CNBC Daily Open: Soft Landing Doubts Emerge

Cnbc daily open some arent convinced of a soft landing – CNBC Daily Open: Soft Landing Doubts Emerge sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. The CNBC Daily Open, a prominent segment on the financial news channel, has become a platform for lively discussions on the current economic landscape, particularly the possibility of a soft landing.

The recent episodes have featured a heated debate among experts, with some expressing skepticism about the feasibility of a soft landing while others remain optimistic. This blog delves into the arguments for and against a soft landing, exploring the key economic indicators and potential implications for various sectors.

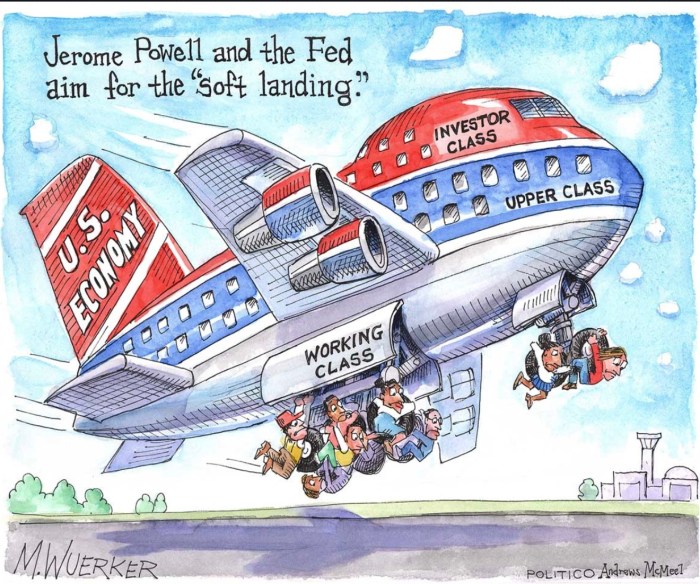

The debate centers around the Federal Reserve’s efforts to combat inflation without triggering a recession. While some analysts believe that the Fed can successfully navigate this delicate balancing act, others warn of the potential for unintended consequences. The arguments against a soft landing often cite historical precedents, highlighting the difficulty of achieving a smooth transition from high inflation to a stable economy.

They point to rising interest rates, persistent inflation, and potential for a decline in consumer spending as factors that could derail a soft landing. Conversely, proponents of a soft landing argue that the economy is showing signs of resilience, with strong labor market conditions and moderate economic growth.

They emphasize the Fed’s commitment to bringing inflation under control while avoiding a recession, highlighting the potential for a gradual slowdown in economic activity.

The CNBC Daily Open and the Soft Landing Debate

The CNBC Daily Open, a popular segment on the CNBC network, plays a crucial role in shaping market sentiment. Each morning, prominent financial experts and analysts gather to discuss the latest economic trends, market movements, and key factors influencing investor behavior.

The CNBC Daily Open discussed the possibility of a soft landing for the economy, but some analysts remain unconvinced. It’s a complex situation, with global factors like the ongoing conflict in the Middle East, which has a long and intricate history, playing a role.

The Middle East conflict a brief background provides a good overview of the conflict’s roots. Ultimately, whether or not we see a soft landing depends on a multitude of factors, including how these global events unfold.

The segment often features lively debates on pressing economic issues, providing valuable insights for both seasoned investors and newcomers to the market.Recent discussions on the CNBC Daily Open have focused heavily on the possibility of a soft landing for the US economy.

As the Federal Reserve continues its fight against inflation, the market is grappling with the potential consequences of aggressive interest rate hikes. A soft landing refers to a scenario where the economy successfully navigates a period of high inflation and tight monetary policy without falling into a recession.

Arguments for and Against a Soft Landing

The debate surrounding a soft landing has been particularly heated on the CNBC Daily Open, with experts presenting compelling arguments on both sides.

Arguments for a Soft Landing

Proponents of a soft landing often cite the strength of the US labor market as a key factor supporting their view. The unemployment rate remains low, indicating robust demand for workers and a healthy economy. They also point to the resilience of consumer spending, which has remained surprisingly strong despite rising inflation.

Additionally, some experts believe that the Federal Reserve’s commitment to controlling inflation will ultimately succeed, allowing the economy to cool down gradually without triggering a recession.

Arguments Against a Soft Landing

Skeptics of a soft landing highlight the ongoing inflationary pressures and the potential for a recession. They argue that the aggressive interest rate hikes by the Federal Reserve are already starting to impact the economy, leading to slower growth and potential job losses.

