Student Loans Cost $311 Billion More Than Estimated, Watchdog Says

Direct student loans cost 311b more than education departments estimates federal watchdog says – Student loans cost $311 billion more than education departments estimates federal watchdog says. This staggering figure, revealed by a recent federal watchdog report, has sent shockwaves through the higher education system and ignited a heated debate about the rising cost of college.

The report, which meticulously scrutinized the Department of Education’s management of direct student loans, paints a stark picture of a program plagued by inefficiencies and overspending.

The report delves into the intricate workings of the direct student loan program, examining the various loan types, their eligibility criteria, and the complexities of repayment. It sheds light on the crucial role the Department of Education plays in administering these loans, a responsibility that carries significant weight given the program’s colossal scale and impact on millions of borrowers.

The Federal Watchdog’s Report

A recent report by the Government Accountability Office (GAO), the federal watchdog, has raised serious concerns about the cost of direct student loans. The report found that the U.S. Department of Education has significantly underestimated the cost of these loans, resulting in a substantial cost overrun for taxpayers.

The news about direct student loans costing $311 billion more than the Education Department estimated is certainly alarming. It’s a reminder that we need to be vigilant about how our money is being spent, especially when it comes to education.

Meanwhile, the world is watching as tensions rise between the U.S. and China, with China threatening military action if House Speaker Nancy Pelosi visits Taiwan. This situation highlights the importance of diplomacy and finding peaceful solutions to international disputes, just as we need to find a way to address the student loan crisis in a responsible and equitable manner.

Cost Overrun and Calculation

The GAO report found that the Department of Education’s projections for the cost of direct student loans were significantly off the mark. The report estimates that the cost of direct student loans will be $311 billion higher than the department’s initial projections over the next decade.

The GAO calculated this cost overrun by analyzing the department’s budget projections, historical data on loan defaults, and other relevant factors.

Implications for Taxpayers and the Government

This significant cost overrun has significant implications for taxpayers and the government. The increased cost of direct student loans will require the government to spend more money on these programs, potentially leading to higher taxes or cuts in other government programs.

The cost overrun also highlights the need for the Department of Education to improve its cost projections and ensure that it is accurately accounting for the costs of its programs.

The news that direct student loans cost $311 billion more than the Education Department estimated is alarming. It raises questions about accountability and transparency, and whether we’re truly investing in the future of our nation. This begs the question: how can we ensure that our public funds are being used effectively and ethically?

Perhaps we need to revisit the very foundations of our democratic system, considering whether free speech is essential for democracy, or could it also be democracy’s downfall ? After all, free and open debate is crucial for holding our institutions accountable.

Ultimately, the cost of student loans is just one symptom of a larger issue, and we need to be open to examining all aspects of our democracy to find solutions.

Direct Student Loans

The federal government offers direct student loans as a way to help students pay for their education. These loans are a significant source of funding for higher education, with billions of dollars disbursed each year. Understanding the different types of direct student loans, the process of obtaining and repaying them, and the role of the Department of Education is crucial for students and borrowers.

Types of Direct Student Loans

Direct student loans are categorized into two main types: subsidized and unsubsidized.

- Subsidized loansare based on financial need. The government pays the interest on the loan while the borrower is in school, during grace periods, and during periods of deferment.

- Unsubsidized loansare not based on financial need. Interest accrues on these loans from the time they are disbursed, regardless of the borrower’s enrollment status.

In addition to these two main types, there are other direct student loans available, including:

