Pay-Per-Mile Tax: EV Drivers Pay Less Under Labor

Pay per mile road tax system means drivers of these cars pay 600 under labour – Pay-Per-Mile Tax: EV Drivers Pay Less Under Labor sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. Imagine a world where your car’s mileage determines your road tax bill, not a flat fee based on engine size.

This is the reality of a pay-per-mile road tax system, a concept that’s gaining traction in various countries. But how does this system impact drivers of electric vehicles (EVs)? Are they paying less, more, or the same? The answer, it seems, depends on where you live.

In the UK, for example, a recent study revealed that drivers of electric vehicles could end up paying significantly less in road tax under a pay-per-mile system, compared to their gasoline-powered counterparts. This is because EVs tend to be driven less, thanks to their lower running costs and the increasing availability of charging infrastructure.

Pay-Per-Mile Road Tax System

The traditional vehicle registration fee system is being challenged by a new concept: the pay-per-mile road tax system. This system, as the name suggests, charges drivers based on the number of miles they drive, rather than a fixed annual fee.

This shift in taxation is driven by a growing need for a more equitable and environmentally conscious approach to road funding.

Pay-Per-Mile Road Tax System Explained

This system directly links road usage to taxation, meaning drivers who travel more pay more, while those who drive less pay less. The concept of pay-per-mile road tax involves tracking vehicle mileage using various technologies, such as GPS devices, odometers, or smartphone apps.

This data is then used to calculate the tax owed, which can be paid through various methods, including online portals or automatic deductions from bank accounts.

Differences Between Pay-Per-Mile and Traditional Vehicle Registration Fees

The key difference lies in the basis of taxation. Traditional vehicle registration fees are a fixed annual fee, regardless of mileage driven. In contrast, the pay-per-mile system charges based on actual road usage. This approach offers several advantages, including:

- Equity:Drivers who use roads more frequently contribute proportionally more to road maintenance and infrastructure development. This promotes a fairer system where those who benefit more from roads pay more.

- Environmental Impact:By encouraging drivers to reduce their mileage, the pay-per-mile system can contribute to lower emissions and a more sustainable transportation system. This aligns with the growing focus on reducing carbon footprint and promoting environmentally friendly practices.

- Congestion Management:By encouraging drivers to consider alternative modes of transportation, especially during peak hours, the pay-per-mile system can contribute to reducing traffic congestion and improving overall traffic flow.

Rationale for Implementing a Pay-Per-Mile Road Tax System

The pay-per-mile road tax system offers several advantages over traditional vehicle registration fees, making it a compelling alternative for road funding. These advantages include:

- Fairer and More Equitable:The pay-per-mile system aligns taxation with road usage, ensuring that those who benefit more from roads contribute proportionally more. This addresses concerns about fairness and equity in road funding.

- Environmentally Conscious:By incentivizing drivers to reduce their mileage, the system can contribute to lower emissions and a more sustainable transportation system. This aligns with the growing global focus on reducing carbon footprint and promoting eco-friendly practices.

- Improved Traffic Flow:By encouraging drivers to consider alternative modes of transportation, especially during peak hours, the pay-per-mile system can help alleviate traffic congestion and improve overall traffic flow. This benefits all road users by reducing travel times and improving the overall efficiency of the transportation system.

- Sustainable Funding:The pay-per-mile system provides a more sustainable source of funding for road maintenance and infrastructure development. As vehicle technology evolves and mileage usage patterns change, the system can adapt accordingly, ensuring a steady and reliable source of funding for road infrastructure needs.

Potential Benefits of a Pay-Per-Mile System

A pay-per-mile road tax system, where drivers pay based on the distance they travel, presents several potential benefits that could address various challenges facing transportation systems today.

The pay-per-mile road tax system is a hot topic, with some arguing it’s fairer than the current system. But it’s not without its critics, who point out that it could disproportionately impact lower-income drivers. It’s a complex issue, and one that requires careful consideration, especially as Europe’s economy navigates the challenging landscape of global trade, as highlighted in this recent article europes economy survived terrible prophecies but must now tackle trade with china eus gentiloni.

Finding a solution that works for everyone is crucial, and the pay-per-mile system, while potentially beneficial, needs to be examined thoroughly to ensure it doesn’t create unintended consequences.

Reduced Traffic Congestion, Pay per mile road tax system means drivers of these cars pay 600 under labour

A pay-per-mile system could potentially reduce traffic congestion by encouraging drivers to consider alternative modes of transportation, particularly for shorter trips. For instance, a pay-per-mile system might incentivize people to opt for walking, cycling, or public transportation for short commutes or errands, thereby reducing the number of cars on the road.

Additionally, the system could be designed to dynamically adjust the cost of driving during peak hours, discouraging travel during congested periods and promoting more evenly distributed traffic flow.