The CNBC Daily Open discussed the possibility of a soft landing, but some analysts remain skeptical. It’s hard to ignore the larger global picture, especially with conflicts like the one in Ukraine, which some argue is this war is a fraud.

These global events undoubtedly influence economic uncertainty, making a soft landing a delicate balancing act.

Additionally, they point to the rising risk of a global recession, which could further dampen US economic growth.

Key Points of Contention

The CNBC Daily Open has provided a platform for experts to debate the key points of contention surrounding a soft landing.

- The Impact of Interest Rate Hikes:One major point of contention is the extent to which interest rate hikes will impact economic growth and employment. While proponents of a soft landing argue that the Fed can effectively manage inflation without causing a recession, skeptics believe that the aggressive tightening will ultimately lead to a downturn.

The CNBC Daily Open was buzzing today with talk about the Fed’s efforts to achieve a soft landing, but some experts remain skeptical. Amidst all the economic uncertainty, it’s hard to ignore the news about the Pentagon’s potential surveillance activities on Americans, a topic that has been gaining traction in recent months.

Is the Pentagon spying on Americans ? The answer, unfortunately, remains unclear, but it’s a question that adds another layer of complexity to an already volatile economic landscape. Whether the economy can navigate this turbulent terrain and achieve a soft landing remains to be seen.

- The Strength of the Consumer:Another key point of contention is the resilience of consumer spending. Proponents of a soft landing believe that consumer spending will remain strong, while skeptics argue that rising inflation and higher interest rates will eventually erode consumer confidence and lead to a decline in spending.

- The Global Economic Outlook:The global economic outlook is also a major factor in the soft landing debate. Skeptics argue that a global recession could significantly impact the US economy, making a soft landing less likely. Proponents, on the other hand, argue that the US economy is relatively insulated from global shocks.

Arguments Against a Soft Landing

While the possibility of a soft landing remains a topic of debate, many economists and market analysts express significant concerns about its feasibility. They argue that the current economic landscape is fraught with challenges that make a smooth transition away from inflation highly unlikely.

Economic Indicators and Data Points, Cnbc daily open some arent convinced of a soft landing

A key argument against a soft landing is the persistence of high inflation. While inflation has shown signs of cooling, it remains stubbornly above the Federal Reserve’s target rate. The persistence of inflation suggests that underlying economic pressures are not easing quickly enough to allow for a gradual slowdown in growth without triggering a recession.

- The Consumer Price Index (CPI) rose 4.9% in April 2023, indicating that inflation remains a persistent issue. While this represents a slowdown from previous months, it remains significantly higher than the Fed’s 2% target.

- The core CPI, which excludes volatile food and energy prices, also rose 0.4% in April, suggesting that inflationary pressures are still present across a broad range of goods and services.

Furthermore, the labor market, while strong, shows signs of potential strain. While unemployment remains low, wage growth remains elevated, potentially fueling further inflationary pressures.

- The unemployment rate fell to 3.4% in April 2023, reflecting a tight labor market. However, this low unemployment rate has not led to a significant slowdown in wage growth, which remains above historical averages.

- Average hourly earnings rose 0.5% in April 2023, demonstrating that employers are still competing for a limited pool of workers. This sustained wage growth could contribute to continued inflationary pressures.

Comparison to Historical Instances

The current economic situation shares similarities with past periods when achieving a soft landing proved challenging.

- The 1970s, marked by stagflation, saw a period of high inflation and stagnant economic growth. The Federal Reserve’s attempts to combat inflation through aggressive interest rate hikes led to a recession in 1973-75. The experience of the 1970s underscores the difficulty of controlling inflation without triggering a recession, especially when it is driven by supply-side factors.

- The 1980s saw another period of high inflation, followed by a recession in 1981-82. The Federal Reserve’s efforts to curb inflation through interest rate hikes, known as the “Volcker shock,” led to a sharp contraction in economic activity. This period highlights the potential for aggressive monetary policy to create unintended consequences, even when aimed at controlling inflation.

Potential Risks and Challenges

The path to a soft landing is fraught with potential risks and challenges.

- Geopolitical uncertainty, such as the ongoing war in Ukraine and tensions with China, can create volatility in global markets and disrupt supply chains, further exacerbating inflationary pressures.

- Consumer confidence, already impacted by high inflation, could deteriorate further if interest rates continue to rise, leading to a decline in consumer spending and economic growth.

