What is Carried Interest and How Does it Affect Startups?

What is carried interest and how does it affect startups? This question has become increasingly relevant in the world of venture capital, where the potential for high returns often comes with complex financial structures. Carried interest, also known as “carry,” is a percentage of the profits generated by a venture capital fund that is distributed to the fund managers, often referred to as general partners.

This seemingly straightforward concept plays a crucial role in the success of startups, influencing their access to funding and ultimately shaping their future.

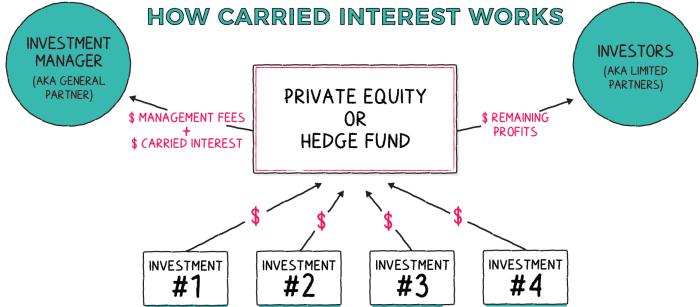

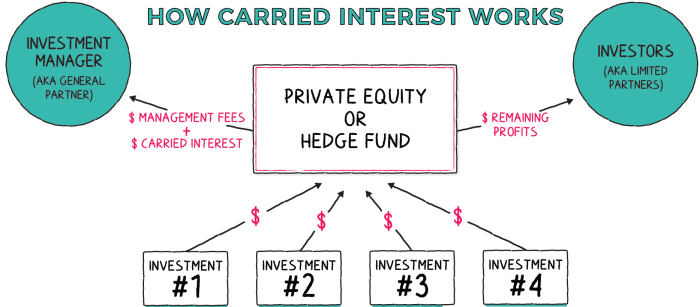

Imagine a group of experienced investors pooling their money to invest in promising startups. They form a venture capital fund, with the goal of generating substantial returns for their investors. To incentivize the fund managers to work hard and make smart investments, they are often granted a portion of the profits, known as carried interest.

This “carry” provides a direct link between the fund manager’s success and their financial reward, creating a powerful incentive to identify and nurture companies with high growth potential.

Introduction to Carried Interest

Carried interest is a form of compensation that venture capitalists (VCs) receive when their investments in startups are successful. It is a crucial element of the venture capital industry, providing a significant incentive for fund managers to generate high returns for their investors.Carried interest is essentially a percentage of the profits earned by a venture capital fund, typically ranging from 15% to 25%, after the initial investment capital is returned to investors.

This “carry” is distributed among the fund managers as a reward for their expertise, time, and effort in identifying and nurturing successful startups.

Understanding Carried Interest, What is carried interest and how does it affect startups

Carried interest is a crucial element in the venture capital industry, as it directly incentivizes fund managers to strive for exceptional returns. The concept of “carry” originated in the early days of venture capital, when it was considered a way to align the interests of fund managers with those of investors.

The fund managers were motivated to maximize returns, knowing that a portion of those returns would directly benefit them.

The Evolution of Carried Interest

Carried interest has evolved over time, with various structures and arrangements emerging. While the core principle of aligning incentives remains, the specific details of carry arrangements can vary significantly. Some of the key aspects of carried interest that have evolved include:

- Carry Allocation: Historically, carry was typically allocated equally among all fund managers. However, more recently, there has been a shift towards performance-based carry allocation, where managers with stronger track records receive a larger share of the carry.

- Hurdle Rate: The hurdle rate is the minimum return that a fund must achieve before fund managers can receive any carry. This helps to ensure that investors are adequately compensated for their initial investment before fund managers start sharing in the profits.

- Clawback Provisions: Clawback provisions are designed to protect investors in the event that a fund manager generates high returns in the early years but subsequently underperforms. These provisions allow investors to reclaim a portion of the carry that has already been distributed to fund managers if the fund’s overall performance falls below a certain threshold.

Carried interest, a key component of venture capital fund compensation, can significantly impact the financial landscape of startups. While the debate over its fairness continues, the news that the newest U.S. aid package to Ukraine will include surveillance drones highlights the importance of strategic investment and the need for transparency in funding structures.

As startups navigate the complex world of funding, understanding the implications of carried interest becomes crucial in ensuring equitable growth and long-term success.

The Impact of Carried Interest on Startups

Carried interest plays a significant role in shaping the venture capital landscape and, consequently, the startup ecosystem. It provides a powerful incentive for VCs to invest in and support promising startups, driving innovation and economic growth.

