Your Ultimate Best Practices to Buy Bitcoins: A Guide for Beginners

Your ultimate best practices to buy bitcoins takes center stage, and this guide will take you through the essential steps to enter the exciting world of cryptocurrency. From understanding the basics of Bitcoin to securing your digital assets, we’ll cover everything you need to know to make informed decisions and navigate the world of Bitcoin confidently.

This comprehensive guide will demystify the process of buying Bitcoin, making it accessible to everyone, regardless of their technical expertise. We’ll explore the different platforms and methods for acquiring Bitcoin, emphasizing the importance of security and risk management. Whether you’re a seasoned investor or a curious newcomer, this guide will equip you with the knowledge and tools to embark on your Bitcoin journey with confidence.

Understanding Bitcoin and its Value

Bitcoin is a decentralized digital currency that has gained immense popularity in recent years. Understanding its core principles and the factors that influence its value is crucial for anyone considering investing in it.

Bitcoin’s Decentralized Nature

Bitcoin operates on a decentralized network, meaning it is not controlled by any single entity like a government or financial institution. Transactions are verified and recorded on a public ledger called the blockchain, which is maintained by a network of computers.

This decentralized structure eliminates the need for intermediaries and provides greater transparency and security.

Factors Influencing Bitcoin’s Price Volatility

Bitcoin’s price is known for its volatility, experiencing significant fluctuations in value. Several factors contribute to this volatility, including:

- Supply and Demand:Like any other asset, Bitcoin’s price is influenced by the balance between supply and demand. Increased demand from investors and traders can drive prices up, while decreased demand can lead to price drops.

- Media Coverage and Public Perception:Positive news and media attention can boost Bitcoin’s popularity and drive up its price, while negative news or regulatory concerns can have the opposite effect.

- Adoption and Use Cases:As more businesses and individuals adopt Bitcoin for payments and transactions, its value is likely to increase. Conversely, limited adoption can limit price growth.

- Regulatory Landscape:Government regulations and policies concerning Bitcoin can have a significant impact on its price. Favorable regulations can create a more stable and predictable environment for Bitcoin, while stricter regulations can create uncertainty and hinder price growth.

- Technological Developments:Advancements in blockchain technology and Bitcoin’s infrastructure can positively impact its value. However, security vulnerabilities or technical issues can negatively affect its price.

Real-World Use Cases for Bitcoin

Bitcoin’s use cases are expanding beyond just a speculative investment. Here are some examples:

- Payments:Bitcoin can be used for online and offline payments, offering a faster and cheaper alternative to traditional payment methods, especially for cross-border transactions.

- Remittances:Bitcoin can facilitate faster and more cost-effective remittances compared to traditional methods, particularly for sending money to countries with limited banking infrastructure.

- Investments:Bitcoin is considered a store of value and a hedge against inflation by some investors, making it a potential alternative to traditional investments like gold.

- Micropayments:Bitcoin’s small transaction fees make it suitable for micropayments, enabling small-value transactions that are not feasible with traditional payment methods.

- Decentralized Finance (DeFi):Bitcoin is being integrated into decentralized finance applications, enabling users to access financial services without relying on traditional intermediaries.

Choosing a Bitcoin Exchange: Your Ultimate Best Practices To Buy Bitcoins

Once you’ve grasped the fundamentals of Bitcoin, the next step is to select a reliable platform to buy, sell, and store your digital assets. Navigating the world of Bitcoin exchanges can be overwhelming, given the sheer number of options available.

This section will guide you through the process of choosing a suitable exchange, comparing various factors, and highlighting the advantages and disadvantages of different exchange types.

Comparing Bitcoin Exchanges

Choosing the right Bitcoin exchange is crucial for a smooth and secure trading experience. Here’s a breakdown of key factors to consider:

Fees

Fees are a significant aspect of any exchange, and Bitcoin exchanges are no exception. Different exchanges charge varying fees for trading, deposits, and withdrawals.

When it comes to buying Bitcoin, security and reliability are paramount. I always recommend using a reputable exchange with strong security measures and a good track record. Just like how Jackson, Mississippi ran out of water due to infrastructure issues, a lack of proper infrastructure and security can lead to serious problems in the crypto world.

So, choose your exchange wisely and keep your Bitcoin safe!

