Financing a New Car: Save Big with Good Credit

Financing a new car heres how much you can save thanks to a good or excellent credit score is a major financial decision, and your credit score plays a huge role in determining how much you’ll pay. A good credit score can unlock lower interest rates, resulting in significant savings over the life of your loan.

This means more money in your pocket and less stress about your monthly payments.

Think of it this way: your credit score is like a financial passport, and a good score gives you access to the best deals and terms. We’ll explore how credit scores impact car financing, strategies to improve your score, and the benefits of getting pre-approved before you even step foot in a dealership.

Understanding Credit Scores and Their Impact

Your credit score is a numerical representation of your creditworthiness, a key factor influencing your ability to borrow money, including financing a new car. A higher credit score indicates a lower risk for lenders, making you a more attractive borrower.

Understanding the nuances of credit scores and their impact on car financing is crucial for securing the best possible loan terms.

Credit Score Ranges and Significance, Financing a new car heres how much you can save thanks to a good or excellent credit score

Credit scores are typically categorized into different ranges, each with its own implications for car financing. Here’s a breakdown of common credit score ranges and their significance:

- Excellent (800+):This range represents the highest creditworthiness, allowing you to access the most favorable loan terms, including lower interest rates and potentially longer loan terms. This translates to significant savings over the life of the loan.

- Good (740-799):This range indicates strong creditworthiness, enabling you to secure good loan terms, but possibly not the absolute best. You’ll likely receive lower interest rates compared to those with lower scores, resulting in substantial savings.

- Fair (670-739):This range reflects average creditworthiness, which may lead to higher interest rates and potentially shorter loan terms. While you can still qualify for financing, the cost of borrowing might be higher.

- Poor (580-669):This range suggests a higher risk for lenders, leading to significantly higher interest rates and potentially limited loan options. You might face challenges securing financing, and if you do, the cost of borrowing could be considerably higher.

- Very Poor (300-579):This range indicates a very high risk for lenders, making it extremely difficult to secure financing. Even if you qualify, the interest rates and loan terms will be very unfavorable.

Benefits of a Good or Excellent Credit Score

Having a good or excellent credit score offers numerous advantages when financing a car:

- Lower Interest Rates:Lenders perceive borrowers with good or excellent credit as less risky, allowing them to offer lower interest rates. This translates to substantial savings over the life of the loan.

- Longer Loan Terms:A good credit score can qualify you for longer loan terms, which can lower your monthly payments. However, it’s important to consider the total interest paid over the loan’s duration.

- More Loan Options:Lenders are more likely to offer a wider range of loan options to borrowers with good or excellent credit, giving you greater flexibility in choosing a loan that suits your needs.

- Increased Approval Odds:Having a good credit score significantly increases your chances of loan approval, reducing the risk of rejection and delays.

Credit Score’s Impact on Interest Rates and Loan Terms

A credit score’s impact on interest rates and loan terms is substantial, directly influencing the overall cost of borrowing. Here are some real-life examples:

Example 1:A borrower with an excellent credit score of 800 might qualify for a car loan with a 3.5% interest rate, while a borrower with a fair credit score of 680 might receive a 7% interest rate. This difference in interest rates can lead to thousands of dollars in additional interest paid over the life of the loan.

Example 2:A borrower with a good credit score might be eligible for a 60-month loan term, while a borrower with a poor credit score might only qualify for a 36-month loan term. This difference in loan term can significantly impact monthly payments and the overall cost of borrowing.

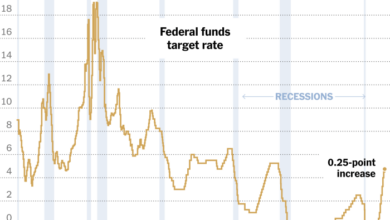

Saving money on your car loan is a big deal, especially with rising interest rates. A good or excellent credit score can save you hundreds or even thousands of dollars over the life of your loan. While you’re focused on your finances, it’s also worth keeping an eye on the political landscape.