- Financial market volatility, driven by concerns about inflation and interest rate hikes, could lead to a sudden tightening of credit conditions, hindering investment and economic activity.

Arguments Supporting a Soft Landing

While some experts remain skeptical, a growing number of economists and market analysts believe a soft landing for the US economy is possible. This view hinges on several factors, including the resilience of the labor market, easing inflationary pressures, and the proactive steps taken by the Federal Reserve.

Economic Indicators Supporting a Soft Landing

Several economic indicators point towards a potential soft landing. The unemployment rate remains historically low, indicating a strong labor market. While inflation has cooled from its peak, it’s still above the Federal Reserve’s target, suggesting further rate hikes may be needed.

However, the decline in inflation, coupled with strong consumer spending, suggests a gradual slowdown rather than a sharp recession.

Strategies and Policies Supporting a Soft Landing

The Federal Reserve’s monetary policy tightening has been a key factor in slowing economic growth and curbing inflation. The Fed’s careful approach, gradually raising interest rates, aims to bring inflation under control without triggering a recession. Additionally, the Biden administration’s policies, such as infrastructure investments and support for clean energy, are expected to stimulate economic growth in the long term.

Table: Contrasting Viewpoints

| Argument | For Soft Landing | Against Soft Landing |

|---|---|---|

| Labor Market | Strong and resilient, with low unemployment. | Weaker than it appears, with layoffs and hiring freezes in certain sectors. |

| Inflation | Cooling, with signs of easing price pressures. | Persistently high, with potential for further increases. |

| Consumer Spending | Relatively strong, indicating consumer confidence. | Vulnerable to rising interest rates and inflation. |

| Federal Reserve Policy | Effective in slowing inflation without causing a recession. | Too aggressive, risking a sharp economic downturn. |

Implications of a Soft Landing or Hard Landing: Cnbc Daily Open Some Arent Convinced Of A Soft Landing

The possibility of a soft landing or a hard landing has significant implications for various sectors of the economy, from consumer spending and business investment to the stock market and financial markets. Understanding these implications is crucial for businesses, investors, and policymakers alike.

Economic Consequences of a Soft Landing vs. Hard Landing

The potential consequences of a soft landing versus a hard landing can be analyzed by examining their impact on different sectors of the economy. Here’s a table comparing the potential outcomes:| Sector | Soft Landing | Hard Landing ||—|—|—|| Consumer Spending| Moderate growth, as confidence remains high and unemployment stays low.

| Sharp decline, as consumers face job losses, reduced income, and heightened uncertainty. || Business Investment| Continued expansion, driven by strong demand and low borrowing costs. | Significant contraction, as businesses cut back on spending due to weak demand and rising borrowing costs.

|| Employment| Stable or moderate growth, with low unemployment rates. | High unemployment, with widespread job losses across industries. || Inflation| Gradual decline, as supply chains normalize and demand moderates. | Persistent or even accelerating inflation, as supply chain disruptions continue and demand remains strong.

|| Interest Rates| Gradual increase, as the central bank manages inflation expectations. | Sharp increase, as the central bank attempts to control inflation, potentially leading to a recession. || Stock Market| Steady or moderate growth, reflecting healthy economic conditions. | Significant decline, driven by concerns about economic growth and corporate earnings.

|| Financial Markets| Stable and liquid, with moderate volatility. | High volatility and potential for market crashes, as investors react to economic uncertainty. |

Impact on Consumer Spending, Business Investment, and Employment

A soft landing would likely lead to continued growth in consumer spending, driven by high consumer confidence and low unemployment rates. Businesses would also be more likely to invest in expansion, given strong demand and low borrowing costs. This scenario would result in stable or moderate employment growth, with low unemployment rates.On the other hand, a hard landing would likely lead to a sharp decline in consumer spending, as consumers face job losses, reduced income, and heightened uncertainty.

Businesses would also be likely to cut back on investment, due to weak demand and rising borrowing costs. This scenario would result in high unemployment, with widespread job losses across industries.

Implications for the Stock Market and Financial Markets

A soft landing would likely result in steady or moderate growth in the stock market, reflecting healthy economic conditions and strong corporate earnings. Financial markets would also be relatively stable and liquid, with moderate volatility.However, a hard landing would likely lead to a significant decline in the stock market, driven by concerns about economic growth and corporate earnings.

Financial markets would also experience high volatility and a potential for market crashes, as investors react to economic uncertainty.

