Should You Buy Solid Power on the Dip?

Should you buy Solid Power on the dip? It’s a question many investors are asking as the company’s stock price has recently taken a tumble. Solid Power is a leading developer of solid-state battery technology, a promising innovation in the energy sector that could revolutionize the way we power our vehicles and devices.

But with the stock down, it’s natural to wonder if this is a buying opportunity or a sign of trouble ahead.

In this blog post, we’ll delve into the factors driving Solid Power’s recent dip, analyze its potential for a rebound, and examine the overall investment opportunity. We’ll also consider the competitive landscape, regulatory environment, and future growth prospects for the company.

Understanding Solid Power

Solid Power is a company developing solid-state batteries, a revolutionary technology with the potential to transform the energy sector. These batteries offer significant advantages over traditional lithium-ion batteries, including improved safety, longer lifespan, and faster charging times.

The Potential Benefits of Solid Power’s Technology

Solid-state batteries employ a solid electrolyte instead of a liquid one, which eliminates the risk of leaks and fires. This makes them inherently safer than traditional lithium-ion batteries, especially crucial for electric vehicles (EVs) and other applications where safety is paramount.

Buying solid power on the dip is a tempting strategy, especially when you see a company like BYD, with its impressive growth, taking a tumble. But before you jump in, it’s wise to consider the factors driving that dip. A recent analysis explored whether Warren Buffett and Charlie Munger, known for their astute investing, saw a problem with BYD, analysis did buffett and munger see byds one problem.

Understanding the underlying reasons for a dip can help you decide if it’s a genuine buying opportunity or a warning sign to wait and see.

Additionally, solid-state batteries can store more energy in the same space, leading to longer driving ranges for EVs and increased power output for other applications. The solid electrolyte also allows for faster charging times, further enhancing the appeal of solid-state batteries.

Solid Power’s Development and Commercialization

Solid Power is currently in the advanced stages of developing its solid-state battery technology. The company has secured partnerships with major automotive manufacturers, including Ford and BMW, to accelerate the commercialization of its batteries. Solid Power is focusing on developing batteries for both electric vehicles and other applications, such as grid storage and consumer electronics.

Deciding whether to buy solid power on the dip is a tough call, but it’s always a good idea to consider the bigger picture. Remember, investing isn’t just about numbers, it’s about understanding the underlying trends. That’s why I find it helpful to think about leadership skills, especially in today’s fast-paced world.

Check out this article on 10 most important leadership skills for the 21st century workplace and how to develop them to see how these skills can translate to your investment decisions. It’s about taking a long-term perspective, adapting to change, and making smart choices, just like a good leader would.

So, while the dip might be tempting, remember to analyze the situation and make the best decision for your own portfolio.

The company is aiming to bring its solid-state batteries to market in the coming years, potentially revolutionizing the energy landscape.

Analyzing the Dip: Should You Buy Solid Power On The Dip

Solid Power’s stock price has experienced a recent decline, raising concerns for potential investors. It is important to analyze the contributing factors to this dip to assess the current situation and potential for future growth.

Factors Contributing to the Dip

Several factors have contributed to the recent decline in Solid Power’s stock price. These include:

- General Market Volatility:The broader market has been experiencing volatility in recent months, impacting the performance of various stocks, including those in the EV battery space. Solid Power, being a relatively new company, is particularly susceptible to market fluctuations.

- Delayed Timeline for Commercialization:Solid Power has faced delays in its commercialization timeline, which has raised concerns about its ability to meet its targets. This delay has contributed to investor uncertainty and pressure on the stock price.

- Competition in the Solid-State Battery Market:The solid-state battery market is becoming increasingly competitive, with several established players investing heavily in this technology. This competition could put pressure on Solid Power’s market share and profitability in the long run.

Valuation Compared to Peers

It’s essential to compare Solid Power’s valuation to its peers in the industry to understand its current market position. Solid Power’s valuation is currently lower than some of its peers, such as QuantumScape and SolidEnergy Systems, who are also developing solid-state battery technologies.

However, Solid Power’s valuation is higher than some other companies in the early stages of development.

Potential for Rebound

Despite the recent decline, Solid Power has several factors that could contribute to a rebound in its stock price:

- Strong Partnerships:Solid Power has established partnerships with major automotive manufacturers, including Ford and BMW. These partnerships provide validation for its technology and potential for large-scale adoption in the future.

- Advancements in Technology:Solid Power continues to make advancements in its solid-state battery technology, improving its performance and cost-effectiveness. These advancements could drive future growth and attract more investors.

- Growing Demand for Solid-State Batteries:The demand for solid-state batteries is expected to grow significantly in the coming years due to their superior safety and performance characteristics compared to traditional lithium-ion batteries. This growing demand could benefit Solid Power as a leading player in this market.

Evaluating the Investment Opportunity

Solid Power’s potential as an investment hinges on its ability to successfully commercialize its solid-state battery technology and establish a strong foothold in the rapidly growing electric vehicle (EV) market. To assess the investment opportunity, we need to delve into its financial performance, potential risks, and competitive landscape.

Financial Analysis

Solid Power’s financial performance is currently limited due to its pre-revenue stage. The company is heavily reliant on funding rounds and strategic partnerships to fuel its research and development efforts. However, the company’s valuation reflects investor confidence in its long-term prospects.

Solid Power’s revenue streams are expected to come from licensing its technology to automotive manufacturers and potentially from manufacturing its own batteries in the future. The company’s profitability is currently negative, as it continues to invest heavily in research and development.