The recent rally by Kamala Harris and Tim Walz in key battleground states, as reported in this article , highlights the importance of voting for candidates who support policies that benefit working families. Ultimately, both financial and political decisions can impact your future, so stay informed and make choices that work best for you.

The Power of a Good Credit Score in Car Financing

A good credit score can be your secret weapon when it comes to financing a new car. It’s not just about getting approved for a loan; it’s about securing the best possible terms, which can save you thousands of dollars over the life of your loan.

Lower Interest Rates and Monthly Payments

Lenders view borrowers with good credit scores as less risky. This translates to lower interest rates, which directly impact your monthly payments. Imagine financing a car with a 5% interest rate compared to a 7% rate; the difference in monthly payments can be significant, even for the same loan amount.

Potential Savings on Interest

Let’s explore the potential savings you can reap with a good credit score.

The higher your credit score, the lower your interest rate, and the less you pay in interest over the life of the loan.

For example, let’s consider a $30,000 car loan over 60 months.

| Credit Score Range | Estimated Interest Rate | Total Interest Paid |

|---|---|---|

| 670-739 (Good) | 5.00% | $4,500 |

| 740-799 (Very Good) | 4.50% | $3,800 |

| 800+ (Excellent) | 4.00% | $3,100 |

As you can see, a good credit score can save you thousands of dollars in interest alone.

Monthly Payment Differences

Here’s a table illustrating the potential monthly payment differences for various credit scores and loan amounts:

| Loan Amount | Credit Score Range | Estimated Interest Rate | Monthly Payment |

|---|---|---|---|

| $20,000 | 670-739 (Good) | 5.00% | $387 |

| $20,000 | 740-799 (Very Good) | 4.50% | $372 |

| $20,000 | 800+ (Excellent) | 4.00% | $358 |

| $30,000 | 670-739 (Good) | 5.00% | $581 |

| $30,000 | 740-799 (Very Good) | 4.50% | $558 |

| $30,000 | 800+ (Excellent) | 4.00% | $535 |

The difference in monthly payments might seem small at first, but it can add up to a substantial amount over the life of the loan.

Strategies to Improve Your Credit Score

Improving your credit score is a crucial step towards achieving your financial goals, especially when it comes to securing favorable loan terms for a new car. By understanding the key factors that influence your credit score and implementing effective strategies, you can significantly enhance your financial standing and unlock better financing options.

Paying Bills on Time

Paying your bills on time is one of the most significant factors contributing to your credit score. It demonstrates your financial responsibility and ability to manage debt effectively. Late payments can negatively impact your credit score, making it more challenging to secure loans with favorable interest rates.

- Set reminders for bill due dates and use online bill payment services for greater convenience and accuracy.

- Consider setting up automatic payments to ensure timely payments and avoid any potential late fees.

- If you are facing financial difficulties, reach out to your creditors to discuss payment options and potentially negotiate a payment plan.

Managing Credit Utilization

Credit utilization refers to the amount of credit you are using compared to your total available credit. Maintaining a low credit utilization ratio is essential for a healthy credit score. A high utilization ratio can indicate that you are heavily reliant on credit, which may raise concerns for lenders.

Getting a great interest rate on your new car loan is a game-changer, and a good or excellent credit score can really boost your savings. It’s like when Halle Berry, with her amazing acting career, had to face the internet’s jokes about her characters’ wigs in this article – she just owned it! So, focus on building your credit, and you’ll be driving off in your dream car with a smile on your face, just like Halle Berry, rocking her own style.

- Strive to keep your credit utilization ratio below 30%, ideally below 10% for optimal results.

- Pay down your credit card balances regularly to reduce your utilization ratio.

- Consider requesting a credit limit increase if you have a good payment history, as this can lower your utilization ratio without increasing your debt.

