Small Business Confidence Plummets Amid Worsening Sales and Recession Fears

Small business confidence hits all time low on worsening sales outlook and belief on main street recession is here, painting a stark picture of the challenges facing small businesses across the nation. This decline in confidence isn’t just a blip on the radar; it’s a reflection of a deep-seated unease among entrepreneurs who are grappling with a perfect storm of economic headwinds.

Rising inflation, supply chain disruptions, and a shift in consumer spending patterns have created a perfect storm that’s impacting small business revenue, leaving many struggling to stay afloat.

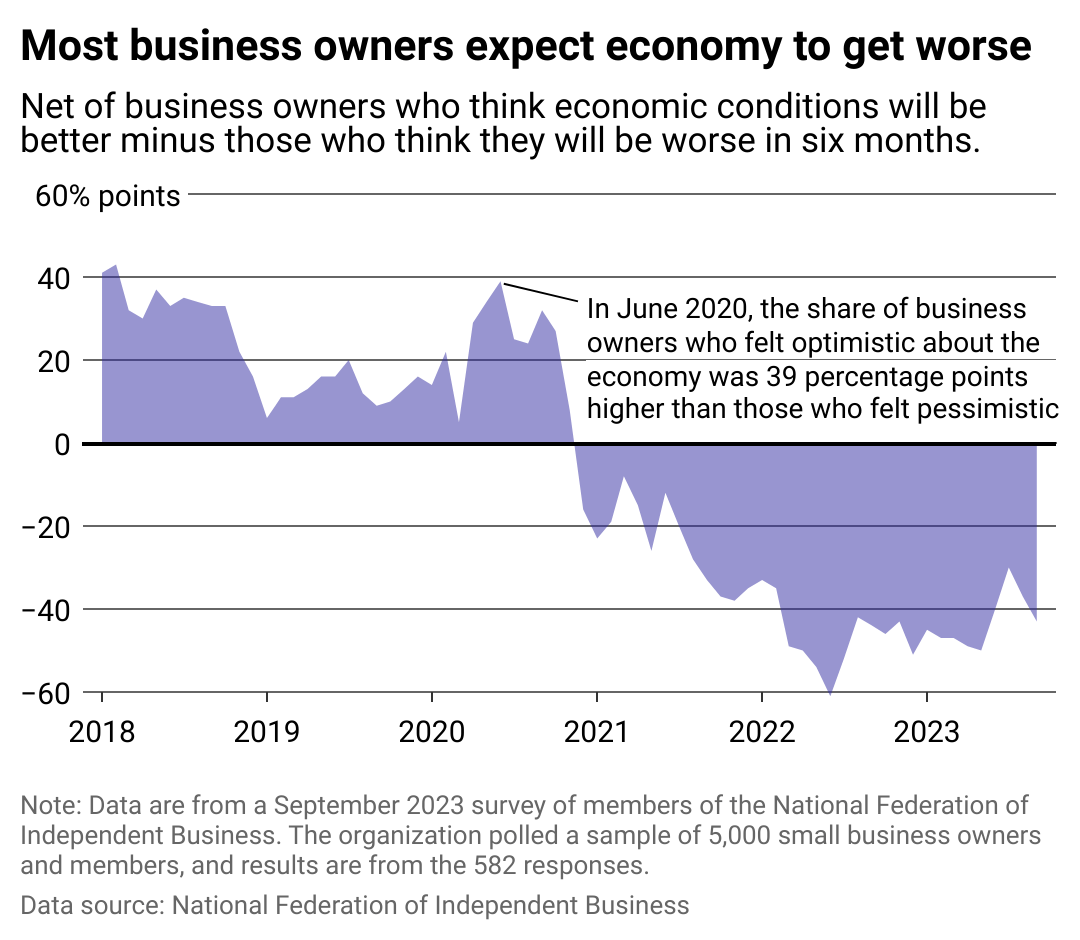

The data paints a grim picture. The latest survey by [insert specific survey name and source] revealed a sharp drop in confidence, with a significant portion of small business owners expressing pessimism about the future. This downturn is driven by a confluence of factors, including the worsening sales outlook and a growing belief that a “Main Street recession” is already underway.