- Trading Fees:These are charged on every buy or sell order you place. They are typically expressed as a percentage of the transaction value. Some exchanges may also have maker-taker fees, where you receive a discount for providing liquidity to the market (making orders) or pay a higher fee for taking existing orders.

- Deposit Fees:Some exchanges charge fees for depositing funds, usually a fixed amount or a percentage of the deposit. Others offer free deposits for certain payment methods.

- Withdrawal Fees:Withdrawal fees are charged when you transfer your Bitcoin from the exchange to a personal wallet. These fees vary depending on the exchange and the withdrawal method used.

It’s important to compare the fee structures of different exchanges to find one that offers competitive rates and aligns with your trading volume and frequency.

Security Features

Security is paramount when dealing with cryptocurrencies, as they are susceptible to hacking and theft. Look for exchanges that prioritize security measures such as:

- Two-Factor Authentication (2FA):This adds an extra layer of security by requiring a second verification step, usually a code sent to your phone or email, in addition to your password.

- Cold Storage:A significant portion of an exchange’s Bitcoin should be stored offline in cold wallets, making it inaccessible to hackers.

- Encryption:Exchanges should employ strong encryption protocols to protect user data and transactions.

- Regular Security Audits:Reputable exchanges undergo regular security audits to identify and address vulnerabilities.

User Interface

A user-friendly interface is essential for a smooth and enjoyable trading experience. Consider the following aspects:

- Ease of Navigation:The platform should be intuitive and easy to navigate, allowing you to quickly find the features you need.

- Order Placement:The order placement process should be straightforward, allowing you to easily set buy and sell orders with various parameters.

- Mobile App:A mobile app can provide convenience for checking your portfolio and placing orders on the go.

- Customer Support:A responsive and helpful customer support team is essential for resolving any issues or answering your questions.

Choosing a Reputable Exchange

Selecting a reputable Bitcoin exchange is crucial for protecting your funds and ensuring a safe trading environment. Here are some tips:

- Research and Reviews:Read reviews from other users on reputable websites and forums to gain insights into the exchange’s reliability, security, and customer service.

- Check Regulations:Look for exchanges that are licensed and regulated by financial authorities in their respective jurisdictions. This indicates a higher level of compliance and accountability.

- Security Features:As discussed earlier, prioritize exchanges with robust security features like 2FA, cold storage, and encryption.

- Customer Support:Check the exchange’s customer support channels and response times. A responsive and helpful support team is essential for resolving any issues.

- Reputation:Choose exchanges with a good track record and a positive reputation in the cryptocurrency community.

Centralized vs. Decentralized Exchanges

Bitcoin exchanges can be categorized as centralized or decentralized. Each type has its advantages and disadvantages:

Centralized Exchanges

- Advantages:Centralized exchanges are typically user-friendly, offer a wide range of trading pairs, and often have higher liquidity. They also provide features like order books and charts for advanced trading.

- Disadvantages:Centralized exchanges are more susceptible to security breaches and hacks. They also have the potential for regulatory issues and may require KYC (Know Your Customer) verification, which some users may find intrusive.

Decentralized Exchanges (DEXs)

- Advantages:DEXs are considered more secure as they eliminate the need for a central authority, reducing the risk of hacks. They also offer greater privacy as they do not require KYC verification.

- Disadvantages:DEXs can be more complex to use and may have lower liquidity compared to centralized exchanges. They may also have higher fees and slower transaction speeds.

Setting Up Your Bitcoin Wallet

A Bitcoin wallet is essential for storing, sending, and receiving Bitcoin. It’s not a physical wallet containing coins; instead, it’s a software program that manages your private keys, which are the unique codes that give you control over your Bitcoin.There are various types of Bitcoin wallets, each with its advantages and disadvantages.

Choosing the right wallet depends on your security needs, convenience preferences, and technical expertise.

Types of Bitcoin Wallets

Bitcoin wallets can be categorized into three main types:

- Hardware wallets: These are physical devices that store your private keys offline, making them highly secure. They are generally considered the most secure option, as they are not susceptible to malware or hacking. However, they can be more expensive and less convenient to use than other types of wallets.

- Software wallets: These are applications that run on your computer, smartphone, or tablet. They are more convenient than hardware wallets, but they are also more vulnerable to security risks, such as malware or hacking. Software wallets can be further categorized into desktop wallets, mobile wallets, and web wallets.

- Paper wallets: These are physical pieces of paper containing your private keys, printed as a QR code or text. They are considered very secure, as they are offline and not accessible to hackers. However, they are prone to damage or loss, and they require careful storage and handling.