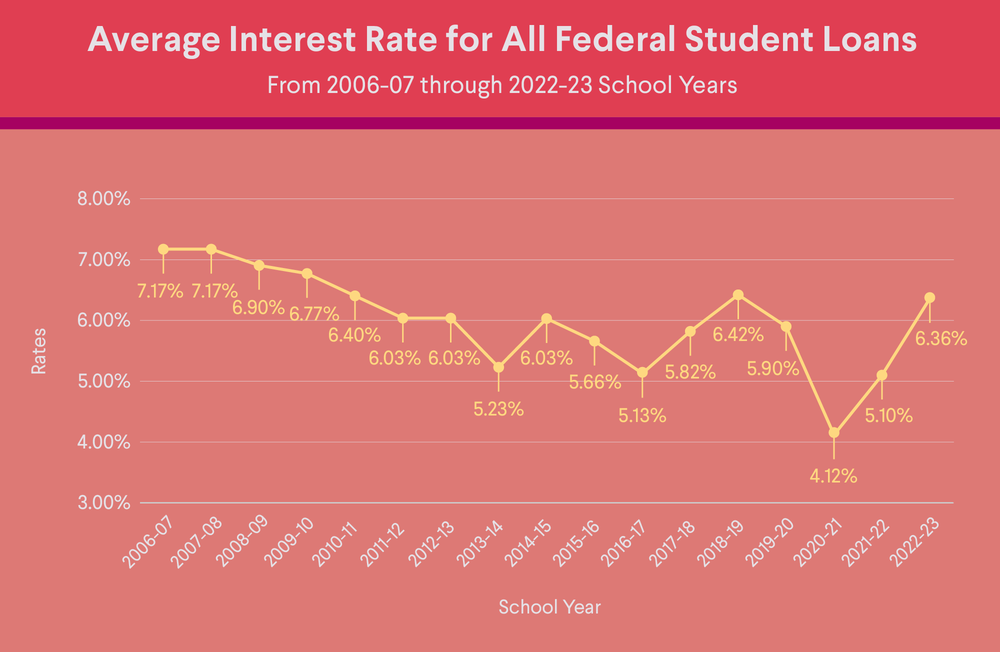

- Direct PLUS loansare available to graduate students and parents of undergraduate students. These loans have higher interest rates and do not require a credit check.

- Direct Consolidation Loansallow borrowers to combine multiple federal student loans into a single loan with a new interest rate.

Obtaining and Repaying Direct Student Loans

To obtain a direct student loan, borrowers must first complete the Free Application for Federal Student Aid (FAFSA). The FAFSA determines the borrower’s eligibility for federal student aid, including direct student loans. Once approved, the loan proceeds are disbursed directly to the borrower’s school.

Repayment of direct student loans begins six months after the borrower graduates, leaves school, or drops below half-time enrollment. Borrowers have various repayment options, including:

- Standard Repayment Plan:This plan spreads payments over 10 years.

- Graduated Repayment Plan:Payments start low and increase gradually over time.

- Extended Repayment Plan:This plan extends the repayment period to 25 years for borrowers with high loan balances.

- Income-Driven Repayment Plans:These plans tie monthly payments to the borrower’s income.

The Role of the Department of Education

The Department of Education (ED) is responsible for managing and administering direct student loans. This includes:

- Disbursing loans:ED disburses loan funds to borrowers’ schools.

- Managing loan payments:ED receives and processes loan payments from borrowers.

- Providing loan counseling and assistance:ED offers resources and support to borrowers.

- Overseeing loan forgiveness programs:ED manages programs that allow borrowers to have their loans forgiven under certain circumstances.

Implications for Students and Borrowers: Direct Student Loans Cost 311b More Than Education Departments Estimates Federal Watchdog Says

The $311 billion cost overrun in the Direct Student Loan program could have significant implications for students and borrowers, potentially affecting their loan repayment plans, forgiveness programs, and overall financial burden. This substantial cost increase could lead to various consequences, including changes in loan terms and a greater financial strain on borrowers.

Impact on Loan Repayment Plans and Forgiveness Programs

The cost overrun could impact the availability and accessibility of loan repayment plans and forgiveness programs. The government may need to make adjustments to these programs to manage the increased cost, potentially affecting borrowers’ ability to access them.

It’s a tough pill to swallow: direct student loans costing $311 billion more than the Department of Education estimated, according to a federal watchdog. While that’s a sobering reality, it’s a good reminder that sometimes you just need a break.

Maybe a getaway to the Ritz-Carlton Lake Tahoe is the perfect antidote to stress. Of course, the student loan crisis isn’t going anywhere, but at least a little escape can help us all face the challenges ahead.

- Reduced Eligibility:The government might tighten eligibility criteria for income-driven repayment plans, making it harder for borrowers to qualify for lower monthly payments.

- Increased Loan Caps:The government might lower the maximum loan amount eligible for forgiveness under programs like Public Service Loan Forgiveness (PSLF).

- Program Funding Cuts:The government might reduce funding for existing programs, potentially limiting the number of borrowers who can participate or delaying program implementation.

Policy Recommendations and Solutions

The recent report from the Federal Watchdog highlighting a $311 billion cost overrun in direct student loans calls for urgent policy interventions. This substantial discrepancy between projected and actual costs necessitates a comprehensive approach to address the issue and ensure the long-term sustainability of the program.

Addressing the Cost Overrun

The cost overrun in direct student loans stems from various factors, including rising tuition costs, increasing enrollment, and changes in loan disbursement practices. Addressing this issue requires a multifaceted approach that tackles both the supply and demand sides of the student loan market.

Policy Options and Their Potential Impacts

- Policy Option:Increase Pell Grant Funding Potential Impact:Increased affordability of college, reducing the need for student loans, and potentially mitigating the cost overrun.