While the term “Main Street recession” may not be officially recognized, it encapsulates the feeling among many small business owners that the economic downturn is impacting their communities directly, even if broader economic indicators suggest otherwise.

Small Business Confidence Plunge: Small Business Confidence Hits All Time Low On Worsening Sales Outlook And Belief On Main Street Recession Is Here

The latest economic indicators are painting a grim picture for small businesses across the country. Confidence among small business owners has hit an all-time low, driven by a worsening sales outlook and a growing belief that a “Main Street recession” is already underway.

This decline in confidence signals a significant shift in sentiment and raises concerns about the health of the broader economy.

The news about small business confidence hitting an all-time low due to worsening sales outlook and a widespread belief in a “Main Street Recession” is concerning. It’s a reminder that economic challenges often have a ripple effect, and while we’re grappling with these issues, it’s also important to address other critical matters like the lack of female representation in leadership positions, as highlighted by Margrethe Vestager’s recent criticism of the lack of effort in naming women commissioners – vestager slams capitals lack of efforts in naming women commissioners.

Addressing these broader issues is crucial for building a more resilient and inclusive economy, which in turn can help small businesses navigate the current turbulent landscape.

Factors Driving the Decline

The decline in small business confidence can be attributed to several factors, including:

- Worsening Sales Outlook:The National Federation of Independent Business (NFIB) Small Business Optimism Index, a key gauge of small business sentiment, has plummeted in recent months. The index fell to 89.8 in June 2023, the lowest level since the early days of the COVID-19 pandemic.

This decline is primarily driven by a sharp drop in expectations for future sales, reflecting growing concerns about consumer spending and economic uncertainty.

- Inflation and Rising Costs:Soaring inflation continues to be a major headache for small businesses, eroding profit margins and making it challenging to maintain affordability for customers. The NFIB survey found that 42% of small businesses reported higher costs for raw materials, while 27% reported higher costs for labor.

The news of small business confidence hitting an all-time low, fueled by worsening sales outlooks and the belief that a “main street recession” is upon us, is a stark reminder of the tough times many businesses are facing. While this economic climate is challenging, there are bright spots, like the potential for California to transform how fast food workers are treated, as outlined in this article california could transform how fast food workers are treated.

This kind of forward-thinking legislation could inspire a ripple effect across the country, ultimately impacting the very fabric of our economy, hopefully offering a glimmer of hope amidst the current economic uncertainty.

These increased costs are making it difficult for small businesses to pass along price increases to consumers without impacting demand.

- Supply Chain Disruptions:Ongoing supply chain disruptions continue to create challenges for small businesses, leading to delays in deliveries, higher inventory costs, and difficulty obtaining essential materials. These disruptions are exacerbating inflationary pressures and making it difficult for small businesses to operate efficiently.

It’s tough out there for small businesses right now. The latest data shows confidence plummeting, fueled by a worsening sales outlook and a widespread belief that a “main street recession” is already upon us. This economic uncertainty, coupled with the recent news that a watchdog took months to report missing Secret Service texts draft shows watchdog took months to report missing secret service texts , doesn’t exactly inspire optimism for the future.

It’s a stark reminder that we’re facing a complex web of challenges, and small businesses are bearing the brunt of it all.

- Labor Shortages:The tight labor market continues to pose a challenge for small businesses, with many struggling to find and retain qualified employees. This labor shortage is driving up wages, further increasing costs for small businesses.

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes are making it more expensive for small businesses to borrow money, potentially hindering investment and expansion plans.

The “Main Street Recession”

The term “Main Street recession” refers to a situation where small businesses are experiencing a downturn while the overall economy appears to be doing relatively well. While the national unemployment rate remains low and the stock market has shown some resilience, small businesses are facing a different reality.

Many are reporting declining sales, rising costs, and difficulty hiring, creating a sense of economic distress that is not reflected in broader macroeconomic indicators.

“The ‘Main Street recession’ is a real phenomenon, and it’s having a significant impact on small businesses across the country,” said [insert name], [insert title], [insert organization]. “The combination of inflation, rising costs, and supply chain disruptions is making it incredibly difficult for small businesses to thrive.”