Choosing a Bitcoin Wallet

When choosing a Bitcoin wallet, consider the following factors:

- Security: The most important factor is security. Hardware wallets are generally the most secure option, followed by paper wallets and software wallets.

- Convenience: Software wallets are the most convenient option, as they can be accessed from anywhere with an internet connection. However, they are also the most vulnerable to security risks.

- Features: Different wallets offer different features, such as the ability to send and receive Bitcoin, exchange Bitcoin for other cryptocurrencies, or manage multiple wallets. Choose a wallet that meets your needs.

- Reputation: Choose a wallet from a reputable provider with a good track record. Read reviews and research the provider before choosing a wallet.

Creating a Secure Bitcoin Wallet

Once you’ve chosen a Bitcoin wallet, it’s important to create it securely. Here are some tips:

- Choose a strong password: Your password should be at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols.

- Enable two-factor authentication (2FA): This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password.

- Store your private keys securely: Your private keys are the most important part of your Bitcoin wallet. Never share them with anyone, and store them in a safe place.

You should back up your private keys in multiple locations, such as on a USB drive, in a cloud storage service, or written down on paper.

- Be aware of phishing scams: Phishing scams are a common way for hackers to steal Bitcoin. Be careful about clicking on links in emails or websites, and never enter your private keys on suspicious websites.

Buying Bitcoin

Now that you’ve chosen an exchange and set up a wallet, it’s time to buy some Bitcoin! This is where the magic happens, and you’ll finally own a piece of the decentralized future. But before you dive in, let’s explore the various ways to purchase Bitcoin and the steps involved.

Buying Bitcoin can feel like navigating a border crossing – it’s a journey with its own rules and challenges. It’s crucial to choose a reputable exchange, like Coinbase , and always prioritize security. Just as border crossings have fluctuating traffic patterns, the Bitcoin market is dynamic, so understanding its trends and choosing the right time to enter is key to maximizing your investment.

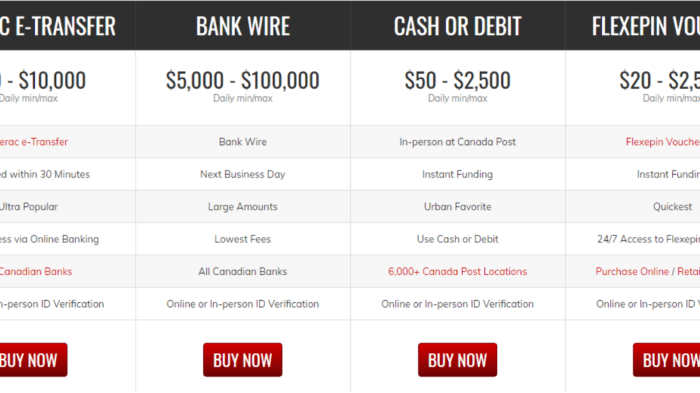

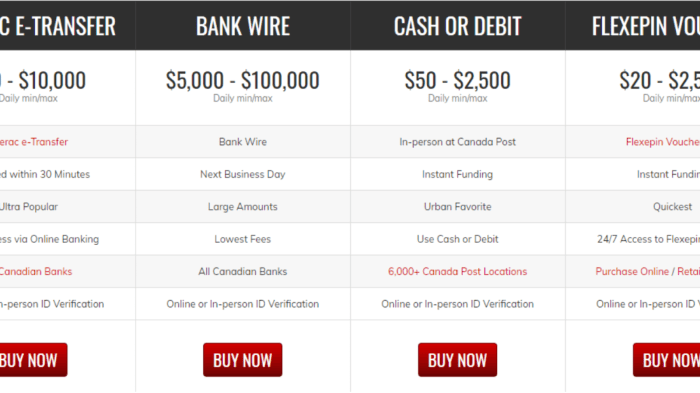

Methods of Buying Bitcoin

There are several common methods for acquiring Bitcoin, each with its own advantages and disadvantages. Understanding these options will help you choose the best method for your needs.

- Cryptocurrency Exchanges:These platforms allow you to buy, sell, and trade cryptocurrencies, including Bitcoin. They typically offer a wide range of payment methods, such as bank transfers, credit cards, and even other cryptocurrencies. Popular exchanges include Coinbase, Binance, and Kraken.

