The Fed Wont Say the R-Word: Why the Silence Matters

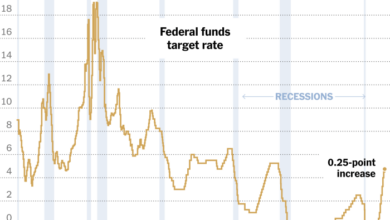

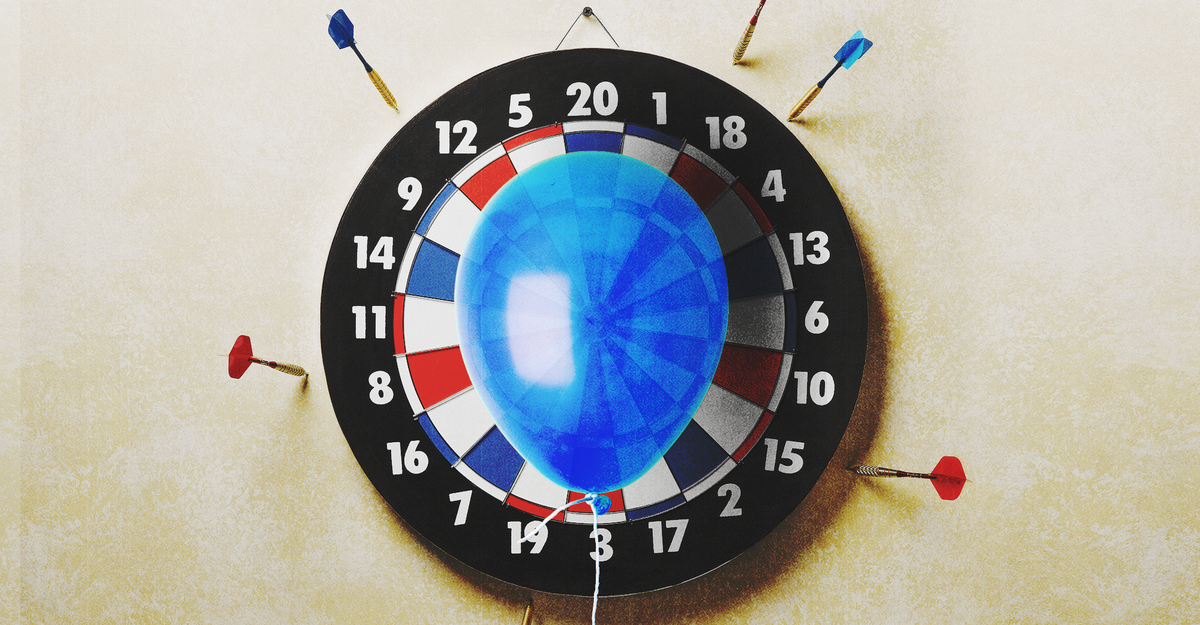

The fed wont say the r word – The Fed won’t say the R-word, and that silence speaks volumes. While the economy grapples with inflation, rising interest rates, and a potential downturn, the Federal Reserve remains hesitant to officially declare a recession. This strategic silence raises questions about the Fed’s communication strategy, the current economic landscape, and the potential impact of a recession on individuals and businesses alike.

The Fed’s reluctance to use the term “recession” is a departure from past periods of economic uncertainty. Historically, the Fed has used language to influence market sentiment and shape public perception. However, in the face of current economic challenges, the Fed appears to be taking a more cautious approach, potentially seeking to avoid further market volatility.

Market Reactions and Investor Sentiment: The Fed Wont Say The R Word

The Federal Reserve’s recent pronouncements and actions have sent ripples through the financial markets, prompting a diverse range of reactions from investors. While the Fed has refrained from explicitly declaring a recession, its cautious tone and continued interest rate hikes have fueled uncertainty and volatility in the market.

Investor Sentiment and Market Volatility

The Fed’s communication has significantly impacted investor sentiment, contributing to heightened market volatility. Investors are grappling with the implications of rising interest rates and the potential for a recession. The stock market, in particular, has experienced significant fluctuations, with investors attempting to gauge the Fed’s future policy direction.

“The Fed’s communication has been a key driver of market volatility, as investors try to decipher the central bank’s intentions and assess the potential impact on the economy.”

[Source

Financial Times]

Market Segment Reactions

Different market segments are responding to the current economic uncertainty in distinct ways.

- Equity Markets:The stock market has been volatile, with investors concerned about the potential impact of rising interest rates on corporate profits and economic growth. The tech-heavy Nasdaq index has been particularly hard hit, as investors have rotated out of growth stocks in favor of more defensive sectors.

- Bond Markets:Bond yields have risen in response to the Fed’s rate hikes, as investors anticipate higher inflation and a potential slowdown in economic growth. This has led to losses for bond investors, as bond prices move inversely to yields.

- Currency Markets:The US dollar has strengthened against other major currencies, as investors seek safe haven assets in a period of uncertainty. The strength of the dollar has implications for US exports and international trade.

Economic Outlook and Future Policy, The fed wont say the r word

The Fed’s communication and actions are closely watched by investors, as they provide insights into the central bank’s assessment of the economy and its future policy path. The Fed’s stance on inflation and growth will continue to shape market expectations and drive investor sentiment in the coming months.

Ending Remarks

The Fed’s decision to remain silent on the “R-word” highlights the complexities of navigating the current economic landscape. While the Fed’s actions can influence the overall health of the economy, the future remains uncertain. Understanding the Fed’s communication strategy and its potential impact on the economy is crucial for investors, businesses, and individuals alike.

As we move forward, it will be essential to monitor key economic indicators, analyze market reactions, and stay informed about the Fed’s evolving stance on the economy.

The Fed’s reluctance to utter the “R-word” is a sign of the times, but a little escape to a summer mountain paradise might be just what we all need. The Ritz-Carlton Lake Tahoe is the perfect place to unwind and forget about the economic anxieties, even if just for a weekend.

Of course, the Fed will likely continue to dance around the “R-word” for a while longer, but at least we can find solace in the stunning views and luxurious amenities of a mountain getaway.

The Fed’s reluctance to utter the “R” word is a clear indication of the delicate balance they’re trying to maintain. While the economy might be teetering on the edge, it seems the real secret to happiness lies elsewhere. According to science, it’s not money, but rather acts of kindness and generosity that truly fuel our contentment.

Perhaps the Fed should consider taking a page from this playbook, as a little more compassion could go a long way in boosting both our spirits and the economy.

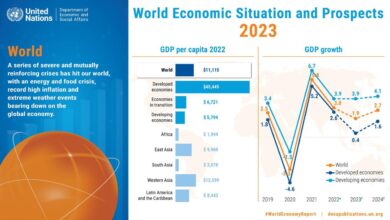

The Fed might be avoiding the “R” word, but the recent economic data is making it harder to ignore. The news that the U.S. economy shrank again in the second quarter has reignited recession fears, making the Fed’s silence even more unsettling.

While they may not be ready to declare a recession, the economic indicators are starting to paint a bleak picture, and it’s a picture that’s getting harder to ignore.