- Policy Option:Promote Transparency and Competition in Higher Education Potential Impact:Encourage institutions to focus on affordability and efficiency, leading to lower tuition costs and potentially reducing the cost overrun.

- Policy Option:Implement Income-Based Repayment (IBR) Reforms Potential Impact:More affordable repayment options for borrowers, potentially reducing the cost overrun by making loans more manageable.

- Policy Option:Enhance Student Loan Counseling and Financial Literacy Programs Potential Impact:Empower students to make informed borrowing decisions, potentially reducing the overall demand for loans and mitigating the cost overrun.

- Policy Option:Explore Alternative Financing Models Potential Impact:Diversify funding sources for higher education, potentially reducing the reliance on federal loans and mitigating the cost overrun.

Evaluating Policy Options, Direct student loans cost 311b more than education departments estimates federal watchdog says

The feasibility and effectiveness of these policy options depend on several factors, including political will, economic conditions, and the willingness of stakeholders to collaborate.

Comparative Analysis of Policy Options

| Policy Option | Feasibility | Effectiveness | Potential Impacts |

|---|---|---|---|

| Increase Pell Grant Funding | Moderate | High | Increased affordability, reduced loan burden, potentially lower cost overrun. |

| Promote Transparency and Competition in Higher Education | High | Moderate | Lower tuition costs, increased efficiency, potentially lower cost overrun. |

| Implement Income-Based Repayment (IBR) Reforms | Moderate | High | More affordable repayment options, potentially lower cost overrun. |

| Enhance Student Loan Counseling and Financial Literacy Programs | High | Moderate | Informed borrowing decisions, potentially lower demand for loans, potentially lower cost overrun. |

| Explore Alternative Financing Models | Low | Moderate | Reduced reliance on federal loans, potentially lower cost overrun. |

Prioritizing Policy Recommendations

Based on the potential impact and feasibility of each policy option, prioritizing the following recommendations is crucial:

- Increase Pell Grant Funding:This policy has the highest potential impact on affordability and could significantly reduce the need for student loans.

- Promote Transparency and Competition in Higher Education:This policy can encourage institutions to prioritize affordability and efficiency, leading to lower tuition costs.

- Implement Income-Based Repayment (IBR) Reforms:This policy can make repayment more manageable for borrowers, reducing the risk of default and potentially mitigating the cost overrun.

Public Perception and Response

The federal watchdog’s report on the inflated cost of direct student loans has garnered significant public attention, sparking widespread concern and debate. The report’s findings, revealing a substantial discrepancy between the government’s projected costs and the actual expenses, have ignited a firestorm of reactions from students, borrowers, and policymakers alike.

Public Sentiment and Reactions

The report’s findings have resonated deeply with the public, particularly among students and borrowers burdened by student loan debt. The report’s revelations have fueled a sense of anger and frustration, as many feel misled and betrayed by the government’s handling of the student loan program.

“This report is a wake-up call. We’ve been told for years that the government is on our side, but this report shows that’s not true. We’re being taken advantage of,” said Sarah, a recent college graduate struggling with student loan payments.

Social media platforms have become a breeding ground for discussions and reactions to the report. Hashtags like #StudentLoanDebt and #GovernmentFailure have trended widely, reflecting the public’s growing discontent.

Public Pressure on Policymakers

The public outcry following the report has put significant pressure on policymakers to address the issue of rising student loan costs. The report’s findings have galvanized a broad coalition of advocacy groups, student organizations, and concerned citizens, demanding immediate action.

“This report is a clear indictment of the current student loan system. We need comprehensive reform that addresses the root causes of the problem, not just band-aid solutions,” stated the president of the National Student Loan Association.

The public’s sustained pressure has led to increased scrutiny of the student loan program and calls for investigations into the government’s handling of the program.

Role of Advocacy Groups and Stakeholders

Advocacy groups and other stakeholders have played a crucial role in shaping public perception and influencing policy changes related to student loans. They have actively disseminated the report’s findings, organized protests, and lobbied policymakers for reforms.

“We’re not going to let this issue fade away. We’re going to keep the pressure on until we see real change,” declared the director of a student loan advocacy organization.

These groups have also leveraged their influence to educate the public about the complexities of the student loan system and the implications of the report’s findings.

Final Wrap-Up

The federal watchdog’s report on the exorbitant cost of direct student loans serves as a stark reminder of the urgent need for reform in higher education financing. The report’s findings underscore the importance of transparency, accountability, and efficient management within the Department of Education.

Moving forward, policymakers face the daunting task of addressing the root causes of this financial burden while ensuring access to affordable higher education for all. The path forward demands a collaborative effort, involving stakeholders from all sectors, to create a sustainable and equitable system that empowers students and safeguards taxpayers.