- Peer-to-Peer (P2P) Platforms:P2P platforms connect buyers and sellers directly, allowing you to purchase Bitcoin from individuals. These platforms often offer more competitive prices but may require more caution regarding security and trust.

- Bitcoin ATMs:These machines allow you to buy Bitcoin using cash. They are convenient for those who prefer not to use online platforms but may have higher fees and limited availability.

Buying Bitcoin on an Exchange

Let’s walk through the process of buying Bitcoin on a cryptocurrency exchange, using Coinbase as an example.

- Create an Account:If you haven’t already, create an account on the chosen exchange. You’ll need to provide personal information and verify your identity.

- Fund Your Account:Choose your preferred payment method (e.g., bank transfer, credit card) and deposit funds into your exchange account.

- Buy Bitcoin:Navigate to the Bitcoin trading section of the exchange and enter the amount of Bitcoin you want to purchase. Confirm the transaction, and your Bitcoin will be credited to your exchange wallet.

Transferring Bitcoin to Your Wallet

Once you’ve purchased Bitcoin on an exchange, it’s crucial to transfer it to your own personal wallet for greater security and control. Here’s how:

- Generate a Bitcoin Address:Your wallet will have a unique Bitcoin address, similar to a bank account number. This address is where you’ll receive your Bitcoin.

- Initiate the Transfer:On the exchange, navigate to your Bitcoin holdings and select the “withdraw” or “transfer” option. Enter your Bitcoin address and the amount you wish to transfer.

- Confirm the Transaction:Review the details of the transaction and confirm it. The transfer process may take some time, depending on the network’s congestion.

Security Best Practices

Securing your Bitcoin is paramount. Just like you’d safeguard your physical cash, you need robust measures to protect your digital assets from theft and unauthorized access. This section will delve into essential security practices to ensure your Bitcoin remains safe.

Strong Passwords and Two-Factor Authentication

A strong password is the first line of defense. Avoid using common words, birthdates, or easily guessable combinations. Instead, opt for a complex password that includes uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to generate and store these strong passwords securely.

Two-factor authentication (2FA) adds an extra layer of security. After entering your password, you’ll receive a code on your phone or email, which you must enter to confirm your identity. This makes it significantly harder for unauthorized individuals to access your account, even if they obtain your password.

Protecting Your Bitcoin Wallet, Your ultimate best practices to buy bitcoins

Your Bitcoin wallet is where you store your private keys, which are crucial for accessing and controlling your Bitcoin. Safeguarding your wallet is essential. Here are some strategies to protect it from theft and hacking:

- Use a Hardware Wallet:Hardware wallets are physical devices that store your private keys offline, making them highly secure. They are considered the most secure option for storing large amounts of Bitcoin. Examples include Ledger Nano S and Trezor.

- Choose a Reputable Software Wallet:If you prefer a software wallet, select one from a reputable provider with a proven track record of security. Consider using a wallet that supports multi-signature transactions, requiring multiple confirmations before any Bitcoin can be moved.

- Back Up Your Wallet:Regularly back up your wallet’s private keys in a safe and secure location. This backup allows you to recover your Bitcoin if your wallet is lost or damaged.

- Be Wary of Phishing Scams:Be cautious of suspicious emails, links, or messages that ask for your wallet details or private keys. Never share this information with anyone.

- Keep Your Software Updated:Regularly update your software wallet to benefit from the latest security patches and bug fixes.

Common Bitcoin Security Threats and Mitigation Techniques

Understanding common threats and implementing appropriate mitigation techniques can significantly reduce the risk of losing your Bitcoin.

| Threat | Mitigation Technique |

|---|---|

| Phishing Scams | Verify the authenticity of emails and websites before clicking on links or providing sensitive information. Use reputable exchanges and wallets. |

| Malware Attacks | Install reputable antivirus software and keep it updated. Avoid downloading software from untrusted sources. |

| Key Compromise | Use strong passwords and two-factor authentication. Securely store your private keys. |

| Exchange Hacks | Choose exchanges with robust security measures and a good track record. Consider using cold storage for significant amounts of Bitcoin. |

| Social Engineering | Be wary of unsolicited requests for personal information or financial details. Never share your private keys or passwords with anyone. |

Understanding Bitcoin Fees

Bitcoin transaction fees are an essential part of the Bitcoin network, as they incentivize miners to process and validate transactions. Understanding how these fees work and how to manage them is crucial for efficient Bitcoin buying and selling.

