4 Underrated Parts of the Inflation Reduction Act

4 underrated parts of the inflation reduction act – The Inflation Reduction Act, a landmark piece of legislation, is often discussed for its impact on inflation and climate change. But there are four lesser-known aspects of the act that are equally significant and deserve our attention. These provisions, often overlooked, hold the potential to transform our energy landscape, make prescription drugs more affordable, incentivize energy efficiency, and bolster domestic manufacturing.

In this blog post, we’ll delve into these four underrated parts of the IRA and explore how they could shape the future of the United States. From its investment in clean energy to its focus on prescription drug pricing, the IRA offers a comprehensive approach to addressing some of our nation’s most pressing challenges.

Clean Energy Investment: 4 Underrated Parts Of The Inflation Reduction Act

The Inflation Reduction Act (IRA) marks a significant turning point in the United States’ commitment to clean energy. With substantial investments in renewable energy sources and energy efficiency measures, the IRA aims to reshape the country’s energy landscape, moving away from fossil fuels and towards a more sustainable future.The IRA’s provisions incentivize clean energy production and adoption through a combination of tax credits, grants, and loans.

These incentives aim to make clean energy more affordable and accessible, encouraging businesses and individuals to embrace sustainable energy solutions.

Tax Credits for Renewable Energy

The IRA expands and extends existing tax credits for renewable energy projects, making them more attractive to investors and developers. These credits incentivize the development and deployment of a wide range of clean energy technologies, including solar, wind, geothermal, and hydropower.

While the Inflation Reduction Act is often discussed for its climate and healthcare provisions, there are some lesser-known parts that are equally impactful. For example, the act expands access to affordable housing and invests in clean energy infrastructure. It’s a reminder that even amidst tragedies like the recent killing of Gaza blogger Mohammad Medo Halimy in an alleged Israeli strike, as reported here , we must continue to work towards a better future.

The Inflation Reduction Act also provides tax credits for electric vehicle purchases, a move that could significantly benefit consumers and reduce our reliance on fossil fuels.

For example, the IRA extends the Investment Tax Credit (ITC) for solar and wind projects, providing a 30% tax credit for projects placed in service before 2032. This credit is crucial in lowering the upfront cost of renewable energy projects, making them more financially viable.

Clean Energy Manufacturing

The IRA includes significant investments in domestic clean energy manufacturing, aiming to bolster the US supply chain and create jobs in the clean energy sector. This includes tax credits for the production of clean energy components, such as solar panels, wind turbines, and batteries.

These incentives aim to encourage the development of a robust domestic clean energy manufacturing base, reducing reliance on foreign imports and promoting American innovation.

