SoftBanks Shogun Has a Rare Moment of Contrition

Analysis softbanks shogun has a rare moment of contrition – SoftBank’s Shogun Has a Rare Moment of Contrition sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Masayoshi Son, the enigmatic leader of SoftBank, is known for his bold bets and audacious vision, but recently, a different side of the tech investor has emerged.

In a rare display of contrition, Son has acknowledged past missteps and Artikeld a shift in SoftBank’s investment strategy, prompting a wave of speculation about the future of the tech giant.

This shift in tone and approach has sent shockwaves through the tech industry, raising questions about the future of SoftBank’s investment strategy and the broader implications for the tech landscape. The “Vision Fund,” SoftBank’s flagship investment vehicle, has been a driving force in shaping the tech world, pouring billions into startups across various sectors.

However, the fund’s recent performance has been under scrutiny, prompting Son to acknowledge the need for a more cautious and disciplined approach.

SoftBank’s Recent Performance

SoftBank Group, the Japanese conglomerate, has experienced a tumultuous period in recent years, marked by both significant successes and notable setbacks. The company’s performance has been heavily influenced by its investments, particularly through its Vision Fund, a massive venture capital fund.

This analysis explores the recent financial performance of SoftBank, delves into the role of the Vision Fund, and examines the company’s current investment strategy.

It’s fascinating to see SoftBank’s “Shogun” having a rare moment of contrition. Perhaps the shift in the tech landscape, with the rise of AI and the remote work revolution already reshaping America , has forced a reevaluation of their strategies.

Maybe this introspection will lead to more responsible investments in the future, aligning with a more sustainable and ethical approach to technology.

Financial Performance

SoftBank’s recent financial performance has been characterized by volatility. While the company has reported significant profits in some quarters, it has also experienced substantial losses in others. This volatility is largely attributable to the performance of its investments, particularly those in the technology sector.

Here are some key financial metrics and trends:

- Revenue:SoftBank’s revenue has generally been on an upward trajectory, driven by growth in its telecommunications and technology businesses. However, revenue growth has slowed in recent quarters, reflecting the challenging economic environment and the performance of its investments.

- Profitability:SoftBank’s profitability has been highly volatile, with large swings in both net income and operating income. The company’s net income has been significantly impacted by the performance of its investments, with large gains in some quarters offset by substantial losses in others.

- Debt:SoftBank has a significant amount of debt, largely accumulated through its investment activities. The company’s debt levels have been a concern for investors, particularly in light of the recent performance of its investments.

Vision Fund

The Vision Fund is a key component of SoftBank’s portfolio, representing a significant portion of its assets under management. It has been a major driver of the company’s recent financial performance, but its performance has also been a source of volatility.

- Performance:The Vision Fund has generated significant returns in some of its investments, notably in companies like Alibaba and Coupang. However, it has also experienced substantial losses on other investments, particularly in the technology sector. The fund’s performance has been impacted by factors such as market volatility, changes in investor sentiment, and the performance of its portfolio companies.

- Investment Strategy:The Vision Fund has historically focused on investing in technology companies, particularly those in the areas of artificial intelligence, robotics, and e-commerce. The fund has been known for making large, early-stage investments in promising companies. However, the fund has faced criticism for its investment strategy, particularly in light of the recent performance of some of its portfolio companies.

Investment Strategy

SoftBank has made significant adjustments to its investment strategy in recent years, reflecting the challenges it has faced.

- Focus on Profitability:SoftBank has shifted its focus towards investments that generate more immediate profitability, rather than solely focusing on long-term growth. This shift is evident in the company’s recent investments in businesses like renewable energy and real estate.

- Diversification:SoftBank has also been diversifying its portfolio, reducing its exposure to the technology sector and expanding into other industries. This diversification strategy is aimed at mitigating risk and enhancing the company’s overall performance.

- Strategic Partnerships:SoftBank has been forming strategic partnerships with other investors, including government-backed funds, to share the risk and enhance the returns on its investments. These partnerships are aimed at providing access to new markets and opportunities.

The Significance of Contrition

In the cutthroat world of finance, where ambition often trumps humility, the expression of contrition is a rare and significant event. SoftBank’s recent admission of missteps in its investment strategy, marked by a sense of regret and a shift in approach, has sent shockwaves through the industry.

This unexpected turn of events begs the question: what makes SoftBank’s contrition so noteworthy?

SoftBank’s Contrition: A Shift in Mindset

Contrition, in the context of business, signifies a genuine acknowledgment of errors and a willingness to change course. It involves a deep reflection on past decisions, an understanding of their consequences, and a commitment to learn from mistakes. In SoftBank’s case, the expression of contrition reflects a fundamental shift in the company’s mindset, moving away from its previously aggressive and often controversial investment strategies.