Bitcoin Transaction Fees Explained

Bitcoin transaction fees are paid to miners who verify and add transactions to the Bitcoin blockchain. These fees are not fixed and vary based on the network’s congestion and the urgency of the transaction. The higher the fee, the faster your transaction will be processed.

Bitcoin transaction fees are a dynamic mechanism that helps ensure the smooth operation of the Bitcoin network.

Fees Associated with Different Exchanges and Wallets

Bitcoin exchanges and wallets typically charge fees for transactions. These fees can vary significantly, so it’s essential to compare them before choosing a platform.

Exchanges

- Trading Fees:Exchanges charge fees for buying and selling Bitcoin. These fees are usually expressed as a percentage of the transaction amount.

- Withdrawal Fees:Exchanges also charge fees for withdrawing Bitcoin to your wallet. These fees are usually fixed, and they can vary depending on the exchange.

Wallets

- Transaction Fees:Bitcoin wallets usually allow you to set your own transaction fees. The higher the fee, the faster your transaction will be confirmed.

Tips for Minimizing Transaction Fees

- Choose the Right Time to Trade:During periods of low network activity, transaction fees are typically lower. Avoid trading during peak hours or when the network is congested.

- Use a Wallet with Low Fees:Some wallets have lower transaction fees than others. Research and compare wallets before choosing one.

- Set Your Own Fees:When sending Bitcoin from your wallet, you can set your own transaction fee. Set a fee that is high enough to ensure your transaction is processed promptly but not so high that it eats into your profits.

Storing Your Bitcoin

Now that you’ve purchased Bitcoin, the next crucial step is securing it. Just like you wouldn’t leave cash lying around, you need to choose a safe and reliable method to store your Bitcoin. This decision depends on your individual needs, risk tolerance, and how often you plan to access your funds.

Online Storage (Hot Wallets)

Online storage, also known as “hot wallets,” refers to storing your Bitcoin digitally on a device connected to the internet. This method offers convenience and accessibility, allowing you to quickly buy, sell, or spend your Bitcoin. However, it comes with inherent security risks.

Advantages of Online Storage

- Accessibility:Online wallets allow you to easily access and manage your Bitcoin from anywhere with an internet connection.

- Convenience:They are user-friendly and integrate well with online platforms for trading and spending.

- Speed:Transactions are typically processed faster than offline storage methods.

Disadvantages of Online Storage

- Security Risks:Online wallets are susceptible to hacking, phishing scams, and malware attacks, making them vulnerable to theft.

- Exchange Dependence:Many online wallets are associated with specific exchanges, which can limit your choices and expose you to the exchange’s security risks.

- Vulnerability to Loss:If you lose access to your online wallet due to forgotten passwords or device failure, your Bitcoin could be irretrievable.

Offline Storage (Cold Storage)

Offline storage, also known as “cold storage,” involves storing your Bitcoin on a device that is not connected to the internet. This method offers a significantly higher level of security by isolating your Bitcoin from potential online threats.

Advantages of Offline Storage

- Enhanced Security:Offline storage significantly reduces the risk of hacking and other online threats, making it the most secure storage option.

- Long-Term Security:Offline storage is ideal for holding Bitcoin for the long term, as it minimizes the risk of loss or theft.

- Independent Control:You have complete control over your Bitcoin, as it is not stored on any third-party platform.

Disadvantages of Offline Storage

- Accessibility:Offline storage requires a physical device, making it less convenient for frequent transactions.

- Complexity:Setting up and using cold storage methods can be more complex than online wallets.

- Risk of Loss:If you lose or damage your offline storage device, your Bitcoin could be lost forever.

Secure Storage Solutions

Hardware Wallets

Hardware wallets are physical devices that store your Bitcoin offline, providing a high level of security. These devices typically have a small screen and buttons for navigating menus and confirming transactions.

“Hardware wallets are considered the most secure method for storing Bitcoin, as they keep your private keys offline and physically protected.”

Paper Wallets

Paper wallets involve printing your Bitcoin private keys and addresses on a piece of paper. This method offers a simple and secure way to store your Bitcoin offline, but it requires careful handling and storage to prevent loss or damage.