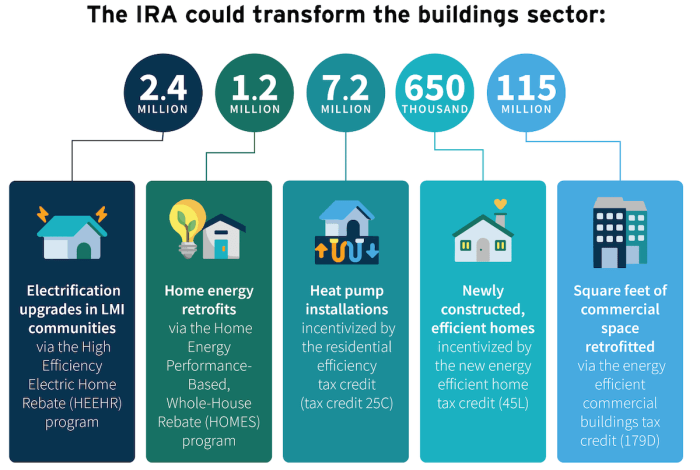

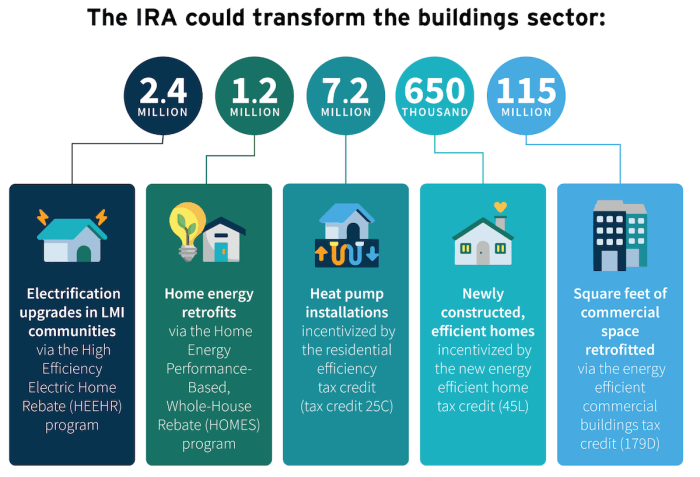

Energy Efficiency Measures

The IRA also provides incentives for energy efficiency improvements in homes, businesses, and industries. This includes tax credits for energy-efficient appliances, home improvements, and building retrofits. These measures aim to reduce energy consumption, lower energy bills, and reduce greenhouse gas emissions.

The Inflation Reduction Act isn’t just about lowering prices, it also includes provisions for clean energy, healthcare, and climate change. One of the less-discussed aspects is the investment in clean energy manufacturing, which aims to create jobs and reduce reliance on foreign suppliers.

This reminds me of the recent criticism from the former CEO of ARM, who argues that Britain needs to be more proactive in supporting its own tech companies. He believes that the UK missed an opportunity to keep ARM, a key player in the semiconductor industry, within its borders.

The Inflation Reduction Act shows that the US is taking steps to build a strong domestic tech sector, and it’s a lesson that other countries could learn from.

For instance, the IRA extends the tax credit for energy-efficient home improvements, providing a 30% tax credit for upgrades like insulation, windows, and doors.

While everyone’s focused on the tax credits and clean energy investments, the Inflation Reduction Act also includes some pretty awesome provisions for things like prescription drug costs and affordable housing. It’s a reminder that sometimes the most impactful policies aren’t always the most flashy.

Speaking of impactful policies, it’s interesting to see the debate around chancellor rachel reeves urged to impose pay per mile scheme on electric cars , which could have implications for the future of transportation and the environment. Ultimately, the Inflation Reduction Act is a complex piece of legislation with a lot to offer, and it’s worth exploring its various facets beyond the headlines.

Clean Energy Deployment

The IRA includes funding for clean energy deployment projects, supporting the development of renewable energy infrastructure and the integration of clean energy into the grid. This includes grants for community solar projects, loans for clean energy projects, and funding for research and development of new clean energy technologies.

These investments aim to accelerate the transition to a clean energy future, ensuring a reliable and affordable energy supply for all Americans.

Prescription Drug Cost Reduction

The Inflation Reduction Act (IRA) includes several provisions aimed at lowering prescription drug costs for Americans. These provisions represent a significant step towards addressing the high cost of prescription drugs, a long-standing concern for many Americans.

Negotiation of Drug Prices

The IRA empowers Medicare to negotiate drug prices for a select group of high-cost drugs. This provision has the potential to significantly reduce drug prices for millions of Medicare beneficiaries.The negotiation process will begin with a list of 10 high-cost drugs, which will be expanded over time.

Medicare will negotiate with drug manufacturers to reach a lower price for these drugs. This will be the first time that Medicare has been allowed to negotiate drug prices directly with manufacturers.

“The IRA is expected to save the government an estimated $257 billion over the next decade, and potentially lower drug prices for millions of Americans.”

The potential impact of this provision on drug pricing is significant. The negotiation process could lead to substantial reductions in the prices of high-cost drugs, making them more affordable for both Medicare beneficiaries and the government.

Out-of-Pocket Spending Cap

The IRA also establishes an out-of-pocket spending cap for Medicare beneficiaries on prescription drugs. This provision will limit the amount that beneficiaries can be required to pay for their medications each year.The out-of-pocket spending cap will be set at $2,000 per year for Medicare Part D beneficiaries.

This means that once a beneficiary has spent $2,000 on their medications, Medicare will cover the remaining costs.

“The out-of-pocket spending cap will provide much-needed financial relief for Medicare beneficiaries who struggle to afford their medications.”

This provision will significantly reduce the financial burden on Medicare beneficiaries, making prescription drugs more accessible and affordable.

Other Provisions

The IRA also includes other provisions related to prescription drug costs, such as:

- A penalty for drug manufacturers that increase drug prices faster than inflation.

- A cap on insulin costs for Medicare beneficiaries at $35 per month.