Carried interest is a powerful motivator for venture capitalists to seek out and nurture high-growth companies. It incentivizes them to go beyond simply making investments and actively engage with portfolio companies, providing guidance, mentorship, and support.

The potential for significant returns through carried interest attracts top talent to the venture capital industry, fostering a competitive environment that benefits startups. However, there have also been criticisms of carried interest, with some arguing that it can lead to excessive risk-taking by VCs and a focus on short-term gains at the expense of long-term value creation.

How Carried Interest Works in Startups

Carried interest, often referred to as “carry,” is a crucial aspect of the venture capital (VC) industry, directly impacting the financial incentives of fund managers and the overall landscape of startup funding. Understanding how carried interest works is essential for both entrepreneurs seeking funding and investors looking to understand the intricacies of VC investments.

Carried interest is a complex concept, but essentially it’s a share of the profits that venture capitalists get from successful investments. This can be a big deal for startups, as it incentivizes VCs to invest and grow companies, but it also means that founders need to understand how this structure affects their equity and potential future earnings.

It’s a bit like how Pope Francis embarks on ambitious Asia Pacific tour , aiming to spread a message of hope and unity, while navigating a complex and diverse region. Similarly, startups need to navigate the complex world of venture capital, understanding the different incentives and structures involved to ensure a successful future.

Structure of a Venture Capital Fund and Its Relationship with Startups

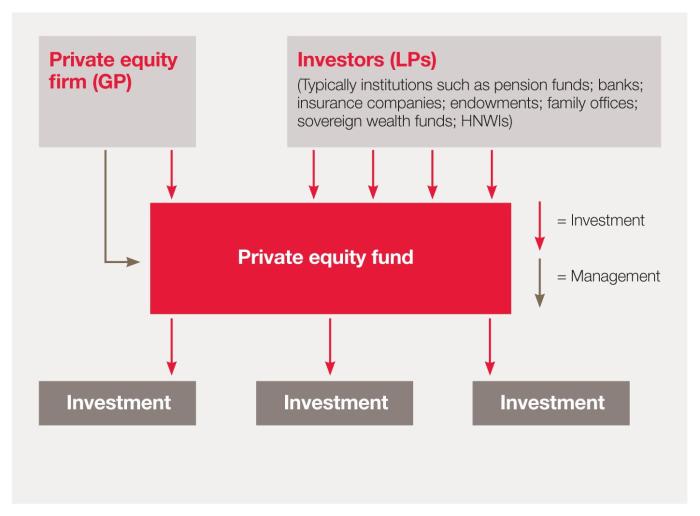

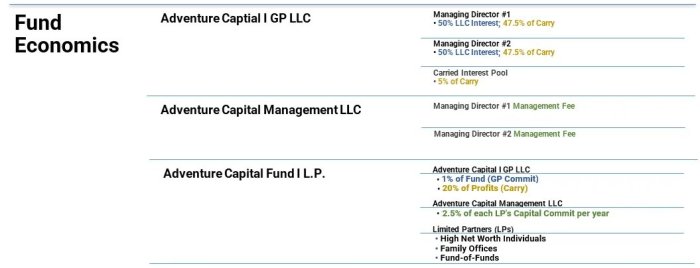

Venture capital funds are typically structured as limited partnerships. The fund manager, also known as the general partner (GP), manages the fund’s investments and receives a management fee for their services. The limited partners (LPs), who are typically institutional investors or high-net-worth individuals, provide the capital for the fund.The fund manager uses the capital to invest in startups, aiming to generate high returns for the LPs.

The GP’s performance is measured by the fund’s overall return on investment (ROI).

Carried Interest Calculation and Distribution

Carried interest is a percentage of the fund’s profits that is distributed to the GP after the LPs have received a predetermined return on their investment. This return is typically known as the “hurdle rate.”

The carried interest calculation can be expressed as:Carried Interest = (Total Fund Profits

Hurdle Rate) x Carried Interest Percentage

For example, if a fund has a 20% carried interest, a hurdle rate of 2x (meaning the LPs receive twice their initial investment back), and the fund generates a total profit of $100 million, the GP would receive 20% of the profits above the $20 million hurdle rate, or $16 million.

Carried interest is a lucrative perk for venture capitalists, giving them a share of the profits generated by the startups they invest in. It’s often seen as a way to align their interests with those of the founders, but it can also lead to conflicts of interest.