When it comes to buying Bitcoin, security and diversification are key. I always recommend using a reputable exchange with strong security features, and splitting your holdings across multiple wallets. While I’m busy securing my crypto, it’s fascinating to see how the war in Ukraine is dismantling the last vestiges of the Soviet Union, as analyzed in this compelling article analysis russias war in ukraine is how the soviet union finally ends.

Ultimately, your best practices for buying Bitcoin should reflect your individual risk tolerance and financial goals.

“Paper wallets are a good option for long-term storage, as they are relatively inexpensive and easy to create.”

Bitcoin Storage Methods Comparison

| Storage Method | Advantages | Disadvantages |

|---|---|---|

| Online Wallets (Hot Wallets) | Accessibility, convenience, speed | Security risks, exchange dependence, vulnerability to loss |

| Offline Wallets (Cold Storage) | Enhanced security, long-term security, independent control | Accessibility, complexity, risk of loss |

| Hardware Wallets | High security, user-friendly, portability | Cost, potential for device failure |

| Paper Wallets | High security, low cost, simplicity | Risk of loss or damage, lack of portability |

Investing in Bitcoin

Investing in Bitcoin can be a complex and exciting venture. It’s important to approach it strategically, understanding the risks and potential rewards. This section delves into key strategies and considerations for investing in Bitcoin.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This strategy helps mitigate risk by reducing the impact of market volatility.When applied to Bitcoin, DCA involves purchasing a predetermined amount of Bitcoin at regular intervals, such as weekly or monthly.

By doing so, you buy more Bitcoin when the price is low and less when the price is high, averaging out your purchase price over time.

DCA can help reduce the emotional impact of market fluctuations, as you’re not trying to time the market.

Diversifying Your Investment Portfolio

Diversification is a fundamental principle of investing that involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and cryptocurrencies. This helps reduce overall risk by minimizing the impact of any single investment’s performance on your portfolio.When it comes to Bitcoin, it’s essential to consider its role within your overall investment strategy.

Bitcoin’s price can be volatile, and it’s not a suitable investment for everyone. Diversifying your portfolio with other asset classes can help mitigate this risk.

Diversification is key to managing risk and ensuring a balanced investment portfolio.

Setting Realistic Investment Goals and Managing Risk

Before investing in Bitcoin, it’s crucial to establish clear investment goals and understand the associated risks. Consider factors such as your risk tolerance, investment horizon, and financial goals.

- Risk Tolerance:How comfortable are you with potential losses? Bitcoin is a volatile asset, and its price can fluctuate significantly.

- Investment Horizon:How long do you plan to hold your Bitcoin investment? Bitcoin’s long-term potential is often discussed, but short-term price fluctuations can be substantial.

- Financial Goals:What are you hoping to achieve with your Bitcoin investment? Are you looking for short-term gains, long-term growth, or a hedge against inflation?

It’s also essential to manage risk by investing only what you can afford to lose. Don’t invest more than you can afford to lose, and avoid using borrowed money to invest in Bitcoin.

Investing in Bitcoin should be a well-considered decision based on your individual financial circumstances and risk tolerance.

Staying Informed About Bitcoin

Staying informed about Bitcoin is crucial for any investor, as it allows you to make informed decisions and navigate the ever-changing landscape of the cryptocurrency market. By staying updated on the latest news, trends, and developments, you can better understand the potential risks and rewards associated with investing in Bitcoin.

Reputable Sources for Bitcoin News and Market Trends

Staying informed about Bitcoin news and market trends is essential for making sound investment decisions. It helps you understand the current state of the market, identify potential opportunities, and mitigate risks. Here are some reputable sources for staying up-to-date on Bitcoin news and market trends:

- CoinDesk:A leading source for Bitcoin and cryptocurrency news, analysis, and insights. They offer a comprehensive range of articles, market data, and opinion pieces from industry experts.

- Cointelegraph:Another popular news platform covering the Bitcoin and cryptocurrency space. They provide in-depth reporting on industry events, regulatory developments, and technological advancements.

- Bitcoin Magazine:A well-respected publication dedicated to Bitcoin, focusing on its technology, history, and impact on the world.

- Bloomberg:A global financial news agency that provides coverage of Bitcoin and other cryptocurrencies, including market analysis and investment insights.

- Reuters:A global news agency offering comprehensive coverage of Bitcoin and the cryptocurrency market, including news, analysis, and data.