Avoiding Unnecessary Credit Inquiries

Each time a lender checks your credit history, it generates a hard inquiry, which can slightly lower your credit score. While hard inquiries are unavoidable when applying for credit, it’s important to minimize them by avoiding unnecessary applications.

- Avoid applying for multiple credit cards or loans simultaneously, as this can create a cluster of hard inquiries.

- Shop around for loan offers within a short timeframe, as most credit bureaus group multiple inquiries within a specific period as a single inquiry.

- Be cautious of pre-approved credit offers, as they often trigger a hard inquiry even if you don’t accept the offer.

The Benefits of Pre-Approval

Getting pre-approved for a car loan before you start shopping can be a smart move, especially in today’s competitive market. It empowers you with valuable insights and a strategic advantage in securing the best possible financing terms.

Understanding the Advantages of Pre-Approval

Pre-approval offers several key advantages that can significantly benefit your car buying experience. It essentially provides you with a loan commitment from a lender, outlining the interest rate and loan amount you qualify for. This pre-determined financing information empowers you to confidently negotiate with car dealerships and explore your options without the pressure of securing financing on the spot.

A good credit score can be a real game-changer when you’re financing a new car. You could save thousands on interest over the life of your loan, giving you more money to spend on other things, like, say, a fancy new cricket bat.

Speaking of which, it’s interesting to see how England’s stand-in captain Harry Brook is stepping up to the challenge in the Ashes series against Australia. As Nasser Hussain has pointed out, this is a great opportunity for Brook to showcase his leadership skills.

But back to that car loan, remember, a good credit score is a valuable asset, and it’s worth taking the time to build one up if you haven’t already.

Pre-Approval Helps Secure Better Rates and Terms

- Negotiating Power:Armed with a pre-approval, you can approach dealerships with a clear understanding of your financing capabilities. This strengthens your negotiating position, enabling you to confidently counter any offers that deviate from your pre-approved terms.

- Competitive Rates:By comparing offers from multiple lenders before pre-approval, you can secure the most competitive interest rates. This pre-approval process allows you to lock in a favorable rate, potentially saving you thousands of dollars over the life of your loan.

- Avoid Hidden Fees:Pre-approval helps you avoid unexpected surprises like last-minute financing fees or unfavorable terms that can arise when applying for a loan at the dealership. It ensures transparency and safeguards you from potential hidden costs.

Pre-Approval Streamlines the Car Buying Process

- Time Savings:Pre-approval streamlines the car buying process by eliminating the need for time-consuming loan applications at the dealership. This saves you valuable time and reduces the overall stress associated with the purchase.

- Enhanced Efficiency:With pre-approval in hand, you can focus on finding the right car without the distraction of securing financing. This allows you to efficiently compare vehicles and make informed decisions based on your budget and needs.

- Increased Confidence:Knowing your financing options beforehand empowers you to make confident decisions about your car purchase. It eliminates the uncertainty and pressure associated with last-minute financing arrangements.

Choosing the Right Loan: Financing A New Car Heres How Much You Can Save Thanks To A Good Or Excellent Credit Score

Securing a car loan is a crucial step in your car-buying journey. Understanding the different loan types available can help you make an informed decision that aligns with your financial goals and circumstances. Let’s explore the popular car loan options and their unique features.

Traditional Car Loans

Traditional car loans are the most common type of financing for vehicle purchases. These loans are offered by banks, credit unions, and online lenders. They provide a fixed interest rate and a set repayment period, allowing you to budget effectively.

Advantages

- Fixed interest rates offer predictable monthly payments, making budgeting easier.

- Longer loan terms are available, potentially resulting in lower monthly payments but higher overall interest costs.

- Traditional lenders often have more flexible eligibility requirements compared to other loan types.

Disadvantages

- Interest rates can be higher compared to other loan options, especially for borrowers with lower credit scores.

- Loan terms can be longer, leading to higher overall interest payments over the life of the loan.