Comparison to Previous Periods of Uncertainty, Small business confidence hits all time low on worsening sales outlook and belief on main street recession is here

The current economic climate bears some resemblance to previous periods of uncertainty, such as the Great Recession of 2008-2009. However, there are also some unique challenges faced by small businesses today.

- The COVID-19 Pandemic:The COVID-19 pandemic had a profound impact on small businesses, forcing many to close temporarily or permanently. While the economy has recovered from the pandemic, many small businesses are still struggling to regain their footing. The pandemic also accelerated the adoption of e-commerce and digital technologies, creating new challenges and opportunities for small businesses.

- Geopolitical Uncertainty:The ongoing war in Ukraine and heightened geopolitical tensions are creating economic uncertainty and volatility, impacting supply chains and energy prices. These factors are making it difficult for small businesses to plan for the future.

Worsening Sales Outlook

The declining sales outlook for small businesses is a significant concern, reflecting a confluence of factors that are collectively squeezing profit margins and dampening economic growth. This downturn is not merely a result of a single factor but rather a complex interplay of economic forces that are impacting businesses across various sectors.

Rising Inflation

Inflation is a major driver of the deteriorating sales outlook. The persistent rise in prices for goods and services, particularly for essential items, has eroded consumer purchasing power, leading to a decrease in discretionary spending. This means consumers are spending less on non-essential items, which often make up a significant portion of small business revenue.

For example, rising food and fuel prices have forced consumers to prioritize essential expenses, leading to a decline in demand for discretionary goods and services, such as restaurant meals, entertainment, and travel.

“Main Street Recession” Fears

The recent decline in small business confidence is fueled by a growing sentiment that a recession is already impacting local communities. This sentiment is reflected in the increasing use of the term “Main Street recession,” a term that highlights the distinct challenges faced by small businesses and their communities compared to the broader economy.

The “Main Street Recession”

The “Main Street recession” is a term used to describe a situation where small businesses and local communities experience economic hardship, while the overall economy may not be in a recession. This can occur due to factors like:* Regional economic downturns:Certain industries or regions may experience a downturn, impacting local businesses even if the national economy is strong.

Rising inflation

Inflation can disproportionately impact small businesses, as they often have less flexibility to raise prices or absorb increased costs.

Supply chain disruptions

Disruptions to supply chains can make it difficult for small businesses to obtain the goods and services they need, leading to higher costs and reduced sales.These factors can have a significant impact on small businesses, leading to:* Reduced sales:As consumers tighten their belts, small businesses may experience a decline in sales, leading to lower profits.

Increased costs

Rising prices for raw materials, labor, and other inputs can squeeze profit margins.

Difficulty accessing capital

Banks may be less willing to lend to small businesses during times of economic uncertainty, making it difficult to invest in growth or even stay afloat.

Economic Indicators Fueling Fears

Several economic indicators are fueling fears of a “Main Street recession,” including:

- Rising inflation:Inflation has reached its highest levels in decades, eroding consumer purchasing power and forcing small businesses to raise prices, which can lead to lower sales. For example, the Consumer Price Index (CPI) rose 8.5% in March 2023, the highest level in over 40 years.

This increase in prices has put pressure on small businesses to raise their own prices, potentially leading to a decline in sales.

- Supply chain disruptions:The ongoing global supply chain disruptions have made it difficult for small businesses to obtain the goods and services they need, leading to higher costs and reduced sales. For example, the ongoing semiconductor shortage has impacted the production of many goods, including automobiles, leading to higher prices and reduced availability.

- Rising interest rates:The Federal Reserve has raised interest rates several times in recent months in an attempt to curb inflation. This has made it more expensive for small businesses to borrow money, which can hinder investment and growth. For example, the Federal Reserve’s benchmark interest rate has risen from near zero in early 2022 to 4.50% in early 2023, the highest level in over 15 years.

This increase in borrowing costs has made it more difficult for small businesses to access capital, which is essential for investment and growth.

These indicators suggest that the economic environment for small businesses is becoming increasingly challenging, and the fear of a “Main Street recession” is a valid concern.