Debt and the Global Economic Crisis of 1997-98: A Contagion

Debt and the global economic crisis of 19979899 – Debt and the global economic crisis of 1997-98, a period marked by financial turmoil and widespread economic hardship, serves as a stark reminder of the interconnected nature of the global economy. The crisis, which originated in Asia, rapidly spread to other regions, exposing vulnerabilities in financial systems and highlighting the dangers of unchecked speculation and excessive debt.

The crisis began in Thailand, where a fixed exchange rate regime, coupled with a large current account deficit and speculative investments, led to a sudden loss of confidence in the Thai baht. The subsequent devaluation of the currency triggered a chain reaction, as investors rushed to sell assets in other Asian economies, leading to currency depreciations, stock market crashes, and banking crises across the region.

Long-Term Consequences of the Crisis: Debt And The Global Economic Crisis Of 19979899

The Asian financial crisis of 1997-98 had profound and lasting effects on the global economy, leaving behind a legacy of increased volatility, risk aversion, and a re-evaluation of financial systems and international governance. While the immediate consequences were severe for the affected countries, the crisis also prompted significant changes in the global financial landscape, leading to new regulations, institutions, and a greater awareness of interconnectedness in the global economy.

Impact on Global Economy

The crisis had a significant impact on the global economy, leading to increased volatility and risk aversion. The crisis highlighted the interconnectedness of global markets and the potential for contagion effects. The rapid spread of the crisis from Thailand to other countries in the region and beyond demonstrated the vulnerability of emerging markets to external shocks.

Investors became more cautious and risk-averse, demanding higher returns for investments in emerging markets, making it more difficult for these countries to access capital.

- Increased Volatility:The crisis led to increased volatility in global financial markets, as investors became more cautious and risk-averse. This volatility made it difficult for businesses to plan and invest, leading to slower economic growth. The dramatic fluctuations in currency values, stock markets, and commodity prices demonstrated the fragility of global financial systems and the potential for sudden and severe disruptions.

- Risk Aversion:The crisis also led to increased risk aversion among investors. Investors became more reluctant to invest in emerging markets, fearing that they might be caught up in another crisis. This risk aversion made it more difficult for emerging markets to access capital, which hindered their economic growth.

This shift in investor sentiment led to a decline in investment in emerging markets, impacting their economic growth and development.

Financial System Reforms, Debt and the global economic crisis of 19979899

The Asian financial crisis triggered a wave of financial reforms in affected countries, aimed at strengthening their financial systems and preventing future crises. The crisis exposed weaknesses in the financial systems of many countries, particularly in emerging markets. These weaknesses included a lack of transparency, poor corporate governance, and excessive reliance on short-term debt.

- Strengthening Financial Regulations:Governments and international organizations implemented stricter regulations for banks and financial institutions to reduce systemic risk and improve financial stability. This included measures like increased capital requirements, improved supervision, and better risk management practices. The crisis highlighted the importance of robust financial regulations to prevent excessive risk-taking and mitigate systemic risk.

- Corporate Governance Reforms:Countries implemented reforms to improve corporate governance and transparency. This included measures to improve accounting standards, enhance disclosure requirements, and strengthen shareholder rights. These reforms aimed to reduce information asymmetry and promote greater accountability within corporations, contributing to a more stable and efficient financial system.

Development of International Financial Institutions

The Asian financial crisis highlighted the need for stronger international financial institutions to address global financial crises and promote financial stability. The crisis also underscored the need for greater coordination among international financial institutions to respond effectively to crises.

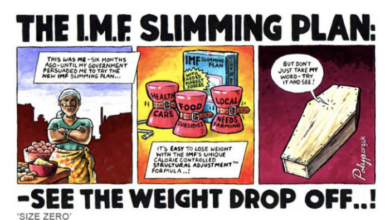

- Strengthening the IMF:The International Monetary Fund (IMF) played a central role in responding to the Asian financial crisis. The crisis highlighted the need for the IMF to have greater resources and flexibility to respond to future crises. The IMF undertook reforms to strengthen its capacity to provide financial assistance to countries in crisis, including increasing its lending capacity and streamlining its lending programs.

- Enhanced Global Governance:The crisis also led to discussions about the need for improved global governance of financial systems. The crisis demonstrated the importance of international cooperation to prevent and manage financial crises. This led to the establishment of new international financial institutions and mechanisms for coordination among existing institutions.

The Financial Stability Board (FSB), established in 2009, is a key example of this effort, aiming to promote international financial stability through cooperation and information sharing among member countries.

The global economic crisis of 1997-98-99, sparked by the Asian financial crisis, exposed the fragility of interconnected economies and the devastating consequences of unchecked debt. This period highlighted the role of international institutions in crisis management, but also revealed the complex interplay of political and economic factors.

One crucial aspect often overlooked is the direct contribution of the US to armed conflicts around the world, as documented in numerous reports and analyses , which can further destabilize economies and exacerbate debt burdens. The ripple effects of these conflicts, coupled with the economic instability of the 1997-98-99 crisis, underscore the interconnectedness of global systems and the need for a more holistic approach to addressing economic and geopolitical challenges.

The Asian financial crisis of 1997-98 was a stark reminder of how interconnected the global economy is, and how quickly a debt crisis can snowball. The crisis, which began in Thailand, spread rapidly across the region, exposing the scale of the debt crisis in Southeast Asia and the vulnerabilities of emerging markets.

It underscored the need for greater financial regulation and transparency to prevent similar crises in the future.

The global economic crisis of 1997-98-99, with its devastating impact on developing nations, exposed a dark side of the international financial system. While the crisis was fueled by excessive debt and speculation, it also highlighted the unintended consequences of food aid, which can sometimes be seen as a form of dumping, undermining local markets and agricultural development.

A closer look at the complexities of food aid, as explored in this article food aid as dumping , can provide valuable insights into the challenges of addressing global poverty and hunger while ensuring sustainable solutions. The lessons learned from the 1997-98-99 crisis continue to resonate today, emphasizing the need for a more balanced and equitable approach to international development, one that recognizes the potential pitfalls of well-intentioned but poorly implemented policies.