Lease Financing

Leasing a car involves renting the vehicle for a set period, typically two to four years. At the end of the lease, you have the option to return the car, purchase it for a predetermined residual value, or lease a new vehicle.

Advantages

- Lower monthly payments compared to traditional loans, as you’re only paying for the depreciation of the vehicle during the lease period.

- Access to newer vehicles with advanced features, as you’re essentially driving a new car every few years.

- No need to worry about resale value as you return the vehicle at the end of the lease.

Disadvantages

- You don’t own the vehicle and are limited by mileage and wear-and-tear restrictions.

- You may face penalties for exceeding mileage limits or causing significant damage to the vehicle.

- At the end of the lease, you have limited options: return the vehicle, purchase it at the residual value, or lease a new one.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including car financing. These loans are offered by banks, credit unions, and online lenders.

Advantages

- Potentially lower interest rates compared to traditional car loans, especially for borrowers with excellent credit scores.

- Flexible repayment terms, allowing you to choose a loan term that suits your budget.

- No requirement to use the loan specifically for a car purchase, providing flexibility for other expenses.

Disadvantages

- Unsecured loans carry higher interest rates compared to secured loans, such as traditional car loans.

- Eligibility requirements can be stricter, especially for borrowers with lower credit scores.

- Personal loans may not offer the same protection as traditional car loans, which typically include a lien on the vehicle.

Loan Comparison Table

| Loan Type | Interest Rates | Loan Terms | Eligibility Requirements |

|---|---|---|---|

| Traditional Car Loans | Variable, based on credit score and market conditions | 2-7 years | Good credit score, proof of income, and a valid driver’s license |

| Lease Financing | Variable, based on the vehicle’s depreciation and market conditions | 2-4 years | Good credit score, proof of income, and a valid driver’s license |

| Personal Loans | Variable, based on credit score and market conditions | 1-7 years | Excellent credit score, proof of income, and a debt-to-income ratio below a certain threshold |

Negotiating the Best Deal

Securing a favorable car loan requires more than just having a good credit score. Negotiation plays a crucial role in securing the best possible terms, ensuring you get the most out of your financing. This involves strategizing to lower your interest rate, negotiate a favorable loan agreement, and ultimately get the best deal possible.

Negotiating a Lower Interest Rate

Negotiating a lower interest rate is a key aspect of securing a favorable car loan. Your credit score is a powerful tool in this process, but it’s not the only factor. Here’s how to leverage your credit score and other strategies to negotiate a lower interest rate:

- Shop Around for Rates:Before you even step foot in a dealership, compare rates from multiple lenders, including banks, credit unions, and online lenders. This allows you to see what’s available and have a benchmark for negotiations.

- Leverage Your Credit Score:A strong credit score is your strongest asset. Armed with a credit score report, highlight your excellent credit history and demonstrate your ability to manage debt responsibly. This builds confidence in the lender and can help you secure a lower rate.

- Pre-Approval for a Loan:Obtaining pre-approval for a car loan from a lender before you visit the dealership gives you a clear idea of your interest rate and terms. This puts you in a stronger position to negotiate, as you have a pre-approved rate to compare against the dealership’s offer.

- Negotiate at the End of the Month:Dealerships often have sales quotas to meet. Negotiating towards the end of the month, when sales are typically lower, might give you a better chance of getting a lower interest rate.

- Be Prepared to Walk Away:If the dealership isn’t willing to meet your expectations, don’t be afraid to walk away. This shows you’re serious about getting a good deal and might prompt them to reconsider their offer.

Negotiating a Favorable Loan Agreement

While a lower interest rate is important, it’s crucial to carefully review the loan agreement to ensure you’re getting the best deal possible. Here are some key aspects to negotiate:

- Loan Term:Consider the impact of the loan term on your monthly payments and overall interest costs. A shorter term might mean higher monthly payments, but you’ll pay less interest overall.