It’s rare to see SoftBank’s Masayoshi Son express remorse, but his recent mea culpa regarding his investment strategy is a sign of the times. The tech sector is facing headwinds, and Son’s portfolio is feeling the strain. This shift in tone is particularly interesting in light of the recent crackdown on the accreditation agency ACICS, feds yank acics recognition add strict requirements on colleges it accredited , which highlights the growing scrutiny of institutions that operate outside of traditional norms.

Perhaps Son’s newfound humility is a reflection of the changing landscape, and a signal that he’s willing to adapt to a more cautious investment climate.

This change is driven by a recognition of the risks associated with its past ventures, particularly in the technology sector, and a desire to rebuild trust with investors and stakeholders.

The Impact of Contrition on SoftBank’s Future

SoftBank’s recent admission of mistakes and its shift towards a more cautious investment approach marks a significant turning point for the company. This newfound sense of contrition could have profound implications for SoftBank’s future investment decisions, its relationship with investors and stakeholders, and its overall trajectory.

Impact on Investment Decisions

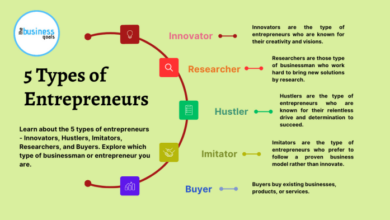

SoftBank’s contrition suggests a more deliberate and risk-averse approach to future investments. The company may now prioritize investments with a clearer path to profitability and a stronger track record of success. This shift could manifest in several ways:

- Focus on Mature Companies:SoftBank might favor investments in established companies with proven business models and a history of consistent performance, rather than high-growth startups with unproven potential. This approach aligns with the company’s stated goal of generating sustainable returns for its investors.

- Increased Due Diligence:SoftBank is likely to conduct more rigorous due diligence on potential investments, scrutinizing business plans, financial projections, and management teams more closely. This will involve a more thorough assessment of risks and potential downside scenarios.

- Reduced Leverage:SoftBank might reduce its reliance on debt financing, opting for a more conservative capital structure. This would limit its exposure to financial risk and allow for a more sustainable investment strategy.

Impact on Investors and Stakeholders

SoftBank’s contrition could lead to a renewed sense of trust and confidence among its investors and stakeholders. By acknowledging its past mistakes and demonstrating a commitment to a more responsible investment approach, SoftBank can rebuild credibility and attract new investors.

This could manifest in:

- Improved Investor Relations:SoftBank’s transparent communication and willingness to address concerns will likely foster better relationships with investors. This could translate into greater investor confidence and support for the company’s future initiatives.

- Enhanced Reputation:SoftBank’s shift towards a more responsible investment strategy could enhance its reputation as a reliable and trustworthy partner. This could attract new investors and strengthen its relationships with existing stakeholders.

- Increased Investment Flow:The renewed confidence in SoftBank’s investment approach could lead to increased investment flows, enabling the company to pursue new opportunities and expand its portfolio.

Challenges and Opportunities, Analysis softbanks shogun has a rare moment of contrition

Navigating this new phase will present both challenges and opportunities for SoftBank.

It’s refreshing to see Softbank’s Shogun exhibit a rare moment of contrition, acknowledging the need for a more balanced approach to investment. This reminds me of the staggering 192 billion gender gap in art , a stark reminder of the systemic biases that continue to hinder progress in various fields.

Perhaps Shogun’s newfound humility can inspire other industry giants to take a critical look at their own practices and work towards a more equitable future.

- Maintaining Growth:SoftBank’s shift towards a more conservative approach might impact its ability to maintain the rapid growth it has achieved in the past. This could require the company to adapt its investment strategy and explore new avenues for growth.

- Attracting Talent:SoftBank’s focus on mature companies and reduced leverage might make it less attractive to some entrepreneurs and startup founders. The company will need to find ways to attract and retain top talent in this new environment.

- Adapting to Market Dynamics:The technology sector is constantly evolving, and SoftBank will need to adapt its investment strategy to keep pace with these changes. This will require a proactive approach to identifying emerging trends and investing in promising new technologies.

The Broader Context of the Technology Industry: Analysis Softbanks Shogun Has A Rare Moment Of Contrition

The technology industry is a dynamic and rapidly evolving landscape, marked by continuous innovation, disruption, and fierce competition. Understanding the broader context of this industry is crucial to appreciating SoftBank’s recent performance and the significance of its shift towards a more cautious approach.

The Current Landscape of the Technology Industry

The technology industry is characterized by several key trends and challenges. One of the most significant trends is the rise of artificial intelligence (AI), which is transforming various sectors, from healthcare and finance to manufacturing and transportation. AI is enabling the development of new products and services, automating tasks, and improving efficiency.