Economic Trajectories for a Soft Landing and a Hard Landing

Visual Representation:[Image: A line graph showing two distinct trajectories. The “Soft Landing” line is a gradual upward trend, while the “Hard Landing” line shows a sharp decline followed by a prolonged period of stagnation.]The graph illustrates the potential economic trajectories for a soft landing and a hard landing. The “Soft Landing” line represents a gradual upward trend in economic activity, with a steady decline in inflation and a controlled increase in interest rates.

The “Hard Landing” line shows a sharp decline in economic activity, followed by a prolonged period of stagnation, as inflation remains high and interest rates rise rapidly.

The Importance of Monitoring Economic Indicators

Navigating the complex world of finance and investing requires a keen understanding of the underlying economic forces at play. This is where the importance of monitoring economic indicators comes into the picture. These indicators provide valuable insights into the health of the economy, helping investors and policymakers alike make informed decisions.

Tracking Key Economic Indicators

Investors and policymakers should closely monitor a range of economic indicators to gauge the current state of the economy and anticipate future trends. These indicators can be broadly categorized into three key areas: inflation, unemployment, and economic growth.

Inflation

Inflation, the rate at which prices for goods and services rise over time, is a crucial indicator of economic health.

- Consumer Price Index (CPI):This widely followed index measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI):This index tracks the average change in selling prices received by domestic producers for their output.

- Personal Consumption Expenditures (PCE) Price Index:This index measures the price changes of goods and services purchased by consumers, including durable goods, nondurable goods, and services.

High inflation can erode purchasing power, making it more expensive for consumers to buy goods and services. It can also lead to uncertainty and volatility in financial markets. On the other hand, low or stable inflation is generally seen as a sign of a healthy economy.

Unemployment

Unemployment, the percentage of the labor force that is unemployed but actively seeking work, is another critical indicator of economic health.

- Unemployment Rate:This rate measures the number of unemployed individuals as a percentage of the total labor force.

- Labor Force Participation Rate:This rate reflects the percentage of the population aged 16 and over who are either employed or actively seeking employment.

A high unemployment rate can indicate a weak economy, as it suggests that many individuals are unable to find jobs. Conversely, a low unemployment rate is often associated with a strong economy, as it suggests that businesses are hiring and the economy is growing.

Economic Growth

Economic growth, the increase in the value of goods and services produced in an economy over time, is a key indicator of overall economic health.

- Gross Domestic Product (GDP):This is the most widely used measure of economic growth, representing the total market value of all final goods and services produced in a country during a specific period.

- Real GDP:This is GDP adjusted for inflation, providing a more accurate picture of economic growth by removing the effects of price changes.

Strong economic growth is generally seen as a positive sign, indicating that the economy is creating jobs, generating wealth, and improving living standards. However, excessive economic growth can lead to inflation and other economic imbalances.

Insights into Soft Landing or Hard Landing

By carefully monitoring these key economic indicators, investors and policymakers can gain valuable insights into the likelihood of a soft landing or a hard landing. A soft landing refers to a scenario where the economy slows down gradually without a recession, while a hard landing involves a sharp economic downturn or recession.

- Inflation:Persistent high inflation can increase the risk of a hard landing, as it can lead to higher interest rates, reduced consumer spending, and slower economic growth. However, if inflation starts to moderate, it could signal a path towards a soft landing.

- Unemployment:A rising unemployment rate can be a warning sign of a potential hard landing, as it suggests that businesses are cutting jobs and the economy is weakening. However, if unemployment remains low or stable, it could indicate a soft landing.

- Economic Growth:A slowdown in economic growth can increase the likelihood of a hard landing, particularly if the slowdown is accompanied by rising inflation and unemployment. Conversely, if economic growth remains moderate or accelerates, it could signal a soft landing.

Impact on Market Sentiment and Investment Decisions

Changes in economic indicators can significantly impact market sentiment and investment decisions.

- Positive Economic Data:If economic indicators show signs of strength, such as declining inflation, low unemployment, and robust economic growth, it can boost investor confidence and lead to higher stock prices and lower bond yields. This positive sentiment can encourage investors to take on more risk and invest in growth stocks.

- Negative Economic Data:Conversely, if economic indicators show signs of weakness, such as rising inflation, increasing unemployment, and slowing economic growth, it can dampen investor confidence and lead to lower stock prices and higher bond yields. This negative sentiment can prompt investors to reduce risk and invest in more conservative assets like bonds.

“Economic indicators are the compass that guides investors and policymakers through the turbulent waters of the financial markets.”