Take, for instance, the recent controversy surrounding trump claims he declassified all the documents at mar a lago even if thats true it probably doesnt matter – while the legal implications of declassification are debated, it’s a stark reminder that transparency and accountability are crucial in the world of finance, whether it’s in venture capital or government.

Ultimately, the success of any startup hinges on trust and collaboration, and that includes ensuring that all parties involved are acting in the best interests of the company.

Carried Interest Agreement Provisions

Carried interest agreements Artikel the terms of the carried interest arrangement. Some key provisions include:

- Carried Interest Percentage:The percentage of profits the GP receives.

- Hurdle Rate:The return LPs must receive before the GP starts earning carried interest.

- Clawback Provision:A clause that allows LPs to reclaim a portion of the carried interest if the GP’s performance falls below expectations.

- Catch-up Provision:A provision that allows the GP to receive a larger share of profits if the fund performs exceptionally well.

- Distribution Schedule:The schedule for distributing carried interest to the GP.

Impact of Carried Interest on Startups: What Is Carried Interest And How Does It Affect Startups

Carried interest, a crucial element in the world of venture capital, significantly impacts the landscape of startups. It acts as a powerful incentive for both investors and founders, shaping the dynamics of funding, talent acquisition, and overall business strategy. However, it also comes with potential downsides, raising ethical and fairness concerns that deserve careful consideration.

Benefits of Carried Interest for Startups

Carried interest can be a potent tool for startups seeking to attract top talent and secure funding. The prospect of sharing in the potential upside of a successful venture can motivate both investors and founders to work towards a common goal.

- Attracting Top Talent:Carried interest can incentivize talented individuals to join startups, offering them a stake in the company’s future success. This can be particularly attractive to individuals who are willing to take risks and believe in the potential of the venture.

- Securing Funding:Venture capitalists are more likely to invest in startups where they have a significant upside potential. Carried interest allows them to share in the profits, making them more willing to take on the risk associated with early-stage companies.

Drawbacks of Carried Interest for Startups

While carried interest can be beneficial, it also presents potential drawbacks that can negatively impact startups.

- Conflicts of Interest:Carried interest can create conflicts of interest. Venture capitalists may prioritize their own financial gains over the long-term interests of the startup, potentially leading to decisions that benefit them at the expense of the company’s growth.

- Misalignment of Incentives:The focus on maximizing profits can sometimes lead to a misalignment of incentives between founders and investors.

Founders may feel pressured to prioritize short-term gains over long-term sustainable growth, potentially hindering the company’s long-term success.

Fairness and Ethical Implications of Carried Interest

The fairness and ethical implications of carried interest have been a subject of ongoing debate. Critics argue that it disproportionately benefits investors at the expense of founders and employees, while proponents argue that it is a necessary incentive to drive innovation and economic growth.

- Distribution of Wealth:Carried interest can lead to a significant concentration of wealth among investors, particularly in successful ventures. This raises concerns about income inequality and the fairness of the distribution of wealth created by startups.

- Tax Treatment:The tax treatment of carried interest has also been controversial.

Some argue that it should be taxed as ordinary income rather than capital gains, as it is often considered to be compensation for services rather than an investment.

Future of Carried Interest

Carried interest, a cornerstone of the venture capital industry, is facing increasing scrutiny as the landscape of venture capital evolves. The traditional model, which rewards fund managers handsomely for successful investments, is under pressure from various stakeholders, prompting discussions about its future.

Regulatory Changes and Industry Reforms

The potential for regulatory changes and industry reforms surrounding carried interest is a significant factor in its future. Growing concerns about fairness and transparency in the VC industry are leading to calls for greater regulation. Here are some potential changes:

- Taxation of Carried Interest: One area of focus is the tax treatment of carried interest. Currently, carried interest is often taxed at the lower capital gains rate, rather than the higher ordinary income rate. Advocates for change argue that this preferential treatment is unfair, as it allows fund managers to avoid paying a higher tax rate on their earnings.

The potential for changes in tax laws could significantly impact the attractiveness of carried interest to fund managers.

- Increased Transparency: There is growing pressure for greater transparency in the VC industry, particularly around carried interest. This includes calls for more detailed disclosure of fund performance, carried interest arrangements, and the fees charged to investors. Increased transparency could help to address concerns about conflicts of interest and ensure that fund managers are held accountable for their performance.

- Alternative Compensation Structures: Some industry players are exploring alternative compensation structures for fund managers. These could include models that are based on a combination of performance, time spent on investments, and the overall success of the fund. This shift away from solely performance-based compensation could help to address concerns about the incentive structure of carried interest.