The proposed pay-per-mile road tax system could mean drivers of electric vehicles pay significantly less than their petrol-powered counterparts, potentially saving them hundreds of pounds annually. This shift in taxation aligns with the growing focus on electric vehicles and sustainability, but it’s important to consider the broader economic implications.

For example, the recent positive performance of the Asia Pacific markets, which opened higher tracking rises in the Dow and S&P 500 ( asia pacific markets open higher tracking rises in dow sp 500 ), might be influenced by investor confidence in the green technology sector, which could further incentivize the adoption of electric vehicles and the implementation of a pay-per-mile road tax system.

Environmental Benefits

A pay-per-mile system can contribute to environmental sustainability by reducing vehicle emissions. By encouraging less driving, especially for shorter trips, the system could significantly decrease the amount of greenhouse gases released into the atmosphere. Moreover, the revenue generated from the pay-per-mile system could be allocated towards funding initiatives that promote cleaner transportation options, such as electric vehicle infrastructure and public transit expansion.

Improved Road Maintenance and Infrastructure Funding

A pay-per-mile system could provide a more equitable and sustainable source of funding for road maintenance and infrastructure improvements. Instead of relying on fixed taxes, the system directly links road usage to funding, ensuring that those who use the roads more contribute proportionally to their upkeep.

This could lead to more efficient allocation of resources, with funds directed to areas with higher traffic volumes and greater maintenance needs.

The pay-per-mile road tax system is a hot topic, and while I’m trying to wrap my head around the implications for drivers, I can’t help but be distracted by the excitement of the US Open! Frances Tiafoe and Taylor Fritz have both advanced to the semifinals, which is awesome news, and the 49ers getting another star back is a big deal for NFL predictions.

Frances Tiafoe Taylor Fritz advance to US Open semifinals 49ers get another star back NFL predictions Anyway, back to the road tax, it seems drivers of certain cars could end up paying $600 less under the new system. That’s a pretty big difference, and it’s definitely something to keep in mind if you’re thinking about buying a new car.

Drivers of Electric Vehicles and the Pay-Per-Mile System: Pay Per Mile Road Tax System Means Drivers Of These Cars Pay 600 Under Labour

The implementation of a pay-per-mile road tax system would undoubtedly impact drivers of electric vehicles (EVs). While proponents of this system argue that it could be a fairer way to tax drivers based on their actual road use, there are important considerations for EV owners.

Potential Cost Implications for EV Drivers

The potential cost implications of a pay-per-mile system for EV drivers depend on several factors, including the mileage rate set by the government and the driving habits of EV owners. Generally, EV owners tend to drive fewer miles than traditional gasoline vehicle owners due to factors like lower fuel costs and the convenience of home charging.

However, this does not necessarily translate to lower overall costs under a pay-per-mile system. For example, if the mileage rate is set at a high enough level, EV owners could end up paying more than traditional gasoline vehicle owners even if they drive fewer miles.

Potential Concerns of EV Drivers Regarding a Pay-Per-Mile System

Several concerns exist regarding a pay-per-mile system for EV drivers.

- Impact on EV Adoption: A pay-per-mile system could potentially discourage the adoption of EVs, especially if the mileage rate is high or if there are concerns about the accuracy of mileage tracking. This could hinder the transition towards a cleaner transportation system.

- Data Privacy Concerns: EV drivers might be concerned about the privacy implications of a pay-per-mile system, as it would require the government to track their driving habits. This raises questions about data security and the potential for misuse of this information.

- Equity and Fairness: A pay-per-mile system might not be equitable for all EV drivers. For example, drivers who rely on EVs for work or long commutes might end up paying more than those who use their EVs primarily for short trips.

- Lack of Infrastructure: The implementation of a pay-per-mile system would require robust infrastructure for mileage tracking. This includes ensuring that all EVs are equipped with the necessary technology to accurately report their mileage data.

Implementation Challenges and Considerations

A pay-per-mile road tax system presents several challenges that need to be addressed before implementation. These challenges range from technical considerations to potential impacts on various groups of drivers.

Privacy and Data Collection

The implementation of a pay-per-mile system raises significant privacy concerns. To track mileage accurately, the system would require constant monitoring of vehicle location and movement. This raises questions about data collection, storage, and security.

- Data Security:The system would need to ensure that the collected data is secure from unauthorized access and cyberattacks. This is critical to protect drivers’ privacy and prevent potential misuse of their personal information.

- Data Retention:The length of time the data is stored and how it is used must be clearly defined and communicated to drivers. There needs to be a clear policy on data retention, with mechanisms in place to ensure data is deleted once it is no longer necessary.