- Fees:Dealerships often charge various fees, such as loan origination fees, documentation fees, and dealer markup. Negotiate to have these fees reduced or waived.

- Prepayment Penalty:Avoid loan agreements with prepayment penalties, which can hinder your ability to pay off the loan early and save on interest.

- Gap Insurance:This insurance covers the difference between your car’s value and the outstanding loan amount in case of a total loss. While it might seem tempting, consider whether you truly need it based on your financial situation.

Researching Local Dealerships and Comparing Offers

Before you commit to any dealership, take the time to research and compare offers from different dealerships in your area. This helps you identify the best deals and avoid being taken advantage of.

- Online Reviews:Read reviews from other customers to get an idea of a dealership’s reputation for fairness and customer service.

- Price Comparisons:Use online tools and websites that allow you to compare prices from different dealerships in your area. This helps you get a sense of the market value of the car you’re interested in.

- Negotiate with Multiple Dealerships:Don’t settle for the first offer you receive. Contact multiple dealerships and present them with your pre-approved loan terms. This creates competition and can lead to better deals.

Effective Negotiation Tactics

- Be Prepared:Know your credit score, your budget, and the market value of the car you’re interested in. This will help you negotiate confidently and effectively.

- Be Polite and Respectful:A professional and courteous approach can go a long way in establishing a positive relationship with the dealership.

- Be Firm but Flexible:Be clear about your desired terms, but be willing to compromise to reach a mutually acceptable agreement.

- Use Your Credit Score as Leverage:A strong credit score gives you bargaining power. Highlight your excellent credit history to demonstrate your trustworthiness and ability to repay the loan.

- Don’t Be Afraid to Walk Away:If the dealership isn’t willing to meet your expectations, be prepared to walk away. This shows you’re serious about getting a good deal and might prompt them to reconsider their offer.

“Remember, the key to successful negotiation is to be prepared, be polite, and be willing to walk away.”

Protecting Your Financial Future

A new car is a significant investment, and responsible financing practices are crucial to ensure you don’t end up trapped in debt. By understanding the potential long-term implications of car loans and making informed decisions, you can protect your financial future and achieve your financial goals.

Budgeting for Car Payments

Effective budgeting is essential for managing your car payments and other monthly expenses. Creating a realistic budget allows you to prioritize your spending and ensure you can comfortably afford your car payments. Here are some helpful tips for budgeting:

- Track your expenses:Carefully monitor your income and expenses to identify areas where you can cut back or allocate funds differently. Consider using budgeting apps or spreadsheets to streamline this process.

- Prioritize essential expenses:Allocate sufficient funds for essential expenses like housing, utilities, food, and healthcare. This ensures you have enough money for your basic needs.

- Allocate funds for car payments:Factor in your car payment amount into your monthly budget, ensuring you have enough funds remaining to cover other expenses and maintain a healthy financial cushion.

Avoiding Debt Traps

Car loans can be a significant financial burden if not managed responsibly. Here are some strategies to avoid debt traps:

- Shop around for the best rates:Compare loan offers from multiple lenders to secure the lowest interest rate possible. This can significantly reduce your overall loan cost.

- Avoid unnecessary add-ons:Resist the temptation to add expensive features or extended warranties that you don’t truly need. These add-ons can inflate the price of your loan and increase your monthly payments.

- Make extra payments:If possible, make extra payments on your car loan to pay it off faster and reduce the amount of interest you pay over time.

Long-Term Financial Implications

Car loans can have a significant impact on your long-term financial well-being. Here are some considerations:

- Impact on credit score:Making timely payments on your car loan can help improve your credit score, while missed payments can negatively impact it. A good credit score can unlock better interest rates on future loans and credit cards.

- Debt burden:A large car loan can significantly increase your debt burden, making it harder to save for other financial goals, such as a down payment on a house or retirement savings.

- Financial flexibility:A substantial car loan can limit your financial flexibility, making it harder to adjust to unexpected expenses or financial emergencies.