However, with successful commercialization, Solid Power could achieve profitability within the next few years.Solid Power’s debt levels are relatively low, thanks to its reliance on equity financing. However, as the company scales up its operations and invests in manufacturing facilities, it may need to take on more debt.

The market is volatile, and buying solid power on the dip can be a risky move. But, before you make that decision, it’s important to consider the broader context. As the fight for reproductive rights intensifies, it’s crucial to understand the role of big money in shaping the narrative.

Read this insightful article, ” Will the Pro-Abortion Rights Billionaires Please Stand Up? ,” and ask yourself: how will these dynamics influence your investment strategy?

Potential Risks and Rewards

Investing in Solid Power carries inherent risks, including:

- Technology Risk:Solid-state battery technology is still in its early stages of development. Solid Power faces significant technical challenges in scaling up production and achieving the desired performance and cost targets.

- Competition:Solid Power is competing with other companies developing solid-state battery technology, including established players like Toyota and Volkswagen. The company needs to differentiate itself and establish a strong market position.

- Market Risk:The EV market is still evolving, and there is uncertainty surrounding the future adoption of solid-state battery technology. If the market for solid-state batteries does not develop as expected, Solid Power’s business could be negatively impacted.

However, the potential rewards of investing in Solid Power are also significant:

- First-Mover Advantage:Solid Power has the potential to be a first-mover in the solid-state battery market, which could give it a significant competitive advantage.

- High Growth Potential:The EV market is expected to grow rapidly in the coming years, providing a large potential market for Solid Power’s technology.

- Strategic Partnerships:Solid Power has established strategic partnerships with major automotive manufacturers, which could provide access to valuable resources and expertise.

Comparison to Other Energy Investments

Solid Power’s investment opportunity can be compared to other potential investments in the energy sector, such as:

- Traditional Oil and Gas Companies:These companies offer relatively stable dividends and cash flows, but their future prospects are uncertain due to the transition to renewable energy sources.

- Renewable Energy Companies:These companies offer exposure to the rapidly growing renewable energy market, but they may face challenges related to government policies and subsidies.

- Battery Technology Companies:Solid Power is competing with other battery technology companies, including those developing lithium-ion and other advanced battery technologies.

Solid Power offers a unique investment opportunity in the rapidly evolving energy sector. The company’s potential for growth and innovation is significant, but it also faces significant risks. Investors need to carefully consider these factors before making an investment decision.

Strategic Considerations

Solid Power’s success hinges on its ability to navigate a dynamic landscape, considering both competitive forces and external influences. This section delves into the strategic considerations that could impact Solid Power’s future trajectory.

Competitive Landscape

Understanding the competitive landscape is crucial for assessing Solid Power’s position and potential for success. Solid Power faces competition from established players in the battery industry, as well as emerging startups. Here are some key competitors and their strengths and weaknesses:

- Established Battery Manufacturers:Companies like LG Energy Solution, Samsung SDI, and CATL have significant manufacturing capacity, established supply chains, and strong relationships with automotive OEMs. However, they may be slower to adopt new technologies like solid-state batteries.

- Solid-State Battery Startups:Companies like QuantumScape, and AESC are focused on developing solid-state battery technologies. They have the potential to disrupt the market with innovative solutions, but they face challenges in scaling up production and securing funding.

Solid Power’s competitive advantage lies in its focus on sulfide-based solid-state electrolytes, which offer potential benefits in terms of cost, performance, and safety. However, the company needs to overcome challenges related to scaling up production and securing partnerships with major automotive manufacturers.

Government Regulations and Policies, Should you buy solid power on the dip

Government regulations and policies play a significant role in shaping the future of the battery industry. Governments worldwide are investing heavily in research and development of electric vehicles and battery technologies, including solid-state batteries. These initiatives can provide opportunities for Solid Power, but they also create regulatory challenges.

- Incentives and Subsidies:Government incentives and subsidies for electric vehicle adoption and battery manufacturing can create a favorable environment for Solid Power. However, the specific terms and conditions of these programs can vary significantly, impacting the company’s overall profitability.

- Safety and Environmental Standards:Stringent safety and environmental regulations for battery manufacturing can increase costs and complexity for Solid Power. The company needs to ensure compliance with these regulations while maintaining its competitive edge.

Growth Opportunities

Solid Power has the potential to capitalize on several growth opportunities in the future.

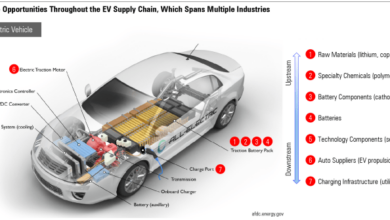

- Electric Vehicle Market:The rapid growth of the electric vehicle market presents a significant opportunity for Solid Power. Solid-state batteries can offer advantages in terms of range, charging time, and safety, making them attractive for electric vehicle manufacturers.

- Energy Storage:Solid-state batteries can also play a role in grid-scale energy storage, helping to stabilize the power grid and reduce reliance on fossil fuels. This is another area where Solid Power can explore growth opportunities.

- Emerging Applications:Solid-state batteries have potential applications beyond electric vehicles and energy storage, including consumer electronics, aerospace, and medical devices. Solid Power can explore these emerging markets to diversify its revenue streams.

Epilogue

Ultimately, deciding whether or not to buy Solid Power on the dip is a personal decision. It’s crucial to conduct your own thorough research, consider your risk tolerance, and weigh the potential rewards against the potential risks. While the future of Solid Power is uncertain, its solid-state battery technology holds significant promise.

If you believe in the long-term potential of this technology, the current dip could present a valuable buying opportunity.