These provisions further contribute to the IRA’s overall goal of reducing prescription drug costs for Americans.

Comparison to Previous Efforts

The IRA’s prescription drug cost reduction measures represent a significant departure from previous efforts. Previous attempts to address drug pricing have often been met with resistance from the pharmaceutical industry.The IRA’s provisions, particularly the drug price negotiation provision, have the potential to be more effective than previous efforts due to their direct approach to lowering drug prices.

Tax Credits for Energy Efficiency

The Inflation Reduction Act (IRA) offers a variety of tax credits for homeowners who make energy-efficient upgrades to their homes. These tax credits can significantly reduce the cost of these upgrades, making them more affordable and encouraging homeowners to invest in energy-saving solutions.

The Tax Credits Offered by the IRA, 4 underrated parts of the inflation reduction act

The IRA offers a range of tax credits for energy-efficient home improvements. The most notable is the Energy Efficient Home Improvement Credit, which provides a tax credit of up to 30%of the cost of eligible improvements. This credit is available for a wide range of upgrades, including:

- Insulation

- Windows and doors

- Heat pumps

- Electric heat pumps

- Solar panels

- Energy-efficient appliances

The IRA also offers a separate tax credit for home energy audits, which can help homeowners identify the most effective ways to improve their home’s energy efficiency. This credit can cover up to $600of the cost of a home energy audit.

The Impact of Tax Credits on Homeowners’ Investment Decisions

The tax credits offered by the IRA can significantly reduce the upfront cost of energy-efficient home improvements, making them more attractive to homeowners. For example, a homeowner who installs a new heat pump for $10,000 could receive a tax credit of $3,000, reducing the net cost of the upgrade to $7,000.

This financial incentive can make the difference for many homeowners, encouraging them to invest in energy-saving upgrades they might not otherwise consider.

The Environmental and Economic Benefits of Energy-Efficient Upgrades

Widespread adoption of energy-efficient home improvements can deliver significant environmental and economic benefits.

- Reduced energy consumption:By making their homes more energy-efficient, homeowners can reduce their energy consumption, leading to lower energy bills and reduced reliance on fossil fuels. This can have a significant impact on greenhouse gas emissions, contributing to a cleaner and healthier environment.

- Increased home values:Energy-efficient homes are often more attractive to buyers, leading to higher resale values. This can benefit homeowners in the long run, increasing their investment in their homes.

- Economic growth:The increased demand for energy-efficient products and services can create new jobs and stimulate economic growth.

This can benefit local communities and the economy as a whole.

Support for Domestic Manufacturing

The Inflation Reduction Act (IRA) aims to boost domestic manufacturing, particularly in the clean energy sector, by providing tax credits and other incentives to companies that invest in US manufacturing facilities. These provisions could incentivize companies to build new factories or expand existing ones, leading to job creation and economic growth.

Incentivizing Domestic Manufacturing

The IRA offers a variety of tax credits and other incentives to companies that manufacture clean energy technologies in the United States. These incentives include:

- A 10% investment tax credit for the construction of new clean energy manufacturing facilities.

- A 30% investment tax credit for the expansion of existing clean energy manufacturing facilities.

- A production tax credit for the manufacture of clean energy technologies in the United States.

These incentives are designed to make it more financially attractive for companies to invest in US manufacturing facilities. For example, a company that builds a new solar panel manufacturing facility in the United States could receive a 10% investment tax credit, which would reduce its tax liability and make the project more profitable.

Impact on Job Creation and Economic Growth

The IRA’s provisions aimed at boosting domestic manufacturing are expected to have a significant impact on job creation and economic growth in the United States. According to a study by the Brookings Institution, the IRA could create up to 1.5 million new jobs in the clean energy sector over the next decade.

These jobs would be created in a variety of industries, including manufacturing, construction, and engineering.The IRA’s provisions could also boost economic growth by increasing investment in US manufacturing facilities. This investment would lead to increased production, which would in turn lead to higher economic output and more jobs.

For example, a company that builds a new solar panel manufacturing facility in the United States would need to hire workers to build and operate the facility. These workers would then spend their wages on goods and services, which would further stimulate the economy.

The IRA’s provisions aimed at boosting domestic manufacturing are a key part of the Biden administration’s plan to create a more sustainable and competitive economy.