to a decline in sales volume. Buyers are becoming more selective, scrutinizing properties more closely and taking longer to make decisions. This cautious approach, driven by financial considerations and uncertainty, has resulted in a slowdown in the pace of home sales.

According to the NAR, existing home sales fell by 2.2% in July 2023 compared to June 2023.

Impact on Price Growth

While price growth has slowed down in some areas, it’s not necessarily a universal trend. In markets with limited inventory, price growth may continue, albeit at a slower pace. However, in areas with higher inventory, prices might even experience a slight decline as sellers adjust to the changing market dynamics.

For example, in the San Francisco Bay Area, where inventory remains low, home prices continue to rise, albeit at a slower rate than before. On the other hand, in areas like Phoenix, Arizona, where inventory has increased, prices have started to stabilize or even decline slightly.

Shift in Buyer Behavior and Market Sentiment

The rising mortgage rates have prompted a shift in buyer behavior and market sentiment. Buyers are becoming more price-sensitive, focusing on affordability and seeking out properties that align with their financial capabilities. This shift in behavior has led to a decrease in bidding wars and a more measured approach to purchasing homes.

The current market sentiment is characterized by caution and uncertainty. Buyers are taking a wait-and-see approach, hoping for further rate adjustments or a potential shift in the market.

Strategies for Home Buyers: Mortgage Rates Jump Again Sending Home Buyers To The Sideline

The current mortgage rate environment presents a significant challenge for homebuyers. With rates fluctuating and showing no signs of immediate stabilization, it’s crucial to consider various strategies to navigate this market. This section will explore options for navigating the current market, including waiting for rates to stabilize or seeking alternative financing options.

We’ll also examine strategies for securing a mortgage in a competitive market.

Waiting for Rates to Stabilize

Waiting for rates to stabilize can be a viable option for homebuyers who are not under immediate pressure to purchase. This approach allows buyers to observe market trends and potentially benefit from lower rates in the future. However, it’s essential to weigh the potential benefits against the risk of rising home prices or a prolonged period of rate volatility.

Exploring Alternative Financing Options

In the current market, exploring alternative financing options can be a strategic move for homebuyers. These options might offer lower interest rates or more flexible terms than traditional mortgages. Here’s a comparison of different mortgage products and their associated interest rates:

| Mortgage Product | Interest Rate |

|---|---|

| Conventional Mortgage | Variable, currently around 7% |

| Adjustable-Rate Mortgage (ARM) | Lower initial rate, subject to adjustment over time |

| FHA Loan | Lower down payment requirement, higher interest rates |

| VA Loan | Available to eligible veterans, often with lower rates |

Securing a Mortgage in a Competitive Market

Securing a mortgage in a competitive market requires a proactive approach. Here are some strategies to enhance your chances of success:

- Improve your credit score:A higher credit score qualifies you for better interest rates.

- Increase your down payment:A larger down payment reduces the loan amount and can lead to lower interest rates.

- Shop around for lenders:Compare rates and terms from multiple lenders to secure the best deal.

- Get pre-approved for a mortgage:A pre-approval letter demonstrates your financial readiness to lenders and can strengthen your offer.

- Work with a real estate agent:An experienced agent can provide valuable insights into the market and guide you through the home buying process.

Expert Opinions and Predictions

The recent surge in mortgage rates has left many wondering about the future direction of the housing market. Real estate professionals and economists offer a range of perspectives on what lies ahead, with predictions influenced by economic factors like inflation and monetary policy.

Impact of Economic Factors on Mortgage Rates

The Federal Reserve’s aggressive monetary policy tightening, aimed at curbing inflation, has been a major driver of rising mortgage rates. The Fed’s actions, including interest rate hikes and reducing its bond holdings, have increased borrowing costs across the board, including for mortgages.

Inflation, another significant factor, has also contributed to higher mortgage rates. When inflation is high, lenders demand higher interest rates to compensate for the erosion of their purchasing power.

Key Market Analysts’ Predictions

- Nariman Behravesh, chief economist at IHS Markit:Behravesh expects mortgage rates to remain elevated in the near term, citing the Fed’s commitment to controlling inflation. He predicts that rates could stabilize around 6% by the end of the year, but warns that they could rise further if inflation proves more persistent than anticipated.

- Lawrence Yun, chief economist of the National Association of Realtors (NAR):Yun anticipates a moderation in mortgage rates in the second half of 2023, as inflation eases and the Fed becomes less aggressive in its rate hikes. He expects rates to fall back to the 5% range by the end of the year.

- Mark Zandi, chief economist of Moody’s Analytics:Zandi predicts a continued rise in mortgage rates in the coming months, driven by ongoing inflation and the Fed’s persistent tightening. He expects rates to peak in the 7% range by the end of 2023.

Conclusion

Navigating the current housing market, with its unpredictable mortgage rates, requires a blend of patience, research, and a willingness to adapt. While the future remains uncertain, it’s crucial to stay informed about market trends and explore all available options.

By understanding the factors influencing mortgage rates and the potential impact on the housing market, buyers can make informed decisions and navigate this challenging landscape with confidence.