Another major trend is the growth of cloud computing, which provides on-demand access to computing resources, storage, and software over the internet. Cloud computing has made it easier for businesses of all sizes to adopt new technologies and scale their operations.

However, the technology industry also faces several challenges. One of the biggest challenges is the increasing competition, with new players emerging and established companies constantly innovating to stay ahead of the curve. Another challenge is the need to address ethical concerns related to the use of AI and data privacy.

Additionally, the industry is facing pressure to become more sustainable and reduce its environmental impact.

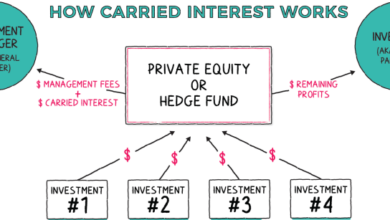

The Role of Venture Capital and Private Equity in the Technology Sector

Venture capital (VC) and private equity (PE) play a crucial role in the technology sector by providing funding to startups and growth-stage companies. VC firms typically invest in early-stage companies with high growth potential, while PE firms focus on more mature companies.

These investments help companies scale their operations, develop new products, and expand into new markets. The role of VC and PE has become increasingly important in the technology sector, as many companies are choosing to stay private for longer periods, raising large sums of money from private investors rather than going public through an initial public offering (IPO).

This trend has been fueled by the rise of technology giants like Amazon, Google, and Facebook, which have demonstrated the potential for long-term growth and profitability in the tech sector.

SoftBank’s Approach Compared to Other Major Players

SoftBank, under the leadership of Masayoshi Son, has been a major player in the technology investment space for decades. SoftBank’s approach has been characterized by its bold bets on emerging technologies and its willingness to invest heavily in companies with high growth potential.

The company has made significant investments in companies like Alibaba, Uber, and Coupang, many of which have become major players in their respective industries.SoftBank’s approach has been praised for its visionary perspective and its ability to identify future trends. However, it has also been criticized for its high-risk investment strategy and its tendency to overpay for companies.

Other major players in the technology investment space, such as Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins Caufield & Byers, have adopted a more cautious approach, focusing on investments in companies with strong fundamentals and proven business models.

“SoftBank’s investment strategy has been a double-edged sword. While it has generated significant returns for the company, it has also led to substantial losses in some cases.”

TechCrunch

SoftBank’s recent performance, including the significant losses it has incurred in its Vision Fund, has led to a shift in its approach. The company is now focusing on more conservative investments, seeking companies with strong fundamentals and proven business models.

This shift reflects the changing landscape of the technology industry, where investors are becoming more risk-averse and focusing on companies with a clear path to profitability.

Lessons Learned from SoftBank’s Experience

SoftBank’s recent performance and its expression of contrition provide valuable lessons for investors and businesses alike. This period of introspection reveals key insights into the dynamics of the technology industry and the importance of responsible investment strategies.

Key Lessons Learned from SoftBank’s Experience

The following table summarizes some of the key lessons learned from SoftBank’s recent performance and its expression of contrition:| Lesson | Description ||—————————————-|———————————————————————————————————————————————————————————————————————————————————————————–|| Over-reliance on Momentum Investing| SoftBank’s heavy investment in growth-oriented technology companies during a bull market led to overvaluation and potential losses when market sentiment shifted.

|| Risk Management and Due Diligence| The need for rigorous risk management and due diligence practices to ensure investments are sound and well-aligned with market conditions.

|| Portfolio Diversification| Diversifying investment portfolios across various sectors and asset classes can mitigate risk and enhance overall returns.

|| Long-Term Vision vs. Short-Term Gains| Focusing on long-term value creation and sustainable growth, rather than chasing short-term gains, can lead to more resilient and profitable investment strategies.

|| Transparency and Communication| Open and transparent communication with investors regarding investment strategies, risks, and performance is crucial for building trust and maintaining confidence.

|

Actionable Takeaways for Investors and Businesses

SoftBank’s experience offers valuable insights that can inform investment strategies and business practices:* Prioritize long-term value creation:Focus on investments that generate sustainable growth and contribute to the long-term success of the business.

Conduct thorough due diligence

Ensure investments are well-researched and aligned with market conditions, with a comprehensive understanding of potential risks.

Diversify investment portfolios

Spread investments across various sectors and asset classes to mitigate risk and enhance overall returns.

Embrace transparency and communication

Maintain open communication with stakeholders regarding investment strategies, risks, and performance to foster trust and confidence.

Adopt a balanced approach to growth

While pursuing growth is essential, it’s crucial to balance growth with risk management and responsible practices.

How SoftBank’s Experience Can Inform Future Investment Strategies

SoftBank’s experience highlights the importance of responsible investment strategies that prioritize long-term value creation, risk management, and transparency. By learning from SoftBank’s journey, investors and businesses can refine their investment strategies to navigate the complexities of the technology industry and achieve sustainable success.