Educational Resources for Learning More About Bitcoin Technology

Understanding the underlying technology behind Bitcoin is essential for comprehending its value proposition and potential for growth. It helps you understand how Bitcoin works, its security features, and its potential impact on the future of finance.Here are some educational resources for learning more about Bitcoin technology:

- Bitcoin.org:The official website of Bitcoin, providing a comprehensive overview of its history, technology, and use cases.

- The Bitcoin Whitepaper:This seminal document, written by Satoshi Nakamoto, Artikels the technical details of Bitcoin and its decentralized nature.

- Andreas Antonopoulos’s “Mastering Bitcoin”:A comprehensive guide to Bitcoin technology, covering its history, technical aspects, and practical applications.

- Coursera:Offers online courses on Bitcoin and blockchain technology, providing in-depth knowledge from leading academics and industry experts.

- EdX:Another platform for online learning, offering courses on Bitcoin, blockchain, and related topics.

Community Forums and Social Media Groups for Bitcoin Discussions

Engaging with the Bitcoin community can provide valuable insights, perspectives, and opportunities to learn from others. It allows you to connect with like-minded individuals, share your experiences, and stay informed about the latest trends and discussions.Here are some community forums and social media groups for discussing Bitcoin-related topics:

- BitcoinTalk:A popular online forum for Bitcoin enthusiasts, where users can discuss various topics, share news, and engage in debates.

- Reddit’s r/Bitcoin:A subreddit dedicated to Bitcoin, providing a platform for news, discussions, and educational resources.

- Twitter:Follow influential figures and industry experts in the Bitcoin space for insights and updates.

- Telegram:Join Bitcoin-related groups and channels for real-time discussions and news updates.

- Discord:Several Bitcoin-focused Discord servers provide a platform for community discussions, events, and support.

Additional Resources

This section provides a curated list of resources to deepen your understanding of Bitcoin and the broader cryptocurrency landscape. Whether you’re a beginner or an experienced investor, these books, articles, websites, and communities can help you navigate the world of Bitcoin with confidence.

Recommended Books

Exploring Bitcoin-related literature can provide a comprehensive understanding of its history, technology, and potential impact. These books offer insightful perspectives from experts in the field:

- “The Bitcoin Standard: The Decentralized Alternative to Central Banking” by Saifedean Ammous:This book delves into the economic and philosophical underpinnings of Bitcoin, advocating for its potential as a sound money alternative.

- “Mastering Bitcoin: Unlocking Digital Cryptocurrencies” by Andreas Antonopoulos:A technical guide to Bitcoin, covering its core principles, cryptography, and practical applications.

- “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money” by Nathaniel Popper:A captivating narrative exploring the origins and evolution of Bitcoin, featuring interviews with key figures in the space.

Recommended Articles

Staying updated with the latest developments in Bitcoin requires access to reliable information. These articles offer valuable insights and perspectives:

- “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto:The original Bitcoin whitepaper, outlining its technical design and vision.

- “Why Bitcoin Matters” by Vijay Boyapati:A compelling essay exploring the economic and social implications of Bitcoin.

- “Bitcoin: The Future of Money?” by The Economist:A comprehensive analysis of Bitcoin’s potential and challenges.

Recommended Websites

Staying informed about Bitcoin and the broader cryptocurrency landscape requires access to reliable and informative websites. Here are some trusted resources:

- CoinDesk:A leading news platform covering the cryptocurrency industry, providing news, analysis, and market data.

- Bitcoin.org:The official website of Bitcoin, offering resources, documentation, and information for users and developers.

- Blockchain.com:A platform offering blockchain explorer tools, wallet services, and educational resources.

Bitcoin Communities and Forums

Engaging with the Bitcoin community can provide valuable insights, support, and networking opportunities. These forums and communities offer a space for discussion, learning, and collaboration:

- BitcoinTalk:A popular forum for Bitcoin discussions, news, and technical support.

- r/Bitcoin:A subreddit dedicated to Bitcoin, where users share news, analysis, and opinions.

- Bitcoin Stack Exchange:A question-and-answer platform for Bitcoin-related technical queries.

Bitcoin-Related Support Organizations

For assistance with specific Bitcoin-related issues, these organizations provide support and resources:

- Bitcoin Foundation:A non-profit organization dedicated to promoting Bitcoin and its adoption.

- Bitcoin Core Developers:The team responsible for maintaining and developing the Bitcoin software.

- Bitcoin.com:A website offering support resources, FAQs, and troubleshooting guides.