- Data Sharing:Transparency is key. Drivers need to understand with whom their data might be shared, whether with government agencies, insurance companies, or other third parties. This transparency will build trust and address potential concerns about data misuse.

Impact on Low-Income Drivers

A pay-per-mile system could potentially disproportionately impact low-income drivers. This is because they often rely on their vehicles for essential needs like commuting to work and accessing healthcare, and they may have limited financial resources.

- Increased Costs:Low-income drivers may find it difficult to afford the higher costs associated with a pay-per-mile system, particularly if they have long commutes or drive frequently for work.

- Limited Transportation Options:If they cannot afford to pay the higher road tax, they may have fewer transportation options, leading to reduced access to employment, education, and other essential services.

- Financial Strain:The additional cost of a pay-per-mile system could put a strain on their already tight budgets, leading to financial hardship and potential debt.

Comparative Analysis of Pay-Per-Mile Systems in Other Countries

While the United States is still exploring the implementation of a pay-per-mile road tax system, several other countries have already adopted similar models. Examining these systems can provide valuable insights into the potential benefits, challenges, and variations that might be encountered in the U.S.

context.

Pay-Per-Mile Systems Around the World

This section will provide a comparative analysis of pay-per-mile systems in different countries. We will examine the different models used, their implementation experiences, and the challenges faced.

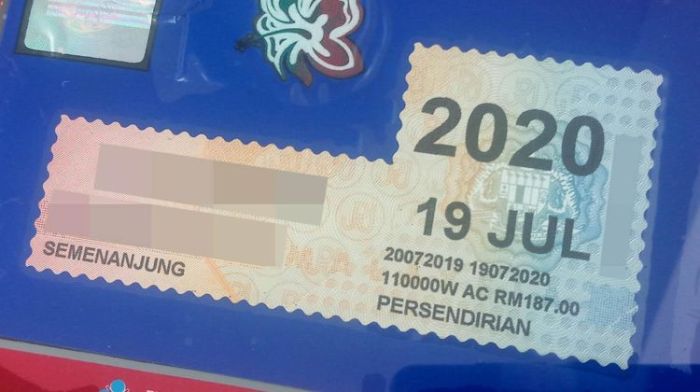

- United Kingdom:The UK has a system called “Vehicle Excise Duty” (VED), which is based on the vehicle’s emissions and age. While not strictly a pay-per-mile system, it does incorporate a distance-based component for vehicles that travel more than 10,000 miles annually.

This “Road Tax” is payable annually and is collected through a combination of vehicle registration and insurance data.

- Switzerland:Switzerland has a unique system called “vignette” where drivers purchase a sticker for their vehicle that allows them to use certain roads and highways for a specific period. This system is a form of pay-per-use, as drivers only pay for the roads they use.

The sticker is typically valid for one year and can be purchased online or at gas stations.

- Oregon, USA:The state of Oregon has implemented a pilot program called “Road Usage Charge” (RUC) where drivers can choose to opt into a pay-per-mile system instead of traditional fuel taxes. This program allows drivers to track their mileage using a mobile app or a device plugged into their vehicle.

Participants are charged a per-mile rate based on their vehicle type and weight. The RUC program is designed to test the feasibility of a pay-per-mile system in the U.S. and gather data on its effectiveness and public acceptance.

Future of Pay-Per-Mile Road Tax Systems

The concept of a pay-per-mile road tax system has been gaining traction in recent years, driven by factors such as the increasing popularity of electric vehicles and the need for more sustainable transportation solutions. This system, which charges drivers based on the distance they travel rather than a fixed annual fee, has the potential to revolutionize the way we fund our roads and incentivize responsible driving habits.

Technological Advancements

Technological advancements play a crucial role in facilitating the implementation of a pay-per-mile system.

- GPS tracking devices:Advancements in GPS technology have made it possible to track vehicles’ movements with high accuracy, providing the necessary data for a pay-per-mile system. These devices can be integrated into vehicles or used as standalone units, offering a cost-effective and reliable method for distance tracking.

- Smartphones and mobile apps:The widespread use of smartphones and the development of mobile applications have created a platform for easy data collection and communication. These devices can be used to track mileage, collect payment information, and provide real-time updates to drivers.

- Vehicle-to-infrastructure (V2I) communication:V2I technology enables vehicles to communicate with roadside infrastructure, such as traffic lights and toll booths. This communication can be used to monitor vehicle movements, collect mileage data, and even provide real-time information to drivers.

- Blockchain technology:Blockchain technology offers a secure and transparent platform for recording and verifying transactions, making it an ideal solution for managing pay-per-mile data and payments. This technology ensures data integrity and prevents fraud, enhancing the system’s reliability.

Advantages and Disadvantages

A pay-per-mile system presents both potential advantages and disadvantages.